- Home

- /

- Australia & Crypto

- /

- Crypto Exchanges in Australia

- /

- Best Crypto Exchanges Australia

Best Crypto Exchanges Australia

Swen Keller

Crypto exchanges facilitate the ease of buying, selling, and investing in crypto, and the overall investment success. There are over 500 exchanges that are tracked by popular crypto aggregator Coinmarketcap.

After detailed research and study of multiple online reviews, this review reveals the best crypto exchanges in Australia to help Australian investors.

These platforms are some of the most reputable, secure, and safe crypto exchanges that support the Australian Dollar (AUD) and are easy to use. We looked into every detail of each crypto exchange to find out about trading fees, security features, regulation, deposit methods, withdrawal fees and options, the performance of each crypto trading platform, customer support and more.

At the end of this review, crypto trading Aussies will be able to choose their favourite crypto exchange in Australia with ease.

Best Crypto Exchanges Australia: Our Opinion

Among the 10 exchanges we reviewed, Bybit is our preferred choice.

What sets Bybit apart is its exceptional blend of security and usability, catering to both novice and experienced traders. It offers unique features like contract trading and trading competitions, providing an exciting edge to the trading experience. Additionally, its testnet allows new traders to familiarize themselves with market dynamics risk-free. Bybit’s combination of safety, innovation, and user-centric features makes it our top pick in the crypto exchange landscape.

Bybit - Overall Best Australian Crypto Exchange

Bybit easily ranks as one of the top cryptocurrency exchanges globally. Founded in 2018, the exchange has grown rapidly to offer over 100 tradeable digital assets to its user base of more than a million from around the world.

Bybit puts a premium on user experience and security. It has an intuitive interface that even first-time crypto traders can navigate with ease. Bybit takes its users’ security very seriously, with rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) processes in place.

Bybit highlights its cutting-edge security protocols, including a quick biometric login and advanced two-factor authentication (2FA) mechanism, making it a stronghold against potential cyber threats.

Bybit is registered and regulated in British Virgin Islands, operating under stringent compliance requirements, further enhancing its credibility in the crypto trading sphere.

On the functionality front, Bybit scores high with swift and efficient withdrawal and deposit methods. It supports a range of options, including Bitcoin, Ethereum, and stablecoins like USDT, ensuring a seamless trading experience for its global users.

Bybit has a competitive fee structure, with maker and taker fees that range from 0.00% to 0.10% for spot trading and from 0.00% to 0.055% for perpetual contracts trading. These rates are quite competitive when compared with other exchanges in the market.

One standout feature on Bybit is its contract trading facility. This offers traders the possibility of leveraged trading, enabling them to maximize potential gains. However, this also comes with increased risk, and hence, is more suited for experienced traders.

Advanced trading features are plentiful on Bybit, including stop and limit orders, price alerts, and portfolio tracking. Additionally, Bybit offers a testnet for new traders, providing a sandbox environment to practice strategies without risking real assets.

A unique offering from Bybit is its trading competitions where users can participate to win substantial prizes. This adds an exciting dimension to the trading experience and opens up additional earning opportunities.

In terms of tax compliance, Bybit provides a comprehensive trade history that traders can download and use for their tax filings.

Finally, Bybit excels in its customer support, providing a 24/7 live chat feature. This level of customer service, coupled with an extensive FAQ and guide section, ensures that traders’ queries and issues are addressed promptly and efficiently.

All these features make Bybit a leading choice among both beginner and seasoned traders.

Pros

- Advanced Trading Features

- Robust Security

- User-friendly Interface

- It has an NFT marketplace

Cons

- Not registered with AUSTRAC

- Lower selection of altcoins

- Complex fee structure

- Inconsistent quality in customer support experiences

Swyftx - Best for User-Friendly Interface

Swyftx tops our list of best crypto exchanges in Australia. The crypto trading platform was founded in 2017 and now supports over 320 tradable digital assets for 600,000+ users in Australia and New Zealand.

Swyftx is known for its simple user interface and exceptional security, enhancing its reputation. Before being verified, all of users must go through Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

With a fast biometric login and an advanced two-factor authentication (2FA) feature infused with password security, investors’ funds are protected from third-party break-ins and theft. It’s worth noting that Swyftx has recorded zero security breaches since its inception.

In terms of regulation, the exchange is registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Other notable features on Swyftx include instant withdrawal and deposit methods for USD, NZD, and AUD into crypto trading accounts. Withdrawal options include PayID, OSKO, POLi, and bank transfer.

