Luis Clark

- Home

- /

- South Africa & Crypto

- /

- Crypto Exchanges in South...

- /

- Valr vs. Luno 2023:...

Valr vs. Luno 2023: Fees, Pros & Cons

Luis Clark

- Headquarter: Johanessbug, SA

- Year Founded: 2018

- No. of Cryptos: 60+

- Fiats Available: 2 (ZAR and ZMW)

- Fees: 0.01% and 0.1% maker/taker fee, Free deposit via EFT, 3.9% for card deposits, free crypto deposits, $10 for USDC wire transfer, 8.5 ZAR for fiat withdrawal, $25 for USDC wire transfer, 0.75% for Auto-Buy, 0.1% for crypto-to-crypto pairs, 0.75% for fiat-to-crypto pairs, 0.85% for Simple Swaps

- NFTs Available: No

- Native Coin: No

- Beginner Friendly: Yes

- Platform App: Desktop/ Android and iOS app

- Security Features: 2FA, cold storage, multi-signatory internal systems

- Headquarter: London, UK

- Year Founded: 2013

- No. of Cryptos: 10+

- Fiats Available: EUR, IDR, MYR, NGN, and ZAR (5)

- Fees: 20 ZAR + 5% for cash deposit, EFT deposit is free, instant EFT incurs 1.4% charge, 2% for both buy and sell functions, 3.9% for Instant Buy, free EFT withdrawal and dynamic crypto transfer charges, 0% maker fees and tier-based taker fees starting from 0.1%

- NFTs Available: No

- Native Coin: No

- Beginner Friendly: Yes

- Platform App: Desktop/ Android and iOS app

- Security Features: 2FA, Trusted Devices, Biometrics and Touch or Face ID

Valr and Luno are two of the most popular crypto trading platforms in the South African landscape. Both centralized trading hubs provide a seamless means to buy, sell, store, and even exchange multiple digital assets.

While they may look similar on the outside, both exchanges differ vastly from one another based on products offered, trading fees, deposit methods and crypto assets supported. In this Valr vs Luno review, we take a cursory look into each platform and their strengths and areas to improve on.

Valr vs. Luno: Verdict

In terms of asset support and trading fees, Valr is our top pick due to its 60+ asset library and industry-leading 0.01% market maker fee. This is in sharp contrast to Luno’s limited 10 crypto repository and 2% buy and sell fee.

In order to write this Valr vs Luno review, we accessed both platforms to provide most value for our readers. To learn more about platforms, read our full Valr vs Luno review.

Both cryptocurrency exchanges enable and facilitate the trading of digital assets. However, both differ in their relative strengths and weaknesses. Below, we go through the pros and cons of both Valr and Luno:

Pros

- Supports 60+ digital assets

- Has very competitive trading fee in line with major players in the industry

- Supports offline storage of users’ private keys

- Low platform fees

- Offers native platform payment infrastructure called Valr Pay

- Offers users Auto-Buy

- Has an advanced trading exchange for sophisticated users

Cons

- Supports only two fiat currencies

- Withdrawal fee via wire transfer is high

- Unregulated

Pros

- Beginner-focused and intuitive platform

- 0% maker fees

- Competitive taker fees

- Offers advanced exchange platform.

- Registered with the South African (SA) Financial Intelligence Center (FIC)

Cons

- Limited asset support

- High trading platform fees

In the area of pros and cons, Valr clearly outpaces the Luno cryptocurrency exchange. However, investors keen on regulation may opt for the more limited Luno platform due to its licensing with the FIC.

Valr vs. Luno: Unique Features

In this Valr vs Luno review, we also considered the unique features of both platforms.

Starting with Valr, we appreciate its 60+ digital currency library. Given that the cryptocurrency exchange is less than five years in the blockchain technology space, Valr has racked up a solid assortment with an eye on adding more digital assets continuously.

Besides offering a basic trading interface for crypto newbies and experts, it offers an advanced trading exchange. Like similar advanced trading platforms, Valr comes with an order book which shows real-time buy and sell orders, a live chart, and other advanced trading tools. There is also limit and market orders and indicators for a more detailed look into a specific digital currency.

The five-year-old Bitcoin trading hub also features a seamless exchange payment system called Valr Pay. This essentially allows clients to send and receive both crypto and cash directly to their Valr Pay ID or Valr account. Transactions on Valr Pay are also free and near-instant.

There is the Simple Buy/Sell feature, which allows users to interface directly with its 60+ crypto retinue and also the Auto-Buy service.

