Carla Moretti

What is a Cold Wallet and How does it Work?

Carla Moretti

What is a Cold Wallet?

A cold wallet is a type of cryptocurrency wallet that stores the user’s private keys in a hardware device or on a paper printout (paper wallet) rather than on a computer connected to the internet.

For whatever reason you have chosen to invest in cryptocurrencies – maybe you invested at the wrong time (at the peak of a bull cycle), or maybe you have just put in your money when the market is down – knowing that whenever the next bull run comes, you will be making good money. Now, you know you are not going to engage your cryptocurrency wallet for a considerable time period, maybe months or even years.

Keeping your wallet connected to the internet and the market at this time can be a huge risk, especially with the number of people out there who are trying to make a living through digital theft and cybercrime.

This is where the concept of a cold wallet comes in. Once your cryptocurrencies and NFTs are disconnected from the internet and safe on an offline, physical source, you can breathe easily. In this article, we will cover everything you need to know about cold wallets, hot wallets, and the different resources you can use to secure your money.

What are Crypto Wallets?

A crypto wallet is a software program that allows you to store your cryptocurrencies, such as Bitcoin and Ethereum, in an address that is secured by a private key or by a combination of private and public keys. These addresses are either stored online or offline, depending on which type of wallet you use.

Crypto wallets are used for storing digital assets like cryptocurrency where they can be accessed from anywhere anytime without the involvement of intermediaries like banks and financial institutions. The best thing about crypto wallets is that it does not require third-party verification before carrying out these transactions. Both, a hot and cold wallet fulfils this function.

Since there would be no central authority involved, it makes them very convenient for everyday use, especially when compared with traditional banking systems where users need to go through several steps before getting their transactions approved (e.g., opening bank accounts).

What are Cold Wallets?

A cold wallet is usually created on a physical device to store cryptocurrency and blockchain-based assets, which is also why it’s often referred to as a hardware wallet. The hardware wallet should be offline and disconnected from the internet. It should be stored in a safe place, such as a safety deposit box at a bank, or a safety deposit box with family in the event of (God forbid) your death.

There are different types of cold wallets out there, each with its own pros and cons. Hardware wallets are physical devices that allow you to store your cryptocurrencies offline. They can come in different forms, such as USB sticks and the popular Ledger Nano S.

A paper wallet is simply a document that contains all the public addresses and private keys that can be used to access funds on cryptocurrency networks. Software wallets (hot wallet) include software on your personal computer, phone, or tablet which enables you to store cryptocurrencies.

They are much easier to use than hardware wallets and paper wallets. The cold wallet is completely disconnected from the outside world and cannot be used without special software/hardware.

Both hot and cold wallets are used to store crypto, NFTs, and other blockchain-based assets but a cold wallet provides maximum security for your funds. They are also known as “cold storage” or “offline storage”. The crypto is kept offline on the device, so it cannot be hacked by malicious actors who are looking for vulnerabilities in the system to steal funds from users.

This is not to say that hot wallets are unnecessarily or unjustifiably unsafe, but most hot wallets can still be hacked, since they are connected to the internet most of the time. Hot wallets can be more convenient than cold wallets because they are accessible online, allowing users to easily perform transactions on the blockchain.

Hot wallets are online storage of crypto, NFTs, and other blockchain-based assets that allow for immediate transactions on the blockchain. To really understand the need for cold wallets rather than a digital wallet, we first need to take a look at what hot wallets really are.

What is a Hot Wallet?

A hot wallet is a cryptocurrency wallet that works in an environment connected to the internet, with the private key available to anyone.

Hot wallets are vulnerable to hacking and theft. They can be accessed by malware or viruses downloaded from websites, which may steal your private keys and funds. Hot wallets also allow for access from anywhere in the world, so it is important to take precautions when using one!

In addition, hot wallets don’t offer as much security as cold wallets do, so if you lose control of your private key or password, then all of your funds will be gone forever (unless you have backups).

