Luis Clark

- Home

- /

- Singapore & Crypto

- /

- Crypto Exchanges Singapore

- /

- AscendEX Singapore Review 2023:...

AscendEX Singapore Review 2023: Is it Legit?

Luis Clark

- URL: https://ascendex.com/en/global-digital-asset-platform

- Headquarter: Singapore

- Year Founded: 2018

- Platform App: Desktop/Mobile

- No. of Cryptos: 300+

- Fiats Available: SGD and 33 more

- Withdraw Method: Wire Transfer/Crypto

- Payment Method: Credit and Debit Card/Simplex/Wire Transfer/Crypto

AscendEX Singapore Review: Our Opinion

AscendEX offers a host of great features, which are comparable with top crypto exchanges. The popularity of AscendEX also stems from the minimum deposit requirements, trading leverage of 1:100, high liquidity, simplified investment programs, a competitive fee structure, and lucrative bonuses.

AscendEX, formerly BitMax, is a Singapore-based centralized crypto exchange founded by a group of Wall Street quantitative trading veterans. Since its inception, AscendEX Singapore is consistently ranked among the largest crypto exchanges in the world with a total verifiable daily trading volume exceeding $100 Million.

Since the decentralized nature of blockchain platforms is often in conflict with local regulations; therefore, it is sometimes hard for investors to pick a suitable crypto exchange for profitable trading and investing. To make things easier, we’ve compiled an unbiased and comprehensive exchange review of the AscendEX Singapore cryptocurrency exchange so you can decide if AscendEX meets your requirements.

An Overview of AscendEX

AscendEX platform is used by retail and institutional investors from more than 200 countries. The company has raised funds from several investors through multiple rounds of financing. As a result, it gained enormous traction in 2021 becoming one of the top crypto exchanges in Asia and the global crypto space.

Pros

- Competitive Fee Structure (low fees)

- Good Liquidity

- High Trading Leverage

- Earn functions

- Advanced trading, i.e. limit order, price chart analysis, etc.

- 24/7 Customer Service

Cons

- Limited Copy Trading Opportunities

- No Direct Fiat Deposits

- No Demo Account

- Limited Order Types

Key Features of AscendEX

DeFi Yield Farming AscendEX

DeFi Yield Farming is another risk-free method to earn rewards on popular crypto assets. It’s more suited to investors who don’t prefer a locking period, which means that token holders can unlock their tokens anytime they want.

Unlike some other trading terminals, the AscendEX platforms offer more than one base currency for yield farming. A useful interface shows different yield assets and a historical yield graph allowing effective decision-making before the farming process begins. The system uses a variety of different protocols to extract maximum yield. To maximize yields, it regularly rotates between different derivatives protocols.

Fortunately, there are no gas fees for participating in a project, which ultimately results in greater profits for DeFi yield farming users. A team of professional miners takes care of all the backend functions. In other words, investors can sit back and watch their favourite coins receive daily rewards.

Overall, the returns for farming are comparable to the industry average but the variety of coins is something to be desired. Hopefully, even more coins will be added in the future.