The Auto-Buy on the other hand, works similarly to a recurring purchase. It allows users to stockpile their favorite crypto assets automatically on a preset period through their bank accounts.

On Luno, the Bitcoin exchange is a bit lean in terms of features. The platform offers an exchange feature which works similarly to most sophisticated trading platforms. It offers a live chart on selected currencies with multiple indicators and is directly integrated with the TradingView platform.

There is also a wallet feature which helps users store their digital assets. However, this is a hot wallet and is software-based. Luno also offers a rewards system as a form of incentive but there is no clarity on how much users get to earn from referrals.

The Luno rewards initiative allow users to earn Bitcoin in return for referring their friends and family to the Luno platform. This is possible both on the Luno web trading platform and its mobile app. On the Luno app, users can trade and manage their crypto investments.

Nonetheless, the platform thrives on intuitiveness and is especially famous for its easy-to-use trading interface.

Winner in Unique Features

In the area of features, Valr comes out top once more due to its more extensive lineup of products and services.

Valr vs. Luno: Cryptocurrencies Available

Although both platforms offer their services in the South African crypto space, both exchanges have different asset support landscapes.

Valr:

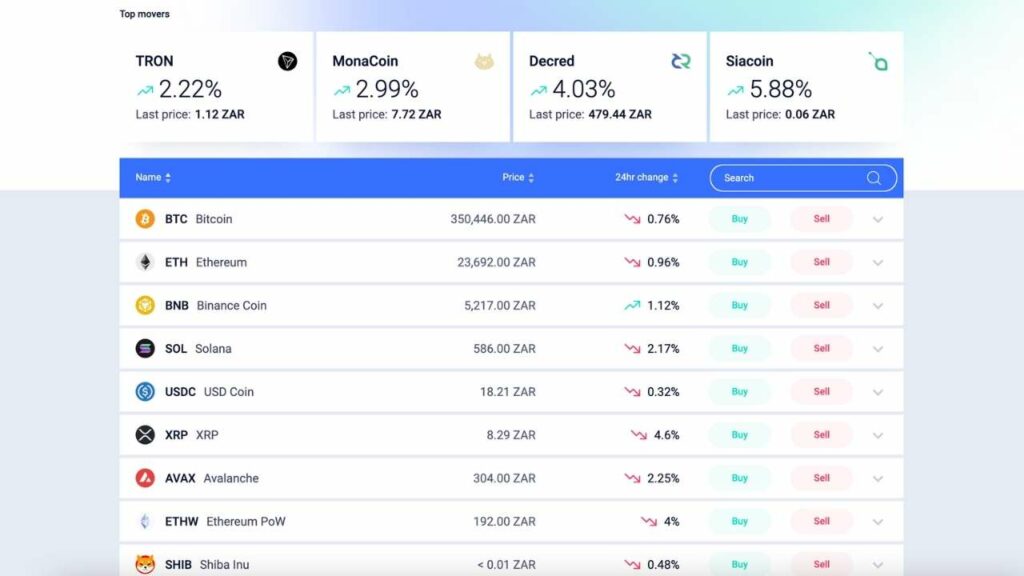

The platform offers a solid 60+ crypto assets. In its line-up are popular names like Bitcoin, Ethereum, XRP, and Cardano, amongst others. Thus, SA investors looking to diversify their investment portfolio have quit a few options on the Valr cryptocurrency exchange with the platform’s deep liquidity.

Luno:

The platform’s asset offering is limited to only 10 digital assets. This is quite low, given the thousands of digital currencies in the emerging industry. However, clients can buy Bitcoin and other major market movers like Ethereum.

Winner in Crypto Availability

In the area of crypto availability, Valr takes the crown yet again.

Valr vs. Luno: Fees

Fees are a crucial metric in choosing a cryptocurrency exchange. In this Valr vs Luno review, we delved deep into each platform’s deposit, withdrawal, and trading fees. This is to identify which suits SA retail investors most.