These methods make payments and withdrawals seamless for Australian traders who prefer to trade using fiat. AUD deposits and withdrawals are fee-free, and the platform charges a flat 0.6% trading fee across all trades.

The Swyftx staking feature is another reason the exchange is considered one of the best for Aussies. With Swyftx staking, investors can lock a portion of their digital assets and earn periodic rewards for crypto that would otherwise be idle in their Swyftx wallet. This provides an alternative way for investors to earn passive income with little effort.

Investors can also take advantage of advanced trading features like stop and limit orders, price alerts, recurring orders, and portfolio tracking.

Before getting started with a trading account, new investors can utilise the demo account offered by Swyftx to understand how the cryptocurrency exchange works and get used to the often volatile crypto market. This feature makes it seamless to trade and reduces the risk of losing funds when dealing with real money.

Another great feature with this Australian cryptocurrency exchange is the Swyftxs individual tax report creator. With this feature the platform prepares a ready-to-download full tax report that traders can use for their tax filings. This tax report can also be customized, per time period.

Swyftx also provides excellent customer service through a live chat support team.

Pros

- Low fees

- Rates from 0.1% for users with high trading volume

- 7-day customer service

- 300+ cryptocurrencies available

Cons

- Card deposits unavailable

- Only available in Australia

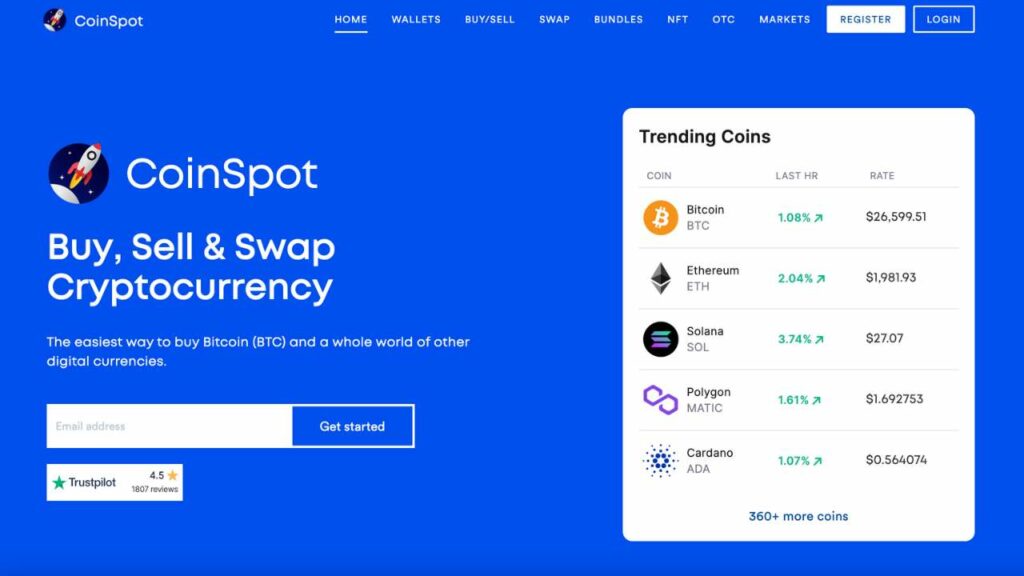

CoinSpot - Australian Crypto Exchange for Over-The-Counter Trading

CoinSpot offers Australian traders a simple way to trade crypto. The platform boasts about 2.5 million customers with access to 370+ different cryptocurrencies, as well as self-managed super funds (SMSFs).

Its beginner-friendly desktop and mobile platforms provide investors with an easy way to create a CoinSpot account, navigate the markets, and carry out various trading and investment activities.

CoinSpot has built immense trust and reputation in the Australian crypto community with its security since its inception in 2013.

This Australian cryptocurrency exchange is a certified member of Blockchain Australia, a community of certified Australian companies in the blockchain industry. Similarly, the exchange is registered with ASIC and regulated by AUSTRAC, fulfilling the regulators’ stringent KYC and AML requirements.

On CoinSpot, a dedicated customer support team is available to help investors 24/7 via live chat or email, in the unlikely event that investors find issues using the platform.

Coinspot supports a wide range of payment and withdrawal methods, including PayID, POLi, OSKO, BPAY, crypto, and fiat deposits.

There are no fees for fiat currency deposits and withdrawals. However, CoinSpot charges an instant buy fee of 1%, a high figure compared with other well-known Australian exchanges. Still, high-volume investors may opt for the platform’s OTC trading feature to trade on the market. With this feature, investors only pay 0.1% in trading fees.