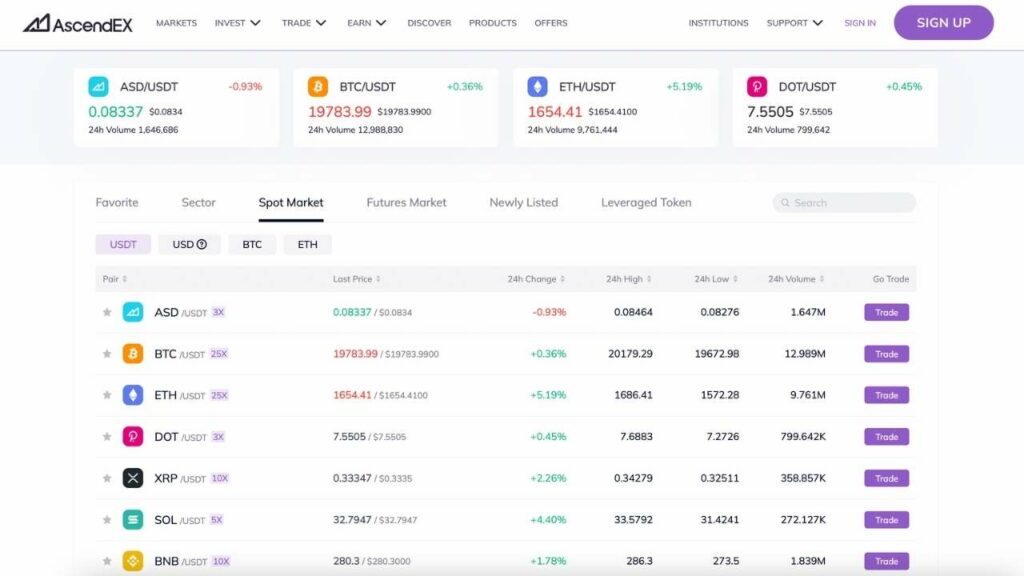

Cryptocurrencies Available on AscendEX Singapore

There are approximately 322 crypto assets available to trade on the AscendEX exchange. Tether, USDT, Bitcoin, BTC, and Ether, ETH, are the dominant base currencies that offer common trading pairs. These cryptocurrencies are complemented by almost 35 futures pairs and numerous newly listed coins.

AscendEX Fees

AscendEX Trading Fees

The spot and futures transaction fees are based on the membership level of the user. Usually, everyone starts at the VIP 0 level and receives an additional discount calculated on a trailing 30-day average period of time.

The maker and taker fee for large market cap assets is set at 0.10% for the VIP 0 level. Trading altcoins incurs 0.20% on both sides. Compared to other exchanges, the fee schedule is one of the lowest in the industry. For institutional and large retail clients, trading fees could be discounted as low as 0.01%.

The futures trading fees at AscendEX Singapore follows the same VIP tier structure but charges a relatively lower rate. The transaction fee is 0.02% for a maker and 0.06% for a taker. In other words, it means that an average retail trader will likely pay 0.08% for opening and closing the trade. Traders are eligible for additional trading fee discounts after 30 days based on their trading volume and membership level.

Anyone holding the native utility token, ASD, is entitled to additional discounts. For instance, holding 5,000 ASD results in a 10% discount and automatic upgrade to VIP 1 level. Similarly, 1,500,000 ASD yields an 80% trading discount and a VIP 7 status. It’s safe to assume that investing in native tokens or allocating a percentage of funds to the native token ASD is probably the easiest method to climb up the VIP tiers for most crypto traders.

Withdrawal Fees

As per the industry standards, the withdrawal fee on AscendEX Singapore depends on the cryptocurrency withdrawn. Potential clients should note that the withdrawal fees can sometimes change based on the network condition and the blockchain. Despite these variable conditions, the withdrawal fee on AscendEX is competitive for highly liquid coins, as it should be on any reputable crypto exchange.

Our research indicates that the withdrawal fee for BTC at AscendEX exchange is comparable with market average. However, the rate of withdrawal for ETH and the minimum amount to withdraw are high. On a positive note, rates for stable coins such as USDT and USDC are extremely competitive. In fact, traders are given multiple options to withdraw USDT, Tether, based on five different blockchains including TRON, ERC20, and Solana.

AscendEX Payment Methods

If you already have crypto in your wallet, just deposit it using the relevant AscendEX wallet address. On the other hand, new investors can buy cryptocurrency listed using their debit card or credit card. Before completing the transaction, users are shown a list of service providers and the relevant exchange rate.

There are at least three service providers for most cryptocurrencies. Luckily, AscendEX Singapore supports all the major service providers including Banxa, MercuryO, Moonpay, and Simplex so everyone can get the best exchange rate. The only downside is that the crypto trading platform supports only Visa and Mastercard for fiat transactions.

