What is Fantom (FTM)?

Luis Clark

- Home

- /

- Cryptocurrencies

- /

- What is Fantom (FTM)?

Luis Clark

Fantom is a smart contract that supports blockchain, powered by its native FTM token. Fantom is a layer-1 blockchain that offers an alternative to Ethereum‘s exorbitant cost and slow speed, which users frequently complain about. Like Hedera Hashgraph, Fantom operates on a blockchain that uses directed acyclic graphs.

Fantom’s mainnet was launched in December 2019 after a $40 million fundraising. Its blockchain showed in 2021 that it could support its own decentralized finance (DeFi) industry and is quick and inexpensive. Fantom’s market cap is currently $3.4 billion, trailing behind Luna’s and Solana‘s market cap. The TVL or total value locked in the Fantom ecosystem is over $6 billion.

Fantom was launched in January 2018 after months of careful preparation and research into creating an ecosystem. It was carried out by a team called Fantom Foundation. The Fantom Foundation works to make the ecosystem necessary for a more decentralized, transparent, and adept future. The group includes scientists, entrepreneurs, engineers, designers, and researchers who share the same goal.

Fantom was founded by Dr. Ahn Byung Ik of South Korea in 2018, and since then, the smart contract project has developed into one of the most well-liked blockchains for DeFi transactions.

It was created to resolve the drawbacks of earlier blockchain platforms like Bitcoin and Ethereum, particularly the slow transaction times. Ethereum was the first to offer smart contracts and is the platform where most decentralized applications are built. However, there have been outages and expensive transaction fees due to congestion problems. As a result, several alternatives have been created that offer cheaper and faster transaction processing. The native token of the Fantom network, or FTM, can be used for network security, validator compensation, and governance-related tasks.

In response to the glaring shortcomings of the Ethereum network, many projects have been springing up to fill these problems. Fantom is one of these initiatives and addresses the “trilemma” problem of scalability, security, and decentralization in a blockchain network.

Fantom is basically a highly scalable, secure, and Ethereum Virtual Machine (EVM)-compliant smart contract platform that enables the integration of numerous DApps via a single consensus method. The network’s token, FTM, is used for network governance, staking, and paying fees associated with deploying apps on the blockchain.

This article on Fantom blockchain protocol aims to educate about the Fantom ecosystem by describing how the Fantom network functions.

What is Fantom?

Fantom is a decentralized, permissionless, open-source smart contract platform for digital assets and decentralized applications (Dapps)— one of several blockchain networks built to offer an alternative to Ethereum.

Fantom is a layer 1 distributed ledger, offering seamless deployment of smart contracts on its network. The platform uses an advanced DAG, or Directed Acyclic Graph, which includes seamless interactions between computer nodes in a network to provide quick and safe transactions. The (DAG) smart contract platform overcomes the issues with the first wave of blockchain platforms.