The platform also integrates with the world’s largest non-fungible token (NFT) marketplace OpenSea to give investors access to popular NFT collections that they can buy, sell, and trade using any other cryptocurrency except Ethereum. Trading NFTs via CoinSpot attracts additional fees of 0.9%.

Investors looking for additional income can also earn staking rewards by locking CoinSpot’s utility token, I/O Coin, in a smart contract on the exchange.

Notably, with CoinSpot Bundles, investors can buy multiple cryptocurrencies in one transaction. This feature suits traders looking to minimise fees and diversify their investment portfolios.

Pros

- Offers 370+ cryptocurrencies

- 24/7 customer support

- Simple, easy-to-use crypto exchange in Australia

- Multi-coin feature available

- Supports NFT purchases

- Provides a self-managed crypto super fund option

Cons

- 1% instant buy/sell fee may be too high for some traders

- Doesn’t support credit and debit cards

KuCoin - Crypto Exchange With Free Trading Bots

KuCoin is one of the biggest crypto exchanges and the best trading platform with free automated bots. The crypto trading platform is notable for its diverse range of cryptocurrencies, including popular altcoins like Ethereum, Dogecoin, Shiba Inu, and Apecoin. With 700+ coins and token on offer, 20 million+ customers, and over $1 trillion accumulated trading volume, it’s easy to see why the exchange is considered one of the best in Australia.

KuCoin offers distinct features to help investors make the most of their crypto journey. Its advanced features, like Futures Trading and Margin Trading, offer investors different income potentials. At the same time, the platform supports the staking, borrowing, and lending of crypto.

Investors can stake their cryptocurrency holdings on the platform to earn free crypto rewards. They may also enter a smart contract to borrow and lend crypto. Lenders make more profit from the interests and commissions charged on the borrowed assets, resulting in additional income with little to no effort.

KuCoin has a peer-to-peer marketplace where investors can easily connect to buy, sell, and exchange cryptocurrencies. There’s also a built-in NFT marketplace for investors looking to add NFTs to their portfolios.

One standout feature that KuCoin has is its crypto trading bot. The platform offers its users free crypto trading bots to automate their investment and trading strategies and take advantage of market price fluctuations even offline. Most platforms charge users for online trading bots, making KuCoin commendable for granting its users free access.

The exchange charges trading fees as low as 0.1%. But investors can take advantage of its 20% discount when paying with KuCoin’s utility token, KCS. With this, investors pay a low trading fee of 0.08%.

KuCoin offers various payment methods. Users can purchase crypto instantly via Visa Card or MasterCard, Apple Pay, or PayID for free, as there are no deposit fees on KuCoin.

Investors with challenges can also speak with the exchange’s dedicated customer support team using the chat box on the website.

The platform supports AUD transaction via the Simplex payments platform. So, Australian users can buy crypto with credit cards linked to Australian bank accounts. Users can access their accounts on the go using the platform’s mobile app, which lets them trade anytime and anywhere.

Pros

- Low fees

- 700+ cryptocurrencies, including altcoins

- Trading platform with free trading bots

- Supports NFTs

- AUD purchases available

Cons

- User interface may be complex for beginner investors

- Not ASUTRAC-registered

Binance - Best Crypto Exchange for Futures Trading

Binance was founded in 2017 by Changpeng Zhao. And today, it is the world’s largest crypto exchange by trading volume.

In its early days, Binance was not suited to Australian investors. However, an Australian exchange, Binance Australia with 350+ cryptocurrencies, is now available to cater specifically to Australian investors.

Binance is fully licensed to operate in Australia. The platform is AUSTRAC-regulated and stores investors’ cryptocurrencies in a cold/offline wallet where it is immune to cybersecurity threats and hacks. It also has a KYC process that users must complete to verify their identities, resulting in a safe environment for investors.

The platform’s advanced trading markets and features also make it one of the best crypto exchanges in Australia.

Advanced trading markets are unavailable on some Australian exchanges, but investors on Binance can take advantage of seven Futures Trading options, including USD Features and Binance leveraged tokens. The exchange also offers Margin Trading, crypto-to-crypto conversion, and fiat-to-crypto instant buying.

Binance allows Australian traders to buy, sell, trade, and invest in a wide range of cryptocurrencies with low fees. It has over 1 million Australian investors and has established itself as a top cryptocurrency exchange for Aussies due to its outstanding features.