Ascendex Security & Regulation

AscendEX has an insurance fund for clients, which is maintained through a portion of its balance sheet. The balance covers potential loss in the customer’s assets. The majority of all deposited funds are held in cold wallets. Similarly, two-factor authentication, 2FA, and multiple layers of safeguards prevent hacking activities.

On a regulatory front, the platform abides by AML and KYC regulations of the Singapore government. AscendEx users can enhance their security using 2-factor authentication methods. AscendEX Singapore also uses Prime Trust, an independent US-regulated trust, to offer Over-the-Counter trading solutions. Citizens of more than 160 countries are eligible to open an account except in certain territories such as North Korea, Sudan, and Zimbabwe.

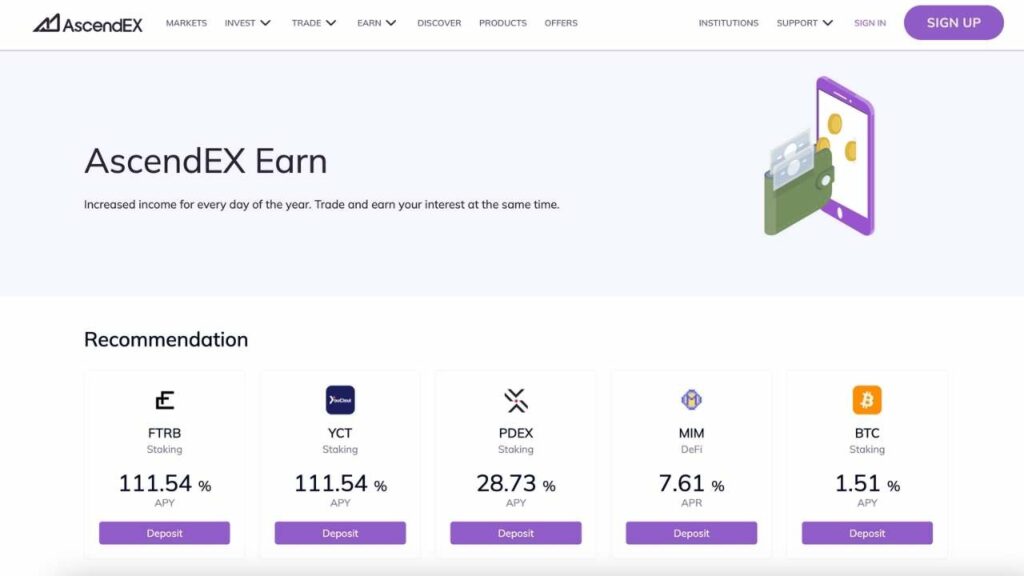

AscendEX Staking Rewards

AscendEX exchange offers a wide range of user-friendly services tailormade for the investment community. Most of these products are carefully designed to benefit from the existing market conditions. The most popular investment products is crypto staking.

Staking is a kind of interest-bearing savings account on cryptocurrency exchanges. It allows traders to invest their capital in high-yield coins. At AscendEX, anyone can stake multiple coins at once. This is a good way to generate rewards instead of letting the coins bite the dust in the wallet.

Similar to other cryptocurrency exchange platforms, AscendEX offers the opportunity to earn rewards through the interest generated by holding the coin. With the current rate, it is conceivable to receive an APY compound rate surpassing 100% on AscendEX.

The staking terms are relatively simple and the platform uses clear terminologies to define complex terms. Most coins offer instant un-bonding, which means that the coin and relevant staking rewards can be claimed right away if the owner decides to withdraw. Of course, there is a fee to pay on an early withdrawal. Depending on the coin, traders can also use the staking capital as collateral to trade the futures contracts.

Trading Experience on AscendEX

AscendEX offers both a web-based trading terminal and mobile platforms for spot trading and investing in financial instruments. Available on Android and iOS systems, the mobile app doesn’t take up much space due to its small size. The current version is responsive, fast, and almost glitch-free. It seems that the development team has successfully removed bugs, which clogged the mobile app in the months following the initial release.