Beginning with Valr

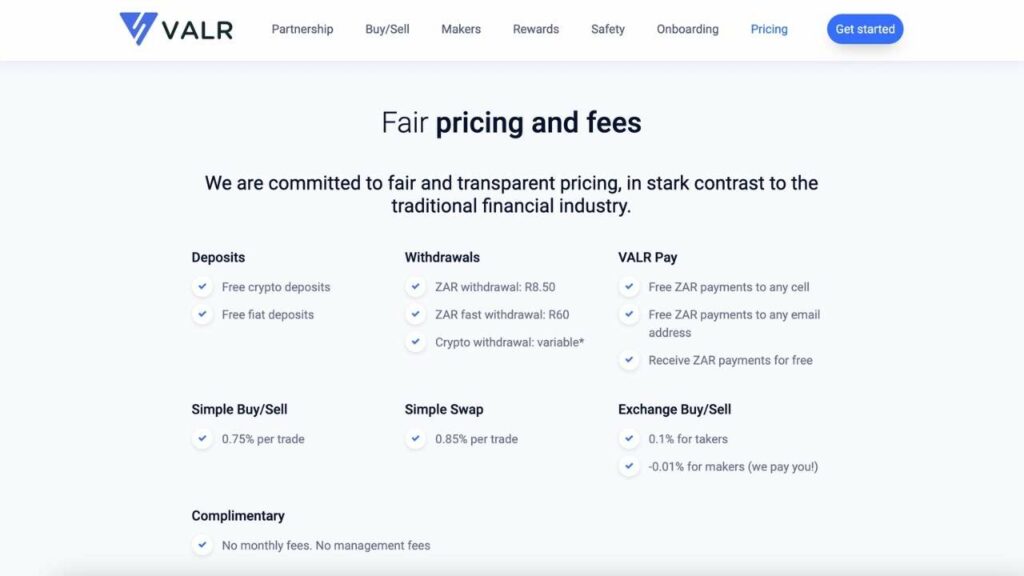

The platform operates a maker and taker-fee structure. Its trading fees are split into 0.01% and 0.1% for both maker and taker, respectively. This shows that Valr offers low fees and clearly indicates that the exchange is competitive in its trading fees structure. However, this is not all. For ZAR cash deposits via electronic funds transfer (EFT), Valr charges no fees, but card deposits incur a 3.9% surcharge. Crypto deposits are free, while USDC deposits via USD wire transfers are charged $10 (179.8 ZAR).

Meanwhile, withdrawals are priced 8.5 ZAR for fiat and $25 (448.9 ZAR) for USDC withdrawal. Auto-Buy setup is charged at 0.75% of the deposit total, while crypto swaps incur 0.85% in charges.

Luno Fees:

Luno charges 0% for maker and 0.1% for taker trading fees, which makes it a low-cost crypto exchange for SA investors. However, for Instant Buy/Sell, users are charged 2%, while instant EFT deposits incur 1.4% in fees. Cash deposits are charged 20 ZAR plus a 5% fee as well.

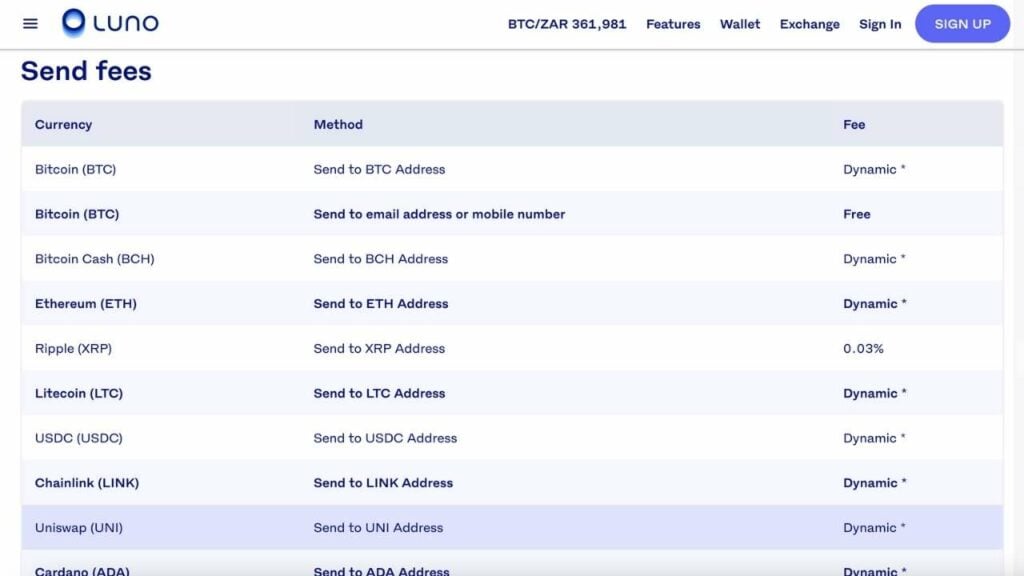

There are no fees for EFT withdrawals, while crypto transfers are charged based on the blockchain network used.