Its P2P Marketplace offers traders an alternative medium for trading cryptocurrency at a negotiated price. This is particularly suitable for high-volume crypto traders who want to cut costs.

Investors also get access to instant crypto loans without credit checks on the platform. The lending and borrowing feature makes Binance perfect for investors who may need quick additional coins for instant buy or sell transactions they consider unmissable.

Binance also has an NFT marketplace where users can purchase and sell the latest and most popular NFT projects. The Binance marketplace connects NFT enthusiasts in one place. Unlike many other Australian crypto exchanges, verified Binance accounts can mint NFTs on the platform. That means they don’t need to create NFTs on other platforms before selling on Binance.

Great ways to earn extra income on Binance are through its “Hold to Earn” and “Learn and Earn” features. With “Hold to Earn”, Binance users can earn interest on over 70 cryptocurrencies by staking and holding for 30, 60, or 90 days.

Investors can use the “Learn and Earn” feature to make money on the platform after completing crypto-related quizzes and courses about decentralised finance (DeFi), Non-Fungible Tokens (NFTs), and much more.

Pros

- 350+ cryptocurrencies available

- No deposit fees using PayID and OSKO

- Advanced trading options available

- Low trading fees

Cons

- Platform may be complicated for new/inexperienced crypto traders

- Strongly encourages the use of BNB tokens

Independent Reserve - Best Fiat-to-Crypto Exchange

The Independent Reserve is one of the world’s best fiat-to-crypto exchanges for Australia. Established in 2013, this exchange has continued to scale in growth. There are now over 30 supported countries and 250,000 customers trading cryptocurrency such as Bitcoin seamlessly with the Australian dollar on the exchange.

The Independent Reserve platform uniquely transforms crypto technology into a safe and robust financial service for beginners and advanced traders, making it one of the best crypto exchanges in Australia.

This innovative exchange offers very high liquidity on supported cryptocurrencies, allowing investors to trade up to 30 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Investors can also trade fiat currencies seamlessly using the Australian, New Zealand, and U.S. dollar.

The Independent Reserve exchange is one of the best exchanges for Australians because it has an engaging suite of features. This exchange features a multicurrency order book, which facilitates easy conversion of orders into the preferred currency of traders’ choice. It also has an innovative mobile trading app available for both Android and iOS devices. Users can buy, sell, and store crypto assets and keep track of price movements in real-time on the go. The interface is suitable for beginners and advanced traders.

Depositing into an Independent Reserve account is simple and quick. Users can initiate deposits through EFT (electronic fund transfer.) This method is strictly geared toward traders with Australian bank accounts for AUD deposits. International traders can also make use of SWIFT to deposit NZD or USD instantly.

This exchange follows a flat fee model of 0.5% for both makers and takers, which can reduce to as low as 0.2% if trading volume increases. Deposits and withdrawals in AUD are free; however, international (non-AUD) withdrawals come with a standard charge of $20. There are charges for crypto withdrawals, but these fees vary based on the type and volume to be withdrawn.

Another top feature of this exchange is its referral program. Once registered, users get a unique code that can be shared with friends as an invitation to the exchange. For every successful referral, users get 50% of the brokerage fees paid by the referred user for the first 90 days.

Independent Reserve incorporates 2-factor authentication and a 3rd-party security provider called Cobalt for its systematic network security and frequent test of the website’s and platform vulnerabilities to prevent fraud or hacks. The exchange’s database is also encrypted, and assets are stored in cold storage, making this trading platform highly secure. Independent Reserve adheres to the laws and regulations applicable to the Australian financial sector as an Australian-based exchange.

Pros

- User-friendly interface

- Mobile support

- Multicurrency

Cons

- $20 fee on international withdrawals

- Small amount of crypto assets offered

Cointree - Top Platform for Fast Deposits and Trades

Cointree is one of the oldest and most renowned exchanges for Australian investors. This Australia-based exchange allows users to buy Bitcoin and other crypto assets with their local currency (Australian dollars). Cointree was established in 2013 to make digital cryptocurrency available to ordinary people. Since then, more than $250 million worth of digital crypto has been traded.

Cointree has a medium-size user base of over 80,000 trusted users because of its professional and unique features. Users can trade over 280 different cryptocurrencies without worrying about missing out on new and exciting coins. Investors can also trade/swap cryptos, with over 15,000 trading pairs to pick from.