This is why, for long-term storage of digital assets, people use cold wallets because they are typically kept offline and never connect directly with any type of internet service providers such as Wi-Fi routers or cellular towers; they are also referred to as “offline” because they are stored securely on hard drives rather than being stored online as hot wallets would be!

Cold Wallets, hence, offer better security than any other type of wallet as long as they are properly protected against thieves. If you make sure that you won’t have a money heist situation on your hand, a cold wallet should serve you well.

Different Options Available When it Comes to Hot Wallets

Metamask

MetaMask is a crypto wallet for decentralized finance (Defi), Web 3.0 decentralized applications (DApps), and NFTs.

MetaMask is a browser extension that allows you to interact with Ethereum-based applications. If you don’t know what Ethereum is or how it works, we’ll get into that later. For now, just know that it’s a blockchain platform and cryptocurrency.

MetaMask is also a bridge that allows you to visit the distributed web of tomorrow in your browser today by allowing users to store cryptocurrencies and NFTs on their computers without having access to any private keys (the encryption method used by most exchanges).

Trust Wallet

Trust Wallet is one of the most popular crypto wallets to store BEP2, ERC20, and ERC721 tokens and more.

It’s also available for Android, iOS, and Web browsers and supports over 500 cryptocurrencies.

Trust Wallet has a built-in exchange where you can buy or sell coins directly from your browser without having to sign up for an account at another exchange first.

The app also includes wallet creation tools so that users can easily create secure accounts for themselves or others who want to access their funds without needing any technical expertise whatsoever!

Now that you know about two of the most famous software wallets, you should consider what and how they connect to allow users to buy and sell cryptocurrencies. Let’s take a brief look at cryptocurrency exchanges next.

Cryptocurrency Exchanges and NFT Marketplaces

Cryptocurrency exchanges are basically where hot wallets shine. A cryptocurrency exchange is a marketplace that you access to buy and sell cryptocurrencies. They have their own wallets that you can use, and some exchanges even allow you to directly connect with wallets like MetaMask and Trust Wallet.

Obviously, any wallet connected to an exchange becomes a hot wallet. Apart from cryptocurrency exchanges, another potential source that connects to wallets is the NFT marketplace.

An NFT marketplace is a community where you can purchase and sell NFTs. Of course, you need to connect your wallet to be able to do that, which is why you need a hot wallet to trade NFTs.

What is a Hardware Wallet?

A hardware wallet (cold wallet) is a device that stores the user’s private keys on a hardware device like a USB. The private key can only be accessed by the owner of the wallet and does not depend on internet connectivity to work.

However, there are some security risks associated with using a physical wallet that one should know about:

- Physical wallets are susceptible to theft or loss; if you lose your physical wallet, all of your funds are gone and cannot be recovered by anyone but you (unless “they” find it first).

- If someone steals your physical device and tries to use it with their own bank account, they could steal any Bitcoins stored within their internal memory.

- This is why many people prefer software wallets instead of hardware ones because they’re more secure against these threats—you don’t need to worry about keeping track of where/how many times each interval has passed.

- Hardware wallets can be a pain because apart from these issues, your hardware device can also break or get damaged.

Ledger Hardware Wallets

Ledger is one of the most popular providers of hardware wallets out there. They offer state-of -the-art wallets that support more than 5,500 tokens, with products coming in all shapes and sizes like the Ledger Nano S Plus and Ledger Nano X. The S Plus is very similar to the X, except for its bigger screen and larger memory. The company offers products that offer a “Bold, fearless protection for your Ledger.”