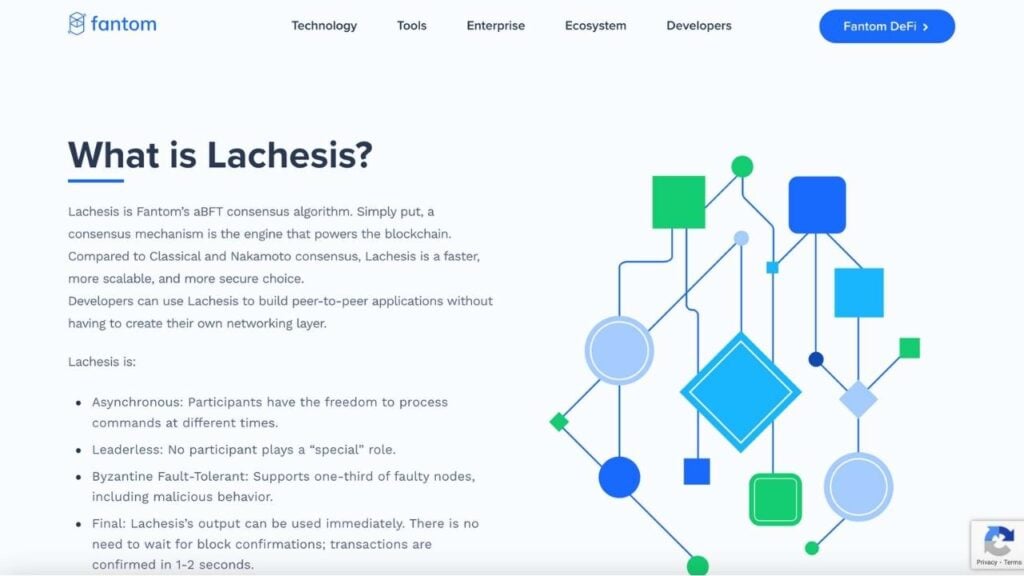

To achieve consensus, Fantom uses a unique Proof-of-Stake (PoS) model, an independent consensus layer known as the “Lachesis Protocol.” This protocol integrates with the Fantom Opera chain, an EVM-compatible smart contract network. In essence, it enables numerous projects to be built on the Fantom Opera chain to enjoy the basic functionalities of Fantom. It comprises adequate security while ensuring swift transactions and low transaction costs for all users. Lachesis protocol as a PoS protocol secures the entire network.

According to its white paper, the Lachesis consensus protocol (or Lachesis protocol) and a directed acyclic graph (DAG) put Fantom to work, which helps the network attain an asynchronous Byzantine fault tolerance (aBFT). Lachesis consensus exclusively transmits events across nodes, unlike other types of consensus that frequently communicate between blocks. Because of this, this protocol is unquestionably superior in terms of transaction speed and security in less than a second. Lachesis Consensus Protocol largely relies on Proof-of-Stake (PoS) to guarantee that all validator nodes have equal control and are free to join or leave the network whenever they see fit.

Lachesis works similar to a standard Proof-of-Stake (PoS) platform, except it is much faster and less expensive. It executes many time periods on a single vote after combining them. This technique streamlines the high transaction process by processing 4,500 transactions per second, including standard transactions and smart contracts.

Each Lachesis node in Fantom uses the Directed Acyclic Graph (DAG) to establish and verify the order of the system’s Event Blocks. After the events have been resolved independently, the confirmed blocks will be pooled as a final chain as part of Fantom’s base layer. Now that the transaction has been finished, it can be processed.

Fantom is positioning itself as a reliable alternative to Ethereum and Bitcoin, whose transaction processing times range from 10 minutes to an hour. While aiming for 300,000 transactions per second, the Fantom network processes each in just a few seconds.

The long-term goal is to provide interoperability within larger transaction bodies worldwide using fast DAG technology that can be more thoroughly integrated into the real world. Additionally, a new sustainable infrastructure with authorizations for data transfer and real-time transactions is being designed.

The Fantom Opera mainnet provides complete smart contract capability with solidity and is compatible with the Ethereum Virtual Machine (EVM). Fantom’s mainnet Opera Chain, powered by Lachesis Consensus, strives to avoid the transaction traffic congestion that slows down and limits the scalability of early-generation blockchains.

Thanks to Fantom’s highly scalable features, every application receives its own unique (independent) blockchain with particular tokens, governance rules, and tokenomics. Fantom is made up of an endless number of decentralized systems, each operating autonomously in its own zone and interacting with the others.

The Fantom ecosystem might eventually comprise multiple blockchain layers with Lachesis at the core. Opera, an Ethereum Virtual Machine (EVM)-compatible smart contract platform that debuted in December 2019, was the first added layer to Fantom. It makes FTM available as an ERC-20 token standard. The Opera chain is a dependent PoS layer that depends on Lachesis to affirm transactions and create new blocks within the network. It supports popular decentralized finance (DeFi) applications such as Curve, CREAM, and others.

Fantom announced integration into Binance Chain in the second quarter of 2019, and as a result, it gained quite a particular place in many people’s hearts. FTM is available as BEP-2 on the Binance Chain of Tokens.

It indicates that the Binance Chain handles transactions on this network. Fantom’s incorporation into the Ethereum and Binance Chain opens the door for a more advanced, interoperable ecosystem. In September 2021, Andre Cronje, a founding member, introduced the NFT marketplace on the Fantom network.