To get started, traders must create a free account, complete the verification, initiate a deposit, and start trading with as low as AUD 10. Funds (Australian dollars) can be deposited using PayID, bank transfer, and the cash ‘instant deposit’ option. This option enables traders to credit their account balance with the initiated deposit amount before the funds are completed and settled in investors’ balances. All deposit methods on Cointree are transparent, quick, and convenient.

To withdraw from Cointree, traders must link their Cointree account to a bank account. Withdrawals are strictly limited to Australian banks.

Cointree uses a tiered fee structure that ranges from 0.5% to 0.9% of the transaction amount used to buy and sell crypto. The more users trade on this platform, the higher their tier scales and the lower the crypto trading fees. A 30-day trade volume worth 1 million AUD is required to unlock the highest tier (diamond) with the lowest fee (0.5%). New users automatically pay 0.9% till their tier scales.

Some of Cointree’s notable features include copy trading integrations. The Cointree copy trading feature allows traders to view successful portfolios of other traders and copy their cryptocurrency trading strategy to profit whenever they profit.

The platform uses 2-step verification, encrypted SSL, a secure server, a closed network environment, and a hot/cold wallet system to safeguard all transactions, held coins and tokens and users’ data. Cointree is validated by the Australian Regulatory Authority (AUSTRAC), establishing its place as one of the best crypto exchanges in Australia.

Pros

- Simple to use

- Copy trading option

- Tiered transactional fees

- Wide range of supported cryptocurrencies

Cons

- Limited features

- No mobile app

CoinJar - Top Crypto Exchange for Reward Points and Discounts

Similar to Independent Reserve, CoinJar is one of the industry’s most popular and oldest Australian-based exchanges. Since its inception in 2013, CoinJar has experienced exponential growth, with over 600,000 registered users and more than $1.5 billion traded in cryptocurrencies.

CoinJar offers a simplified platform to buy and sell up to 50+ cryptocurrencies, including the greatest assets by market cap: BTC, ETH, XRP, LTC, and a range of ERC-20 tokens.

Traders also enjoy ultra-competitive rates and liquidity across supported crypto assets. To get started, simply register an account for free, initiate a deposit, and begin trading in minutes.

The exchange’s unique payment methods and innovative product offerings, like its platform-based crypto debit card, over-the-counter (OTC) trades, and reward points, make it a favourite among Australian crypto investors.

CoinJar has no minimum deposit amount and supports a wide range of payment methods that help registered users deposit Australian dollars to their CoinJar account. These payment methods range from credit/debit cards and PayID to Blueshyft and BPAY. Traders can also fund their accounts using cryptocurrencies. Deposits made with credit/debit cards (Visa and Mastercard) and Blueshyft incur a standard fee of 2% and 1.5%, respectively.

This crypto exchange charges trading fees of 1% flat when traders buy, sell, or exchange cryptocurrency.

CoinJar products offerings serve as key features that make crypto trading smooth. This renowned cryptocurrency exchange issues a debit card powered by MasterCard. Card holders can pay for goods and services while earning excellent rewards on every spend. For instance, a 100 reward points is awarded to users for every AUD 1 spent using the CoinJar debit card. These points are redeemable and can be used to pay expenses. The Coinjar debit card is free from transaction or monthly fees and activation charges.

Additionally, Coinjar allows high net-worth institutional and retail traders to make use of over-the-counter (OTC) desks. The OTC-desk is mainly for trading large volume trades in digital currencies. Transactions that exceed AUD 50,000 can be processed on the OTC.

CoinJar integrates 2-factor authentication, Transport Layer Security, high-level data encryption, and periodic security audits. The exchange uses Amazon Web Services as its platform infrastructure base and integrates a firewall to secure all internal networks. It’s also licensed by AUSTRAC (Australian Transaction Reports and Analysis Centre) to avert money laundering and any form of financing of terrorism.

Pros

- Competitive fee structure

- Reward points

- Crypto debit card

- High liquidity on popular crypto assets

- Over-the-counter (OTC) integration

Cons

- Only Australian traders are allowed to initiate withdrawals and deposit fiat currencies

- Small range of cryptocurrencies

Coinbase - Intuitive User-Friendly Interface for Beginners

Coinbase is one of the most popular and largest cryptocurrency exchanges worldwide and in the United States. This platform was established in 2012 and is known for its reputation, simplified interface, and its intuitive trading features. It has since grown to serve over 103 million+ users across 100+ countries. A subsidiary called Coinbase Australia was created in 2018 to cater specifically to Australian investors.

