Swen Keller

- Home

- /

- Cryptocurrency Exchanges

- /

- DYDX Review 2023: How...

DYDX Review 2023: How to swap and buy crypto

Swen Keller

- URL: https://dydx.exchange

- Headquarter: N/A

- Year Founded: 2017

- Platform App: Web, Mobile

- No. of Cryptos: 35+

- Fiats Available: N/A

- Withdraw Method: MetaMask, Trust Wallet, Coinbase Wallet, imToken, TokenPocket, BitKeep, Rainbow, Coin98, iToken, and WalletConnect

- Payment Method: MetaMask, Trust Wallet, Coinbase Wallet, imToken, TokenPocket, BitKeep, Rainbow, Coin98, iToken, and WalletConnect

- KYC Verification: N/A

- Native Token: DYDX token

DYDX Review: Our Opinion

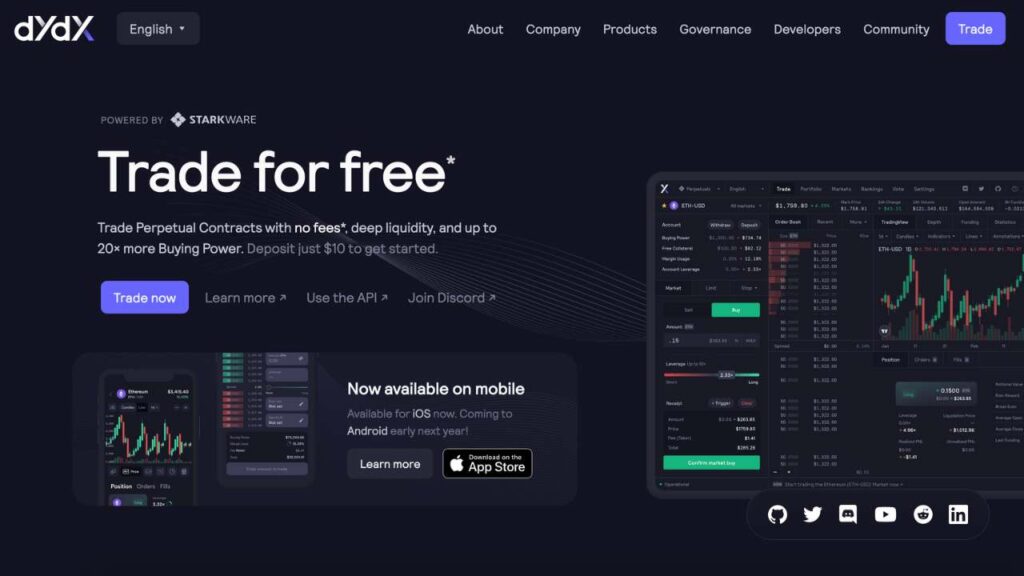

The DYDX exchange is a decentralized exchange built for perpetual trading and margin trading. It works differently than other decentralized crypto exchanges like PancakeSwap and Uniswap. And it is best for users looking for an advanced decentralized exchange, as beginners will find the DYDX exchange difficult to navigate and use to trade crypto assets.

That said, the DYDX platform stands out for its zero fees on perpetual trading and high-leveraged trading offers.

An Overview of DYDX

The DYDX platform is a decentralized exchange based on the Ethereum Layer 2 system, starkware, with plans of moving to its Cosmos-based blockchain soon.

DYDX exchange uses StarkWare’s zero-knowledge proofs to ensure a decentralized crypto exchange.

The DYDX platform of perpetual trading and decentralized margin trading (leveraged trading) was founded by Antonio Juliano, a former Uber and Coinbase developer, in June 2017.

As with most popular decentralized crypto exchanges, DYDX has been supported by various industry giants including the Spartan Group, Polychain Capital, a16z, Hashed, and many more.

The DYDX exchange became so popular during the early days that it rivaled the top centralized exchange Coinbase in its trading volume.

Now, though the DYDX platform is a decentralized exchange, it doesn’t use the same workflow as other decentralized exchanges like PancakeSwap and SushiSwap.

The cryptocurrency exchange was built especially for perpetual (perpetuals) and margin trading.

Perpetual smart contracts are derivatives that get their value from underlying assets (crypto assets in this case). Unlike futures or options, perpetual smart contracts do not have expiration dates.

Also, unlike other decentralized exchanges, DYDX does not depend on the automated market maker (AMM) model to facilitate trades. Rather, the DYDX platform uses a matching model and a traditional order book to satisfy the requests of institutional crypto traders.

The crypto exchange offers a native token called the DYDX token that gives DYDX holders governance participation rights and discounts on fees.

Pros

- Supports perpetual contracts and margin trading

- Offers multiple payment methods

- Supports discounts on fees

Cons

- It does not use automated market maker

- Poor spot trading service

Key Features of DYDX

DYDX Token

DYDX is the governance token of the DYDX exchange that allows community members to govern the DYDX Layer 2 Protocol.