Key Features of Fantom Network

- On the Fantom network, payments take about one second and cost $0.0000001. The Proof-of-Stake technology on the FTM platform also ensures the highest level of security for all transactions. Highly scalable Fantom can scale to thousands of nodes and process thousands of transactions per second. Fantom is EVM compliant and compatible with Ethereum. As a result, the protocol is unquestionably superior in terms of transaction speed and security in less than a second.

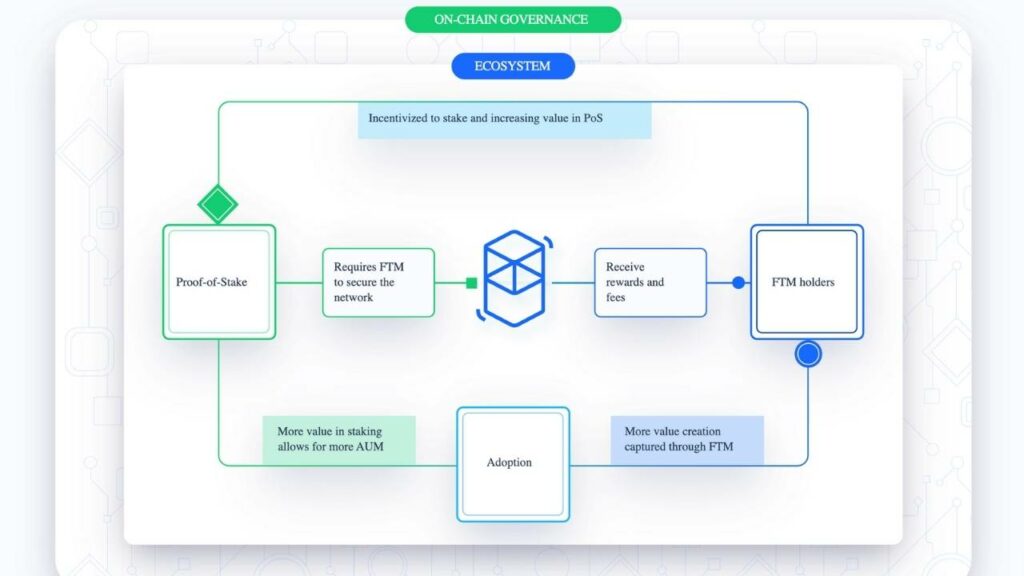

- On-Chain Governance – FTM is entirely permissionless and decentralized. FTM employs a permissionless protocol and asynchronous Byzantine Fault Tolerance (aBFT) to do this. Only FTM owners who have staked their tokens in the FTM network may make decisions. Stakers can make new suggestions, cast votes on important choices, upgrade systems, and lay out the FTM network’s future course.

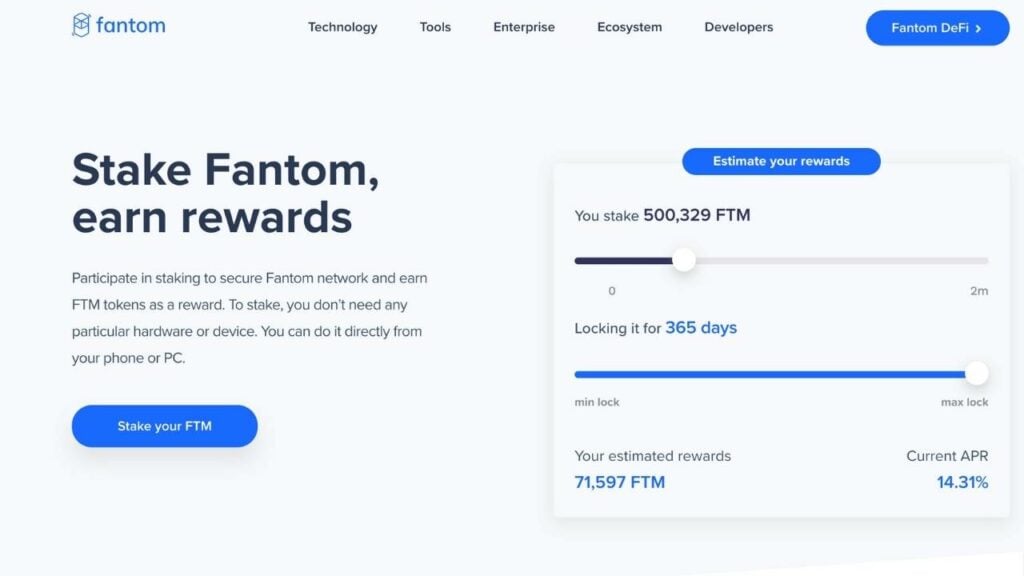

- Users staking their Fantom (FTM) tokens on the platform benefit from an APR of 3.79% to 11.59%. The number of FTM tokens staked and the length of time the tokens are held for both affect the APR rate.