Coinbase Australia has offered Australian-based traders a new way to buy crypto with Australian dollars since its launch. Up to 23 fiat currencies, including AUD, EUR, USD, CAD, and GBP, as well as 100+ cryptocurrencies are supported.

The platform was created to form a pathway for investors keen to purchase Bitcoin, Ethereum, Cardano and co. without having to deal with many complexities, ranging from difficult verification to low crypto offerings.

Signing up with Coinbase Australia is quick and easy. Users can sign up with their first name, a valid email address, and a strong password. The next step is funding the account, and trading can begin immediately.

The minimum deposit is $2. Although there are limited payment methods for Coinbase Australia, traders can initiate a deposit via a debit card. However, Credit cards are no longer accepted for Australian-based users.

For crypto trading fees, this platform charges Australian users a flat fee of $0.99 on a transaction of not more than $10 and $2.99 on transactions that range between $50 and $200. Withdrawal fees also apply when cryptocurrencies are transferred from investors’ accounts. However, this fee varies based on the currency to be withdrawn.

One of Coinbase Australia’s standout features is its innovative mobile application. The Coinbase app can be used to monitor the price movements of crypto assets and historical graphs, real-time market updates, and the latest news in the crypto industry on the go.

To profit off the market movement, traders can leverage Coinbase’s instant buy and sell options, implying that traders can start buying crypto on the go as soon as a deposit is initiated from the bank into their Coinbase account.

Apart from Coinbase Australia’s user-friendly interface, a wide range of crypto offerings, and mobile app incorporation, this platform offers an efficient customer support team. Should traders get stuck navigating the app, Coinbase’s customer support team is always available 24/7.

Coinbase Australia uses SSL technology to encrypt data and 2-factor authentication as an extra layer of protection for traders’ accounts for all-around safety and data protection.

Pros

- Ease of use

- 24/7 Customer support

- Mobile app

- Wide range of fiat currencies

Cons

- Limited deposit option

- High fees

Crypto.com - Best Platform to Buy Crypto for Cashback Rewards

Crypto.com ranks among the best crypto exchanges in Australia due to its comprehensive platform, crypto payments, and innovative product offerings. On this platform, traders can buy and sell over 250+ different types of crypto assets and spend Australian dollars (AUD) using the platform’s visa card, which generates cashback rewards in the form of cryptocurrency.

Australian users can access the crypto market with a minimum deposit of $20 AUD. They can choose their preferred deposit methods, including bank transfer, PayID, and BPAY. Users can also pay with a credit or debit card, but there’s a 2.99% fee for every deposit (this is waived for the first 30 days).

Crypto.com charges 0.04% to 0.4% maker fees and 0.1% to 0.4% taker fees. Fiat deposits and withdrawals are fee-free. Crypto deposits are also fee-free. However, network fees will be applied when a withdrawal is initiated through the app.

Crypto.com offers high liquidity and ready-to-use innovative products like the cashback Visa card. This Visa card is free to order and can be funded with AUD to spend like a regular debit card. Whenever this card is used to purchase goods online or at stores, a certain percentage of cashback is paid in CRO (Crypto.com native token). This token can be used to pay for fees on the platform.

Additionally, Crypto.com features an ‘Earn’ option that allows traders to generate interest from their staked crypto assets. Traders can choose to lock a particular amount of crypto assets they are not ready to trade for a while and earn interest up to 14.5% per annum.

Like Coinbase, Crypto.com also provides an excellent support team for Australian users. The customer support team tends to users via Live Chat and email options.

There are several security measures in place which make Crypto.com a trusted cryptocurrency exchange. 100% of users’ cryptos are stored in cold storage to prevent hacking. 2-factor authentication is another security feature, as is a $750 million insurance policy that covers third-party theft.

Pros

- Mobile app

- 250+ supported cryptocurrency

- Visa debit card with up to 8% cashback reward

- High security standards

- $750 million insurance against third-party theft

- Lots of Earn options

Cons

- High trading spreads

- On desktop, users cannot trade in AUD

Best Crypto Exchanges Australia Comparison Table

| Exchange | Number of Cryptos | Payment Methods | Trading Fees | Platform Features |

|---|---|---|---|---|

| Swyftx | 320+ | Debit/credit cards (third-party), bank transfer and PayID | 0.6% | 24/7 Customer Support, Registered with AUSTRAC, Staking |

| Digital Surge | 300+ | payID, POli | 0.1%-0.5% | Mobile app, 24/7 Live chat, Registered with AUSTRAC and ASIC, crypto wallet |