The DYDX token allows liquidity providers, traders, and DYDX partners to work together to improve the protocol.

DYDX token holders get to vote on important aspects of the protocol including the following:

- The inclusion of a new token listing on the DYDX Layer 2 Protocol

- Determining safety staking pool payouts when a loss happens

- Voting on market makers that will be added to the liquidity staking pool

- The governance of contracts

- DYDX token has a total supply of 1,000,000,000 DYDX tokens.

Below is the breakdown of the allocation of the DYDX token:

- 50% of the token is allocated to the DYDX community. The community includes stakeholders, liquidity providers, traders, and users who have completed trading milestones. A fraction of this will also go to the community treasury.

- 27.3% of the DYDX token is allocated to previously active investors.

- 15. 27% is allocated to the official team of the DYDX exchange. This includes advisors, founders, employees, etc.

- 7% of the DYDX token is reserved for future consultants and employees.

The distribution of the DYDX token by the DYDX exchange will be done over 5 years.

DYDX token holders enjoy discounts on trading fees. The fee discount is dependent on the number of DYDX tokens the user holds in their wallet.

Users who hold 10,000 DYDX tokens or more enjoy a 15% discount on fees.

That said, there are 3 types of rewards for DYDX token holders on the exchange.

Let’s take a brief look at each type of reward.

Trading Rewards

Any trader trading on the exchange’s layer-2 protocol is eligible to earn DYDX trading rewards.

Trading rewards are distributed to encourage crypto traders to use the layer-2 protocol, to grow the popularity of the DYDX exchange, and to speed up the market liquidity process.

The trading rewards a trader gets is dependent on key factors like their trading volume and activity.

Retroactive Mining Rewards

Retroactive mining rewards are distributed to users who have been using the DYDX platform for a long time and DYDX users who trade on the DYDX Layer 2 Protocol. Due to official restrictions, retroactive mining rewards are not available to DYDX traders resident in the United States.

The amount of retroactive mining rewards a user earns is dependent on the tier they belong to and their overall activity on the DYDX crypto exchange.

Liquidity Provider Rewards

Liquidity provider rewards are paid to DYDX users with an active Ethereum address who maintain a minimum maker volume of 5% in the previous epoch.

Liquidity provider rewards aim to accelerate the market liquidity of the DYDX token in the long run. Rewards are paid to liquidity providers after 28 days.

DYDX Hedgies

Hedgies are the in-house NFT collection of the DYDX crypto exchange.

Each Hedgie is an ERC-721 token. There are 4,200 unique collectible avatars created on the Ethereum blockchain.

Hedgies were launched in January 2022 and were distributed on the 1st of February 2022. The initial distribution went to traders, governance voters, and the crypto community.

The distribution of Hedgies is divided into 2 parts: Initial distribution and ongoing distribution.

During the initial distribution, 2,443 Hedgies were allocated. Each wallet address in the distribution received only one Hedgie. There are 4 tiers in the initial distribution and a prior tier must finish before a new tier begins. Any leftover Hedgie from the previous tier was rolled over to the following tier.

The allocation for the 2,443 Hedgies distributed in the initial distribution is as follows:

805 Hedgies were distributed to users who voted in an on-chain governance proposal in the DYDX community.

1,337 Hedgies were allocated to traders who were active in Epoch 5 on the protocol between 21st December 2031 and January 18th, 2022.

The remaining Hedgies from the prior tiers were available to be minted by anyone.

The crypto exchange also pre-minted 205 Hedgies for the DYDX Foundation while 96 Hedgies were pre-minted to be distributed by DYDX Trading Inc through various channels.

Under the Ongoing Distribution, the remaining 1,757 will be distributed for 2 years starting from February 2022.

The Hedgies will be randomly distributed through an auditable distribution method.

DYDX Trading inc has custody of a permission key that allows Hedgies to be minted on any address up to the total supply of Hedgies in the schedule.

Also, for 104 weeks the exchange will distribute 1 Hedgie to the top-performing trader daily. The Hedgies to be distributed daily are selected randomly.

There is also a weekly competition slated to run for 104 weeks during which the exchange will distribute 10 Hedgies weekly.

Hedgie owners enjoy certain benefits on the DYDX crypto exchange.

First, Hedgies serve as identities for governance participants and early traders on the protocol. Hedgie owners also receive a one-tier increase in their DYDX fee tier discount.

For instance, Hedgie owners who hold 5,000 DYDX tokens or more will enjoy an up to 15% discount.

This is 5% more than the normal discount.

Minting Hedgies attract gas fees but the exchange does not charge royalties for Hedgies.

Perpetual Contract Market

The DYDX perpetual contract market is a decentralized contract market that allows users to trade any crypto asset.