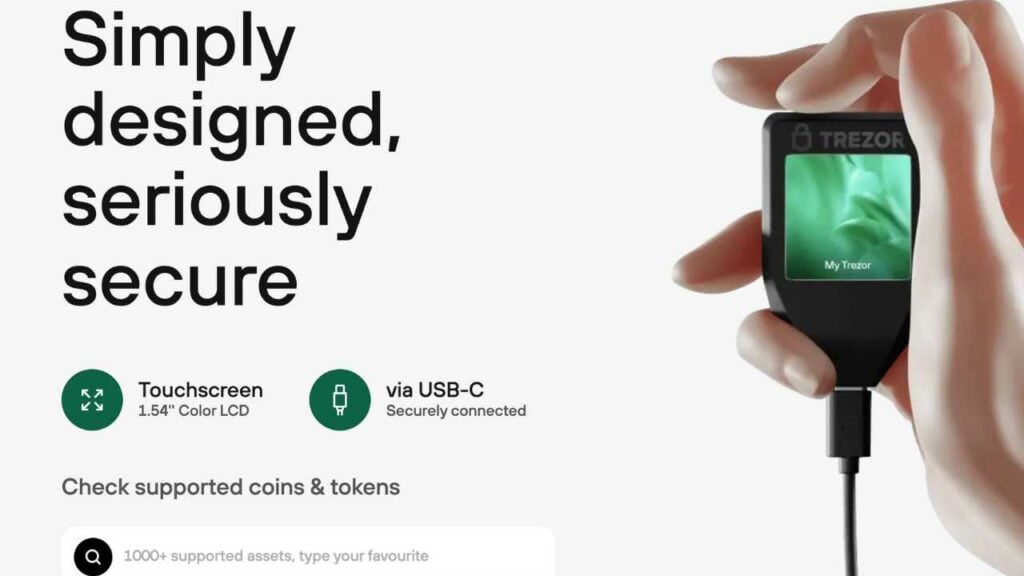

Trezor Hardware Wallets

Trezor hardware wallets claim to be the ultimate solution all your cryptocurrency needs. The wallet comes equipped with the Trezor Suite App, making it easier to manage your blockchain-based assets. Trezor has two popular products, the Trezor One and the Model T. Model T is the more expensive version, building on all the good things that Trezor One had to offer while providing a bigger screen to allow users to manage their assets with ease.

What is a “Paper Wallet”?

Paper wallets are one of the safest methods of storing Bitcoin or any other cryptocurrency that you own. The approach involves printing out your public and private keys on a piece of paper, which you then store and save in a secure place.

Paper wallets are not as secure as hardware wallets, but they are better than having nothing if you don’t have access to an offline computer or smartphone. But you have to be extra careful with them because, at the end of the day, they are just pieces of paper.

They can be damaged by water or fire; using scissors to cut out the private key from your paper wallet could result in losing all your funds forever!

The Importance of Recovery Phrases

The recovery phrase is an important part of securing your cryptocurrency assets. By having a 12-word recovery phrase for each wallet you have, you can restore your funds if you lose access to it. They are used for both a hot or cold wallet.

The recovery phrase is a set of words that are used to restore your wallet if you lose access to it, like a security question that lets you log into a website again once you forget the password or don’t have access anymore because someone else has used it already.

A cold storage wallet makes the job of protecting your digital assets easier for you. There’s no limit to how cold you can make your wallets (no pun intended). If the usual measures do not satisfy you, you could bury them as deep as you want in your backyard.

If you’ve got millions in cryptocurrencies, we would advise putting them in a nuclear shelter (that was a joke!). Cold storage wallets can seem excessive, and you might consider yourself to be immune from the wiliness of hackers, but trust me, it is always better to be safe than sorry when it comes to your hard-earned money. “It won’t happen to me” are very, very famous last words.

Conclusion

Cold wallets store your digital assets offline whereas most hot wallets and online wallets are connected to the internet most of the time, making them prone to hacks and cyber theft.

Cold storage devices therefore provide higher security to your crypto because you are in full charge of your device but you need to take good care of it since you take full custody of your assets!

Whatever wallet you choose never put at risk more money than you can afford to lose. We wish you the best of luck in your investment endeavors!

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.