- The “Blockchain Trilemma,” which Fantom helps solve, is a crucial problem. The blockchain trilemma is the inability to balance speed, security, and decentralization simultaneously. To achieve decentralization and security, Fantom uses a permissionless protocol and asynchronous Byzantine Fault Tolerance (aBFT) to process transactions asynchronously, accelerating the entire process.

- Lachesis consensus, a BFT algorithm developed by Fantom, beats both the Nakamoto and Classical models in terms of performance. Without developing their own networking layer, developers may create peer-to-peer applications with Lachesis, a more effective, scalable, and secure alternative. Lachesis consensus enables Fantom’s validator nodes to resolve the prior blockchain’s problem in terms of transaction volume and time efficiency.

- Because Lachesis is asynchronous, participants can take instructions at their own pace. Additionally, no leader or one performs a “special” role. Lachesis is Byzantine fault-tolerance (BFT), which enables consensus even in problematic nodes engaged in malicious activities. Finally, the output of Lachesis is immediately useful. The requirement to await block confirmations is not necessary because transactions are confirmed in 1-2 seconds.

- In terms of its understanding of asynchronous Byzantine Fault Tolerance, Lachesis can handle transactions flexibly and tolerate up to one-third of faulty users who engage in malicious behavior without endangering the entire network. The Byzantine fault-tolerant (BFT) approach tends to go beyond other Byzantine Fault tolerant’s consensus and is purposefully meant to cut the duration for transactions while also maintaining scalability, in comparison to the time-consuming verification needed by Proof-of-Work (PoW)

- Lachesis is connected to other Lachesis nodes using peer-to-peer networking and a DAG aBFT consensus mechanism to ensure that the same commands are executed precisely. Because the same thing repeatedly happens in several elections, fewer consensus messages are produced. Lachesis accomplishes a quicker time to finality and lower communication overhead compared to synchronous Byzantine Fault Tolerant.

Which BlockChain Does Fantom Use?

Each blockchain network used by a Fantom application is unique. Through a number of commands and network conditions, this DeFi platform assists in the faster execution of smart contracts and transactions.

The system is based on open source software, allowing programmers to quickly create trading platforms, lending applications, and markets for non-fungible tokens or other digital assets. An app developer may easily port in apps created on the Ethereum blockchain because Fantom uses Solana, the same programming language as Ethereum.

The Fantom blockchains can interact with one another since they share a common language.

What is Fantom Used for?

The Fantom blockchain uses its very own utility token called Fantom (FTM), which serves a dual purpose as a cryptocurrency. FTM is the primary coin used on the Fantom Mainnet, and it operates as a BEP-20 token within the Binance ecosystem while also functioning as an ERC-20 token in the Ethereum system.

Payments

The Fantom network’s quick finality makes payments quick and easy (take around a second). The FTM token is also ideal for value exchange due to its fast throughput and low fees (approximately $0.0000001).

Governance

FTM is necessary for on-chain governance, where stakeholders can put forward and vote on advancements and modifications through governance. Fantom’s permissionless and leaderless decentralized ecosystem means that the on-chain governance mechanism makes all network decisions. FTM token holders, primarily validators and delegates, have the right to vote on various governance issues, including block rewards, upcoming upgrades, technical committees, and more. The amount of FTM that a validator or delegator holds determines how much influence a vote has.

Staking

Without the requirement for specialized software or hardware, FTM stakes can be used to protect the Fantom network while earning FTM tokens as a reward. It’s easy, and you can do it from your phone or computer.

Network Fees

Fantom’s network fees, such as those for deploying Fantom smart contracts, building new networks, or even transaction costs, are paid using FTM. By charging a fee, the network is protected from spam and malicious users who may otherwise clog the ledger with useless data or slow down the network.