The first Perpetual contracts market to be launched on DYDX is the BTC Perpetual Contract Market. The DYDX BTC perpetual contracts market gives users access to liquid trading of bitcoin.

It also gives them an easy and efficient way of getting leveraged short or long exposure. With the BTC perpetual contract market, users can enjoy up to 10x leverage with no expiry.

Note that DYDX perpetual contracts are not available to users in the United States.

The 2 major BTC perpetual contract markets on DYDX currently are the BTC – USDC Perpetual and the BTC-USD Perpetual.

DYDX perpetual contract markets are supported by a new protocol, with open-source smart contracts deployed in the Ethereum mainnet.

Cryptocurrencies Available on DYDX

DYDX decentralized exchange supports 35 cryptocurrencies.

Available cryptocurrencies include Bitcoin, Ethereum, DYDX, Dogecoin, USD Coin, Chainlink, Cardano, Bitcoin Cash, Polkadot, Litecoin, Uniswap, Solana, Polygon, Monero, Aave, Cosmos, Maker, Compihd, Avalanche, SushiSwap, Yearn, Curve, 1 Inch, Algorand, Ethereum Classic, Stellar Lumens, etc.

Can You Buy and Sell NFTs on the DYDX?

Yes, aside from margin trading, lending and borrowing, and earning rewards on the DYDX token, the platform allows users to buy and sell NFTs.

However, it isn’t a regular NFT marketplace, rather, it is an NFT collection of 4,200 NFTs called Hedgies.

Hedgies are unique, collectible avatars that are represented as non-fungible tokens on the Ethereum blockchain.

Minting Hedgies on the DYDX protocol will cost users gas fees and a 2.5% royalty sent to the independent artists of the product – the DYDX platform does not receive the royalties.

In addition, users who hold Hedgies will get a boost in one tier in DYDX trading fee discounts.

DYDX Review: Fees

The DYDX exchange uses the maker/taker fee model to determine its trading fees.

DYDX token or stkDYDX holders receive discounts on fees based on the amount of DYDX token they hold at the time of the trade.

Also, any user that holds 1+ Hedgies will automatically get the benefit of rising by one fee tier.

That said, here are its perpetual trading fees:

Perpetual Fees

Free Level

At this level, users have a 30-day trade volume in USD from $0 to $100,000 and a maker/taker fee of 0.000%/0.000%.

Level 1

At this level, users have a 30-day trade volume in USD from $$100,000 to $1,000,000 and a maker/taker fee of 0.020%/0.050%.

Level 2

At this level, users have a 30-day trade volume in USD from $1,000,000 to $5,000,000 and a maker/taker fee of 0.015%/0.040%.

Level 3

At this level, users have a 30-day trade volume in USD from $5,000,000 to $10,000,000 and a maker/taker fee of 0.010%/0.035%.

Level 4

At this level, users have a 30-day trade volume in USD from $10,000,000 to $50,000,000 and a maker/taker fee of 0.005%/0.030%.

Level 5

At this level, users have a 30-day trade volume in USD from $50,000,000 to $200,000,000 and a maker/taker fee of 0%/0.025%.

VIP

At this level, users have a 30-day trade volume in USD from $200,000,000 and a maker/taker fee of 0%/0.020%.

Discounts on Trading Fees

User’s DYDX + stkDYDX Current Balance and fee discount applied:

- ≥ 100: 3.0%

- ≥ 1,000: 5.0%

- ≥ 5,000: 10.0%

- ≥ 10,000: 15.0%

- ≥ 50,000: 20.0%

- ≥ 100,000: 25.0%

- ≥ 200,000: 30.0%

- ≥ 500,000: 35.0%

- ≥ 1,000,000: 40.0%

- ≥ 2,500,000: 45.0%

- ≥ 5,000,000: 50%

Lending and Borrowing Fees

DYDX supports lending and borrowing which comes with particular fees. For borrowing, interest rates float (dynamic) based on demand and supply and can be seen on the Markets page.

However, these borrowing fees are paid straight to the lender and not the DYDX exchange.

Lenders receive interest payments from borrowers, however, 5% of payments are put aside to power an insurance pool for the DYDX protocol.

The rest of the interest received from borrowers is forwarded straight to the lender.

This is prorated by the amount a lender lends. That said, the rate lenders see in the DYDX protocol is exactly what they received, the 5% collected is accounted for.

Deposit and Withdrawal Fees

DYDX does not charge fees for withdrawals or deposits on the crypto exchange. But you will be responsible for covering the gas cost of every deposit/withdrawal transaction.

The only exception to this is the trading platform’s fast withdrawal option on the Layer 2 Perpetual offer, where you’ll be charged a 0.1% fee to cover liquidity required for fast withdrawals.

Liquidating Positions

When you liquidate a position, the collateral of the position will be sold to pay the borrowed funds. This carries a 1% fee for perpetual smart contracts.