The AscendEX interface is neatly divided into well-defined trading, investment, management, and customer support sections. Besides the trading interface, investment opportunities include a lauchpool for new currencies, luckydrops for discount purchases, beginner rewards, and a wide range of other buy-and-hold rewards.

A separate section is devoted to security settings, fee schedules, payment methods, and referral links. For social media enthusiasts, the AscendEX community is active across all the major platforms such as Twitter, Facebook, Instagram, Weibo, WeChat, Youtube, Reddit, and Telegram.

There isn’t a great deal of learning curve involved because the user interface is similar to most popular crypto exchange platforms. To start trading, existing cryptocurrency owners can deposit and withdraw crypto assets using their existing digital wallets. They can also use debit and credit cards to purchase their favourite cryptocurrency with fiat currencies.

The cryptocurrency exchange supports spot and margin trading accounts. By default, there are four order types: market, limit, stop-loss, and stop-market orders. Experienced traders can also use advance orders such as Fill-or-Kill, Good-til-Canceled, and Immediate-or-Cancel.

Spot Trading

AscendEX offers approximately 300 popular digital assets and an even larger spot market for the active trader. The crypto trading platform is streamlined for beginners and experts alike. Traders can view the order book for an in-depth look at the market or check the real-time market price, order size, and related timestamps.

Spot traders using the AscendEX platform can get leverage up to 25 times the initial sum on particular coins. Taking advantage of the leverage is specifically suited to high-risk traders looking to exploit moves in either direction. While there are a lot of coins to pick from, only highly liquid coins are available on margin. Accordingly, the leverage amount is displayed in front of trading pairs.

The platform also supports advanced charts, OTC trading, and advance orders. Spot traders will love the option to use orders types such as Stop Loss, Fill-or-Kill, Good-til-Canceled, and Immediate-or-Cancel. According to independent analysis, almost all major spot trading pairs on the AscendEX exchange offer tight spreads and experience minimal slippage in extreme trading conditions.

Futures Trading

AscendEX exchange offers 100 times collateral for margin trading. This is a great opportunity for day traders and short-term investors who’re confident in their trading style. While there is no doubt that other crypto exchanges offer leverage on futures trading, the amount of leverage at AscendEX is certainly at the top end of the market.

AscendEX offers cross and isolated margin trading account. Cross-Asset trades are initiated at 20 times the initial amount. This 20x cross-asset margin is enough to take advantage of market volatility instead of getting a margin call.

Trading futures contracts at AscendEX has other advantages as well. Perhaps, the most significant advantage is the ability to use cross-asset collateral. As long as investors have capital inside the exchange, it can be used to fund margin requirements. Capital in staked digital assets and crypto-generating yield can also be deployed to trade the futures contract.

For added convenience, active traders can deploy an intelligent risk engine that will manage downside risk. This is a useful feature during news breaks and eventful days. In addition, there are no fees or commissions for margin trading, which means that all the fees excluding the transaction amount go to the trader.

When it comes to the AscendEX exchange, users enjoy unparalleled trading flexibility, empowering them to delve into diverse strategies. However, as with any two-sided sword, increased leverage offers both advantages and risks. It has the potential to amplify gains, but it also poses a danger of wiping out an account in no time. Therefore, exercising caution and considering your risk appetite is crucial.