The transaction fees for conducting operations or building networks are also expressed in FTM. By enforcing setting fees, spam and hacking attempts by malicious users who want to take over the system or cause it to crash become prohibitively expensive.

While Fantom’s network fees may be small, they serve as a significant deterrent for potential attackers. These fees effectively discourage malicious individuals from entering the system due to the high cost involved.

Network Security

The FTM token seeks to safeguard the network through the use of a proof-of-stake method, where stakers must lock their tokens and validators must have a minimum of 3,175,000 FTM to participate. Staker and validator fees and epoch rewards are paid in exchange for their services. In fact, staking FTM tokens offers Fantom users financial incentives to support network security as well as a way to increase profits. The aBFT network structure is created to maximize performance while maintaining network security.

How to Buy Fantom?

All major cryptocurrency exchanges, including KuCoin and Binance, offer FTM for sale, although Binance has the highest volume and the least slippage of any exchange. With Ethereum (ETH), Bitcoin (BTC), BNB, or Tether (USDT), you can buy FTM. To buy Fantom token on Binance:

- Consider buying a stable coin of your choice using a bank transfer to switch with FTM tokens on the Binance exchange.

- Fiat can be traded on Binance by depositing money into your account.

- You could buy FTM on the Binance exchange using credit or debit cards.

There are 3.175 billion Fantom tokens available in total. There are presently 2.1 billion FTM tokens in circulation. The remaining Fantom tokens will be used to pay out staking incentives to FTM holders. The distribution of the rewards to staked FTM holders will depend on governance decisions, although, as of right now, it could take two years for the FTM token to enter full circulation.

By staking or holding a certain amount of tokens in the blockchain system to confirm its transactions, a bit over 31% of the total tokens will be given as rewards. This will keep happening until all the tokens are given out or shared by the year 2024.

All major exchanges offer Fantom tokens for purchase. Due to custodial risks and the lack of staking rewards for FTM holders who purchase FTM from any source other than the official FTM network, the FTM developers discourage this behavior.

How to Store Fantom?

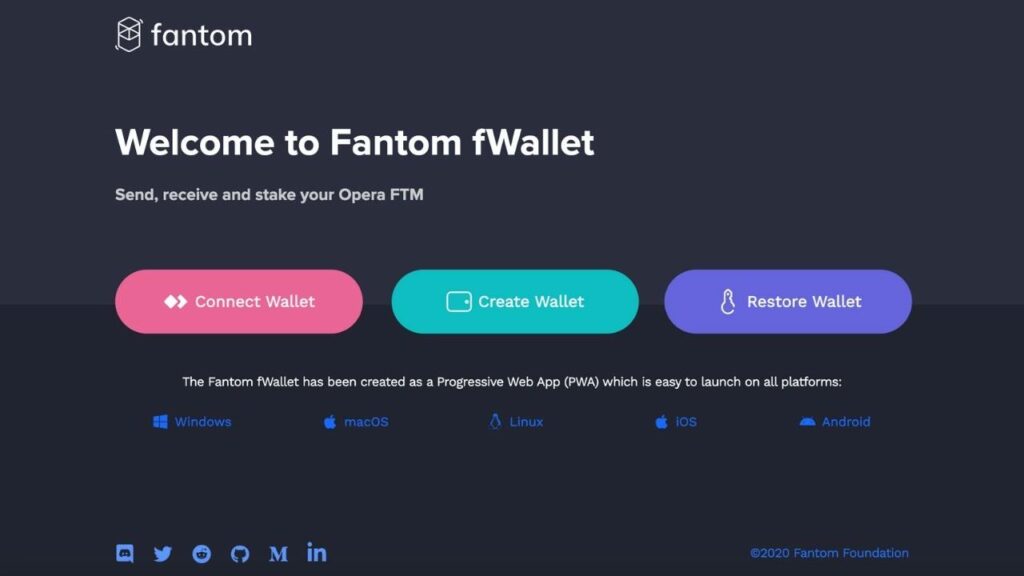

You should avoid storing FTM on exchanges due to the custodial risk. You would also miss out on staking rewards if you rely on custodial services. Wallets such as fWallet (Fantom wallet), MetaMask, Ledger, and other well-known mobile wallets can be used to securely store FTM and Fantom-based coins like USD Coin (USDC) and fUSDT.

