What is Cronos (CRO)?

Luis Clark

- Home

- /

- Cryptocurrencies

- /

- What is Cronos (CRO)?

Luis Clark

What is Cronos (CRO)?

Cronos is a blockchain network that interoperates with both the Cosmos and Ethereum ecosystems and supports the Metaverse, decentralized finance, Web3 gaming, and NFTs. Its objective is to help scale the Web3 user community by enabling builders to be able to transfer crypto assets and applications from one chain to another at speedy finality, low cost, and high throughput.

The Cronos chain was built with support for the Inter Blockchain Communication protocol (IBC), which enables it to bridge and interoperate with the Crypto.org blockchain. It also can interoperate in a decentralized manner with other IBC-enabled chains like Terra and Cosmos Hub. The Cosmos Hub is the primary chain of the Cosmos ecosystem. CRO is the native token of Cronos’ parallel blockchain, Crypto.org, and the CRO blockchain.

The Cronos network is also powered by Ethermint. Ethermint is what enables the speedy transfer of smart contracts and applications from EVM-compatible chains.

Who is the Founder?

Cronos (CRO) was founded by Crypto.org, which was co-founded by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo. Bobby Bao is the lead at Crypto.com Capital and has experience in corporate development, investor relationship, and investment banking. He was previously the head of Corporate Development at Ensogo. Gary Or is a co-founder of Monaco, the brand that later became Crypto.com. Kris Marszalek is the CEO of Crypto.com and Rafael Melo is the CFO of Crypto.com.

How does Cronos (CRO) Work?

Cronos is one of the leading EVM-compatible chains that exist at the intersection of Cosmos and Ethereum. It is built on the Cosmos SDK, which enables the blockchain to access the functions of each ecosystem. Cronos, for example, offers low transaction costs and speedy finality, which are a result of the Cosmos SDK, an open-source blockchain framework that’s powered by the Tendermint consensus engine. In comparison to Ethereum, transactions are confirmed in a couple of seconds at low costs.

Cronos also utilizes multichain interoperability enabling users to seamlessly perform digital asset transfers across other Layer-2 EVM chains and Layer-1 EVM chains in the Cosmos ecosystem via the Inter-Blockchain Communication protocol (IBC). The IBC capability enables Cronos to interact with other IBC-enabled chains, which enables seamless asset transfers across them and further expands the utility of Cronos-native assets to different EVM-compatible chains. Some great examples are Osmosis, Injective, Cosmos Hub, and Terra.

Cronos is also interoperable with the Crypto.org chain facilitating seamless asset transfers between them using the Cronos Decentralised Bridge. Users can transfer CRO assets from Crypto.org to Cronos via the Cronos Decentralised Bridge built with the IBC.

Key Features of Cronos (CRO)

Cronos Bridge

The Cronos bridge is a decentralized protocol built on the open-source projects of IBC and Gravity Bridge that ensures the seamless transfer of assets between blockchains. The Cronos bridge aims to boost interoperability and provide users with the best dApps regardless of the chain.

Cronos Bridge supports the transfer of data from Cronos to Akash, Crypto.org, Terra, and Cosmos. The bridge supports CRO, ATOM, AKT, and LUNA tokens. There are plans to add new tokens like ETH, USDC, DAI, WBTC, and WETH to the bridge.

Currently, the only wallets supported by the bridge are Crypto.com, Keplr, and Metamask wallets.

The following steps will guide you on how to use the Cronos Bridge:

- Connect your wallet by clicking on the “Connect Wallet” button. Once you send the connection request, click on the pop-up that appears in your wallet interface to give consent. Only the supported wallets can be used.

- Select the origin chain and the destination chain and select the token you wish to transfer.

- Enter the amount you wish to transfer. There is no minimum or maximum amount required. Once you input the amount you wish to transfer, the bridge network fee will be calculated and added to the total amount.

- Confirm the transaction

- After confirming the transfer settings, you will be shown a summary of the transaction. A transaction request will be sent to your wallet. Click on the “Confirm” button to authorize the transfer.

- Once the transaction is confirmed the bridge will initiate and wait for the deposit to arrive from the origin chain. Once the deposit is confirmed, a transfer to the destination chain will be initiated.

- After the transaction is completed, you will be notified via a “transfer completed” message.