DYDX Review: Payment Methods

DYDX supports the following non-custodial crypto wallets as payment methods: MetaMask, Trust Wallet, Coinbase Wallet, imToken, TokenPocket, BitKeep, Rainbow, Coin98, iToken, and WalletConnect.

Users can also use a QR code in the Connect Wallet screen to connect other compatible wallets not listed.

DYDX Review: Security

DYDX decentralized exchange is not registered or licensed by any regulatory body or authority. The exchange does not have any control over users’ funds and does not hold users’ private keys through any central intermediates.

All users’ cryptocurrencies on DYDX during trading are secured by smart contracts.

DYDX has conducted intensive intern testing and also contracted leading security firms to perform security audits.

The smart contracts of the Perpertals Protocol on Layer 2 were audited by PeckShield, while those on Layer 1 were independently audited by Zeppelin Solutions.

DYDX decentralized exchange has an administrative account that can add and remove features from the protocol, the account can set new oracles for prices, add new markets and change interest rate functions.

Unlike what is available on other decentralized exchanges, DYDX’s admin account is an on-chain multi-signature wallet, which makes it publicly auditable.

Also, all admin actions on Layer 2 Perpetuals are delayed for 14 days, this enables the DYDX team to identify, cancel and notify the public of any attempted malicious attacks.

Furthermore, the stark keys of users who onboarded to DYDX using supported wallets like Ledger and MetaMask are automatically maintained. All the user needs to recover their account is to connect to DYDX with the same Ethereum address they onboarded with.

Users who lost their stark key stored on supported wallets will not be able to trade, transfer or withdraw assets on Layer 2. The user can however submit a request for Forced Trade or Forced Withdrawal with their Ethereum key.

DYDX Review: Staking Rewards

DYDX had a liquidity pool that offered trading rewards and liquidity provider rewards on USDC and DYDX tokens. However, the community voted to put the rewards at 0% so users will not earn interest for staking their coins in the liquidity pool.

Supported Countries

DYDX supports users from several countries across the globe except for a few. Despite not being a centralized exchange, DYDX does not allow users from the following countries: the United States of America, Cuba, the Democratic Republic of Congo, Iran, Iraq, Somalia, Yemen, Zimbabwe, Burma, Mali, Côte D’Ivoire, Libya, North Korea, Nicaragua, Syria, Sudan and any country, state or region subject to US sanctions.

DYDX Review: Opening a DYDX Account

DYDX is a decentralized finance exchange. This isn’t like centralized exchanges where you need to undergo account opening and KYC processes. Centralized exchanges need to do so due to regulatory bodies.

Instead, all you need to do is go to https://dydx.exchange and click the blue Connect button.

You will see a list of supported non-custodial wallets like MetaMask and Trust Wallet. Choose the wallet with your crypto assets and follow the on-screen instructions.

That’s all! There’s no need to enter your email address or phone number like you would on a centralized exchange like Binance or Kraken.

DYDX Review: Trading Experience

DYDX offers a complex trading experience best suited for advanced traders. The decentralized finance exchange offers advanced trading products for derivatives trading, perpetual contracts trading, and cross-margin trading.

Users also have access to spot trading features.

Depositing funds on the crypto exchange is like on any other decentralized exchange where you need to connect your non-custodial Web3 wallet.

The trading platform is accessible via the DYDX mobile app for Android and iOS and its web platform.

DYDX Review: Customer Service

DYDX offers customer service via the in-app help chat. The exchange also has a Help center with lots of helpful articles that can help users troubleshoot common problems.

The exchange is also active on several social media platforms including Telegram, Twitter, YouTube, LinkedIn, WeChat, and Discord.

Customer Satisfaction

DYDX support channels are limited, this is a major problem especially since the platform is not Beginner-friendly.

The absence of phone or email support makes contacting the DYDX support team difficult for most users.

Does DYDX Offer Education?

Yes, DYDX offers education via its Crypto Learning Center which hosts tons of resources on DeFi and general crypto knowledge such as Hot Wallets, Cold Wallets, Margin Trading, DYDX trading, mining rewards, Centralized Exchanges, and much more.

Is DYDX Right for You?

This trading platform is best for users looking for a decentralized crypto exchange that offers advanced features like margin trading, global liquidity pools, and much more.

Final Thoughts

The DYDX exchange is a great trading platform for experienced traders who want complete control over their digital assets and access advanced trading features like margin trading as you would get on centralized exchanges.

However, it will appear complex to newbies finding their footing in the decentralized space.

you want to know more about Crypto Decentralized Exchanges and other choices you have, check out our detailed Curve Finance Review.

FAQ

Most frequent questions and answers

DYDX supports perpetuals, which are contacts that have underlying assets for value. That said, it offers over 35 cryptocurrencies.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.