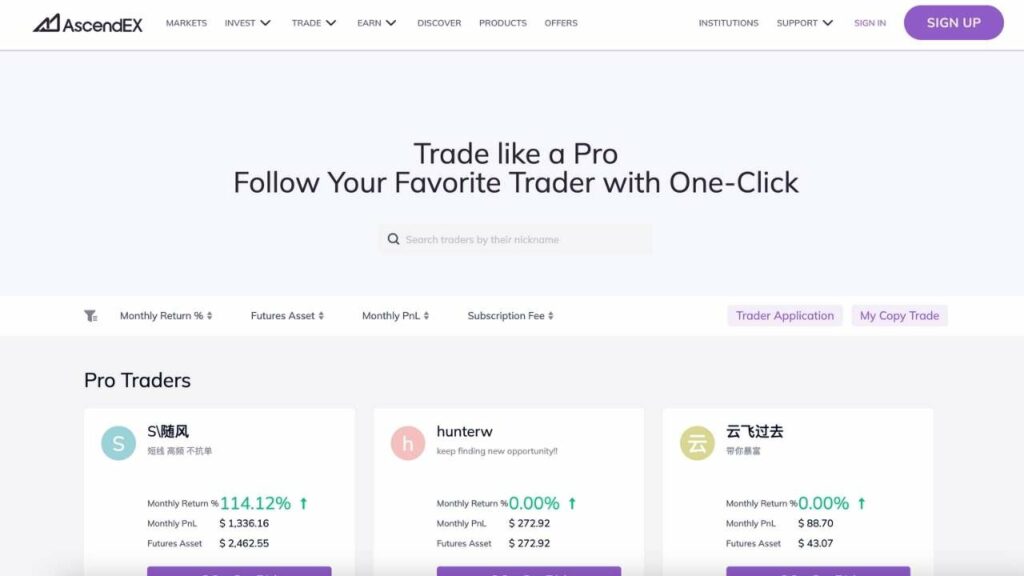

Copy Trading

Copy trading is a relatively new social phenomenon that has garnered a lot of interest in the crypto market due to relatively easy passive income options. In line with customer expectations, AscendEX offers copy trading where users can automatically follow their favourite trader. Just like any newly launched service, it has quite a few positives and some drawbacks.

On a positive note, the performance chart of copy traders is as transparent as it gets. Without duping potential customers, the chart clearly highlights drawdowns, which indicates the profit and loss scenario at every moment in time. This is in stark contrast to a few other social trading platforms that solely rely on profit-loss charts without indicating large drawdowns.

Of course, most professional traders can figure out such stats by looking at the trading pattern but not everyone is a technical guru. Therefore, all kudos to the AscendEX team for keeping it fair and transparent.

Despite the transparency, the digital asset trading platform may need a refresher. First, there are not many expert traders to choose from. Secondly, the copy trading model is built on a monthly subscription that seems counterproductive particularly when other similar models are based on profit sharing where traders don’t pay any fee to participate. Finally, the interface is too simple to reflect on its useful functions.

While there is a lot to be desired, the existing setup is fully functional without any major drawbacks.

AscendEX Customer Support

You can get answers to your questions 24/7 by phone, email, or chat. First, describe the problem using the bot chat feature. If you’re unable to find an answer, click the live chat button at the bottom of the chat window. Fill in the desired information to receive a reply. Get immediate answers to your most pressing inquiries by becoming a member of the official Telegram group.

Final Thoughts

AscendEX Singapore is a reliable crypto platform due to its competitive rates and user-friendly interface. There are lots of crypto-to-crypto coins, significant leverage, tight spreads, and a stable mobile application. The OTC desk for institutional and high-value traders is a bonus. Additionally, users enjoy spot margin and futures trading, decentralized liquidity pools, earning passive income opportunities or generating investment profit.

Our extensive analysis of the Singaporean Crypto Exchanges doesn’t stop here. You can also read about our Kraken Singapore review as an alternative to AscendEX or you can check out our list of Best Crypto Exchanges Singapore to find out what we think would be the best for you.

FAQ

Most frequent questions and answers

Visit the official AscendEX website and press the signup button at the top of the main page to start the registration process. You can easily create an account with a valid email address or a phone number. The system will verify the information by sending a verification code. Institutional investors should follow similar guidelines.

For safety purposes, users at AscendEX are required to undergo KYC before they can withdraw funds from their accounts. You can use a government ID to pass the verification. For added safety, the exchange supports 2-factor authentication for user logins.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.