| CoinSpot | 370+ | Bank transfer, cash deposit, PayID | 0.1% to 1% | NFT marketplace, 2FA, 24/7 Live chat support, Registered with AUSTRAC |

| KuCoin | 700+ | PayPal, bank transfer, cards, Zelle | 0.1% | NFT marketplace, trading bots, Multi-factor authentication, mobile app |

| Binance | 350+ | Cards, bank transfer, PayPal, crypto, SEPA transfer, wire transfer | 0.1% | Mobile app, 2FA authentication, NFT marketplace, P2P trading |

| Independent Reserve | 30+ | OSKO, PayID, SWIFT | 0.5%-0.2% | Customer service, Crypto tax estimator |

| Cointree | 280+ | PayID, bank transfer, cash deposit | 0.55-0.9% | Crypto wallet, Registered with AUSTRAC, Customer support, Beginner-friendly, OTC trading desk |

| CoinJar | 50+ | Cards, bank transfer, Pay ID | 0.04%-0.1% | Registered with AUSTRAC, Multi-level data encryption, Customisable trading interface |

| Coinbase | 150+ | SEPA, sofort, Apple pay, Google pay, 3D secure card | 1% | Mobile app, customer support, Beginner-friendly, Educational tools, 2FA |

| Crypto.com | 250+ | Bank Transfer, Credit Card, Debit Card, Crypto Transfer | 0.04%- 0.4 | Mobile app, Crypto Visa card, 100% Cold storage, 2FA, Beginner-friendly |

What is a Crypto Exchange?

Crypto exchanges are online marketplaces that enable the buying and selling of digital assets. These marketplaces act as intermediaries between buyers and sellers, enabling users to trade cryptocurrencies for fiat currency or altcoins.

Types of Crypto Exchanges

There are several types of crypto exchanges. Below we discuss each one:

Centralised Exchanges

Centralised cryptocurrency exchanges (CEX) serve as a middleman between buyers and sellers and generate revenue through commissions and transaction fees. Users may think of the CEX as a stock exchange for digital assets.

Coinbase, Crypto.com, Gemini, and Binance are well-known centralised cryptocurrency exchanges. These platforms let cryptocurrency investors buy and sell digital assets at the current price (spot) or leave orders to be executed when the investment reaches the investor’s preferred price (limit orders).

CEXs function using the order book method, meaning that buy and sell orders are listed and arranged by the intended buy or sell price. The crypto exchange then matches buyers and sellers based on the best feasible price given the desired lot size. Hence, a digital asset’s price will depend on the supply and demand of that asset against another, whether it be a fiat currency or cryptocurrency.

CEXs decide which digital assets they will support, offering a measure of comfort that shady digital assets may be excluded from the CEX.

Decentralised Exchanges

A decentralised exchange allows the trading of digital assets without an intermediary. Examples of DEXs include Uniswap and PancakeSwap.

These decentralised exchanges are powered by blockchain-based, self-executing bits of code. These “smart contracts” provide more privacy for traders and less “slippage” (another term for transaction charges).

However, even though smart contracts are based on regulations, the lack of a middleman leaves the user on their own, making DEXs appropriate only for experienced investors.

Hybrid Cryptocurrency Exchange

This exchange maximises both CEX and DEX features. It combines the quick transaction speeds offered by centralised systems with the security assurance provided by maintaining private keys.

Hybrid exchanges are a new breed of crypto trading platforms still in their “formative stage”. The Nash and Qurrex exchanges are the two most well-known hybrid types.

How to Choose the Right Exchange?

Choosing a cryptocurrency exchange might be tasky. Therefore, this guide aims to provide some suggestions to assist users in selecting the platforms that will work best for them.

1 – Accessibility

Users should consider which cryptocurrency exchanges are accessible in their country and region.

Due to local or international legislation, users might not be able to buy or sell crypto on specific exchanges. Some countries, like China, have outright banned their citizens from accessing crypto exchanges.

There is also a lot of regulatory ambiguity around cryptocurrencies in the US, and several states have implemented their regulations. Users can check if a platform is accessible by visiting its website or terms of service.

2 – User-Friendliness

Crypto beginners may find navigating these exchanges complex or struggle to understand some of the terms.

Newbie investors should seek to start trading with a simple platform. Look for a user-friendly platform that offers a free wallet upon registration, provides a list of fundamental crypto rules, and includes a feature that lets users monitor price alerts or make payments using a variety of cryptocurrencies.