Winner in Fees

In fees, Luno trumps Valr due to its 0% maker fee structure and lean feature system.

Valr vs. Luno: Payment Methods

Fluidity in deposit and withdrawals means that investors can easily pay and transfer their assets via any payment method.

In our Valr and Luno review, we discovered that both exchanges share similarities in this regard. They both support cash deposits mostly via EFT, bank transfer, crypto deposits, and credit/debit cards. Withdrawals can also be sent directly to a user’s bank account or to an external wallet.

Winner in Payment Methods

In the aspect of payment methods, there is a tie between both platforms.

Valr vs. Luno: Security

Both platforms are centralized crypto businesses and they require new users to complete a know-your-customer (KYC) process. This is in line with the global anti-money laundering (AML) and terrorist financing laws.

On a personal scale, Valr offers two-factor authentication (2FA), cold storage, and multi-signatory internal control systems. The same goes for Luno, as it offers 2FA, a trusted device cache, as well biometric security, and Touch or Face ID. Both platforms lack a crypto whitelisting service, but neither has ever been hacked before, which points to the fact that their security infrastructure is quite sound. Both platforms also offer SSL certificates on their website to encrypt and protect users’ data.

Winner in Security

Valr supports cold storage and thus beats Luno in terms of security features.

Valr vs. Luno: Earn/Staking Rewards

A growing number of crypto exchanges offer passive income streams through staking or savings for investors who are not keen on directly trading the crypto market. Through these methods users earn a variable amount of crypto assets from just storing them on the platform.

However, in our Valr vs Luno review, we discovered that both platforms do not currently offer earn or staking products. Our extensive research shows that Luno previously offered an interest-earning Bitcoin wallet but discontinued the service in December 2022 due to the ongoing crypto winter.

Winner in Earn/Staking Rewards

On the other hand, Valr has not offered this service since making its debut in 2018. In this regard therefore, both Valr and Luno tie.

Valr vs. Luno: Usability

User-friendliness is a key factor in selecting a preferred crypto exchange. In our Valr vs Luno review, we discovered that both platforms are systematically geared toward crypto newbies.

Valr offers a simple buy-and-sell interface, which makes it easy for beginners to interact with their preferred digital assets. The function buttons are easily accessible, and users are shown a real-time price performance of all supported assets. Likewise, the Luno platform thrives on intuitiveness. Users can easily buy assets by selecting from preset values. Also, they can manually set the amount they intend to buy and fund from their bank accounts.

Similarly, users can view the live chart of all supported assets and also their 24-hour highs and lows.

Winner in Usability

In the aspect of usability, both platforms show a similar focus on making the crypto market easily accessible to anyone. Valr and Luno tie in this section as well.

Valr vs. Luno: Customer Service

The crypto market is still unknown territory for several mainstream investors. Given this, crypto-native platforms have to offer customer support to help users navigate properly.

In the customer service segment, Valr customers have access to the Help Center, where several key questions are answered. The help center covers questions about creating and verifying an account, depositing, and withdrawing, amongst others. Users can also submit a request ticket to the support team. In writing this review, we submitted a support ticket. and got a response to be contacted within 24 hours. This is quite slow and could force users to consider alternatives.

In the case of Luno, the platform also offers a support service via its Help Center button. Users are redirected to a FAQ page and can also submit a support ticket in the event their queries are not addressed in the Help Center section.

Winner in Customer Service

In the customer service section, both platforms are equal.

Conclusion: Final Verdict

Valr and Luno are top-tier Bitcoin exchanges that offer users easy access to several crypto assets at reasonable fees.

Overall Winner

Valr is our overall winner largely due to its larger crypto support and more extensive features.

FAQ

Most frequent questions and answers

Valr is widely used in South Africa. However, it is accessible in Zambia as well as other African nations.

A large number of South African banks are part of Valr’s real-time clearing (RTC) network. A number of them include Nedbank, Investec Bank, Discovery Bank, and a number of others.

Luno runs a hot wallet which is notable for the easy access it grants for investors. The platform also offered an interest-earning Bitcoin wallet before discontinuing the service due to severe bear market conditions. However, in terms of storage capability Valr aces as it offers cold storage, which is considered more secure due to their offline nature.

The main disadvantages of using the Luno platform are limited asset support, high buying and selling fees of 2%, and lack of product depth to attract more sophisticated investors.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.