With fWallet (Fantom wallet), you may receive, transfer, stake, and access the Fantom DeFi ecosystem. You may interface with Fantom DApps and store mainnet FTM using MetaMask. Fantom has strong DeFi ecosystem support. You can access the network’s DeFi offerings and conduct trades directly from your wallet.

The Ledger Nano is the most widely used hardware wallet and the safest way to maintain your mainnet FTM and interact with DApps on Fantom. More than 1 million people can access the Fantom network and store FTM with ease using the Coinbase wallet.

Best Place to Stake Fantom

Proof-of-stake consensus algorithm is the foundation of the staking procedure at the scalable blockchain platform for DeFi called Fantom.

You must stake your FTM token to validate transactions on the Fantom network, and you are then rewarded with additional tokens. The staked tokens are only accessible to you, and you can unlock or unstake them whenever you like.

Validator nodes and stakers must, nevertheless, adhere to the following staking requirements:

- The minimum staking amount is 1FTM.

- You can lock your FTM holdings for zero days, earning the base award rate.

- You can lock your FTM holdings for a year, earning the maximum award rate.

- Funds would be available within seven days after staking. It is called bonding time.

- Delegating fee is fixed at 15% on staking rewards.

Future of Fantom

The FTM network presents a powerful solution to the blockchain trilemma problem for cryptocurrency users. As explained previously, the FTM blockchain trilemma refers to the balance between speed, security, and decentralization – something that most blockchains do not offer to their users. Fantom addresses this gap, which is the crucial factor that could entice cryptocurrency users to transfer from other blockchains to the FTM network, potentially driving the price of the FTM token to $10 and above.

The FTM network may face significant competition from Ethereum 2.0. However, before it launches, FTM holders can anticipate more use of the Fantom platform by supporters of the Proof-of-Stake mechanism.

The Fantom (FTM) token runs on its own customized blockchain, so even if major cryptocurrency exchanges, which frequently face custodial sanctions from different governments, were to shut down one day, the decentralized FTM platform would continue to function. Additionally, initiatives with their own blockchain, some of which have been branded “Ethereum killers,” are particularly attractive to investors. Given that the admission of whales will almost certainly drive the token price to all-time highs, it might be a favorable sign for owners of Fantom (FTM).

Given several unpredictable elements, it is now challenging to predict which way Fantom (FTM) will tilt. Thus it is advised to monitor market indicators and technical assessments of cryptocurrency specialists before investing in this token.

Closing Thoughts

Fantom is an international, decentralized network with validators and community members worldwide. Fantom is not a risk-free investment, despite being a highly scalable platform for business apps and cryptocurrency DApps.

Our extensive analysis of the different Cryptocurrencies doesn’t stop here. You can also check out our “What is Shiba Inu (SHIB)?” guide to know more about this Meme Coin that Skyrocketed in 2021.

Given the volatility of this new asset class – the cryptocurrency market – no investment can guarantee returns that meet your expectations. As a result, before investing money, always do your homework on the protocol, team, sponsors, and collaborations. Never make an investment you cannot afford.

FAQ

Most frequent questions and answers

Fantom crypto can be used to safeguard the network through staking as well as for payments and transaction fees within the network. You can stake FTM within the on-chain governance mechanism.

The ability for users to build and deploy their own independent networks in addition to using Fantom’s primary consensus layer makes it a standout feature of the Fantom crypto platform. Every application created using Fantom crypto runs on its own unique blockchain and benefits from the security, speed, and efficiency of operating on it.

Fantom (FTM) can handle more congestion thanks to the process, called Lachesis consensus, which also enhances PoS protocols. The goal of the Fantom development team is to “provide compatibility amongst all transaction bodies around the world,” according to its motto.

The community may soon witness new features in Andre Cronje’s Ve(3,3) project as it purportedly launches its own “emission-based” coin on Fantom to balance the ecosystem’s players. The founders and engineers will also continue to hunt for sponsors and collaborations to improve platform performance and increase community trust in light of the competition in the crypto space.

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.