3 – Authenticity and Integrity

Reputation matters when it comes to cryptocurrency and exchanges. We recommend researching about the exchange before registering an account.

Find the physical address connected to the exchange. Legitimacy is frequently indicated through transparency.

Users may need to get in touch with their exchange platform at some point, so look for one that offers good customer service and is quick to answer queries.

4 – Crypto Assets Available

Many cryptocurrency exchanges do not offer all cryptocurrencies. While popular coins, such as Bitcoin and Ethereum, may be readily available, users might need access to newer altcoins, meme coins, and assets with just a small market cap.

A few platforms might not support new cryptos with smaller market caps. Therefore, it’s a good idea for traders to decide in advance which cryptocurrencies they intend to purchase and then choose an exchange that supports them.

5 – Fees

Although some users choose the exchange with the lowest fees, it’s crucial to comprehend why such fees are necessary and how they are calculated.

Sometimes, paying a larger fee will give customers more protection and streamline the cryptocurrency exchange procedure. Users might also discover that using a platform with a higher fee provides them with a better overall experience than one with a lower fee.

6 – Security

Choosing a secure crypto exchange is crucial for protecting users’ funds and privacy. Some platforms offer insurance packages to protect investors’ digital assets in the event of fraud or hacking.

When choosing an exchange, consider additional security elements, such as a two-factor authentication system and KYC verification.

7 – Tools & Features

New investors should look for a user-friendly platform with a wealth of educational resources to aid in navigating this challenging, rapidly evolving market.

For instance, Coinbase offers a program called Coinbase Earn that pays customers to discover new coins. Others, like Gemini‘s Cryptopedia or Binance Academy, offer in-person classes and resources to help users learn about the cryptocurrency markets, their history, and current developments.

Final Thoughts

In summary, our review has discussed why crypto trading platforms are necessary for profitable investments in digital assets. These platforms simplify the process and enable the trading of assets like Bitcoin, crypto CFDs and even inverse futures contracts.

Knowing how to pick the best crypto exchanges in Australia is vital. We also considered the best features to consider when selecting the best options. The above mentioned platforms are among the best for Aussie traders, with high security, diverse payment methods, deep liquidity, and low trading fees.

FAQ

Most frequent questions and answers

We could not find the best crypto trader in Australia. However, there has been a massive increase in crypto adoption in the country. About 4.6 million Australians now hold cryptocurrencies. That number is expected to increase substantially as Australia further opens up to cryptocurrency.

Our recommendation for the best app for crypto trading in Australia is Swyftx. We chose this exchange because it offers over 320 crypto assets for trading at a low fee of 0.6%.

Swyftx is ideal for crypto novices because it provides an easy sign-up process and account verification. A demo mode is also available to help integrate users into the platform before live trading.

We recommend Digital Surge as the best-value exchange since it has some of the lowest costs of any Australian platform. For instantly buying and selling more than 250 cryptocurrencies, Digital Surge only charges a 0.5% fee.

Yes, digital currencies, cryptocurrencies, and cryptocurrency exchanges are all legal in Australia. Additionally, Australia’s cryptocurrency rules and regulations are progressive. Due to their legal status, cryptocurrencies are governed under Section 5 of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF 2006) and its related regulations in Australia.

Kucoin‘s broad selection of over 700 crypto coins makes it an ideal option for crypto traders, especially if they want to diversify their cryptocurrency portfolio. Additionally, it offers a spotlight area highlighting new currencies so that users can participate early. Remember that riskier coins are usually more recent or less well-known than popular ones.

Crypto.com is our pick for the safest crypto exchange. Crypto.com stores all user cryptocurrencies offline, and its hardware storage is covered by a $750 million physical damage and theft insurance policy.

To safeguard user funds, multi-factor authentication and withdrawal security are in place. Users have several authentication options with multi-factor authentication because it incorporates email and biometric verification.

Coinbase is our recommended exchange for altcoins. The exchange is the ideal platform for novices. Users can easily open an account online without any prior knowledge and from the comfort of their homes.

Coinbase offers many of the preferred payment method like debit/credit cards, SEPA, and ACH.

Binance protects customers’ data and personal information, including Know-Your-Customer (KYC) information, by encrypting users’ data in storage.

Most user funds are secured on the platform with strict protocols and industry-leading technical measures. Customers’ assets are also safely stored in offline, cold storage facilities. Other security measures include real-time monitoring, a 360-degree risk management system, advanced data privacy tools, and end-user security education.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.