Using the Cronos bridge doesn’t cost any money for users, but they need to pay network gas fees. Whenever a transaction is made through the bridge, both the origin chain and the destination chain have network gas fees.

Cronos Chimp Club

Cronos Chimp Club is a collection of 10,000 uniquely generated digital artworks known as Chimps on the Cronos Chain. The Chimps are represented by NFTs existing on the Cronos network. They have unique traits and display different aspects of the Cronos chain.

Each Chimp in the Cronos Chimp Club is generated from over 140 possible traits, with each trait having its rarity. This means that every Chimp on the network is unique and rare. The metadata for all Cronos Chimps is stored in Arweave.

Cronos Ecosystem Grants

The Cronos Grants program was created to support early-stage projects on Cronos. The Grant is a form of monetary support provided by Cronos Labs to deserving projects. It is not a source of venture capital funding

This program aims to align incentives with new builders and teams and provide the needed technical support that will help the projects grow together with Cronos.

Projects seeking to qualify for this grant must meet the following requirements:

- The project must be building an application directly on the Cronos blockchain.

- The application in development by the project must fall within 3 categories: Gaming & Metaverse (Gaming platforms, Metaverse, Single-title games, etc), DeFi (Liquid Staking, Lending, Yield Aggregators, Derivatives, Structured Finance, etc), NFTs (Inter-Nft applications, NFTs, NFT Marketplace, etc), Critical Infrastructure Projects(Oracles), Social Goods and Community engagement projects (DAO projects, governance tools, educational videos on YouTube, Community forum, dedicated medium articles, etc), Tools and Analytics (Analytics developer tools, DeFi protocol tools, dashboards, etc) and Other Web3 applications.

Projects are awarded grants based on the potential of the project, the quality of the team behind the project, execution capabilities, and the value the project adds to Cronos. The awarding of grants is based on pre-agreed milestones like trading volume targets, delivery of Minimal Viable Product (MVP), TVL targets, etc.

Once each milestone is completed, the project will receive the milestone grant.

Projects that qualify for the grant will also receive technical assistance and support from Cronos developers, as well as, marketing support across Cronos’ social media channels. To accelerate the growth of the project, Cronos may also connect the project with the right partners in its ecosystem.

Cronos Accelerator Program

The Cronos Accelerator Program helps Cronos developers and builders to accelerate the growth of the ecosystem.

This program is perfect for projects that are in the pre-seed stage and need growth and mentorship. The Accelerator Program primarily focuses on projects that have to do with Web3 Gaming & Metaverse, advanced DeFi, and Infrastructure and Tooling.

Projects that are enlisted into the program are linked with reputable mentors in the industry. They also take part in weekly workshops organized by Cronos where they will learn all they need to about protocol building.

The program is funded by the Ecosystem Fund and is worth $100 million. About 3 to 4 cohorts (each cohort contains an average of 10 startups) are enlisted in the program yearly.

Key partners that support the Cronos Accelerator Program through workshops, investments, and mentorship include Altcoin Buzz, Crypto.com Capital, OKX Blockdream Ventures, etc.

Other features of the Accelerator Program include:

- Seed Investments between $100,000 and $300,00.

- Business advisory from industry mentors and Cronos Labs.

- Extra grant funding for gas fees, security audits, and node services.

- Fast-tracking with audit partners.

- Investment opportunities from established partners.

- Weekly one-on-one networking and mentorship with industry leaders.

Cronos Play

Cronos Play is a software development kit (SDK) that gaming developers can use to connect their games to the Cronos blockchain for added functionality.

Cronos play has some cool features like special things you can get in the game called NFTs, a way to prove you’re really you, and a special money system using custom tokens.

Weaknesses of Cronos (CRO)

Cronos is still relatively young and this has affected its competition with other well-established blockchains. Most of these other blockchains are faster and cheaper than Cronos.

CRO, the native token of the Cronos blockchain, derives its relevance from the ecosystem. It has very few use cases outside the Cronos ecosystem and this has affected the interest of investors in the token.

How is Cronos (CRO) Created?

All 30 billion Cronos (CRO) coins (following the 70 billion coins burned in 2021) were created when it went live, which makes Cronos unmineable.

Mining Cronos (CRO)

Besides the fact that all Cronos tokens have been created making it an unmineable cryptocurrency, CRO utilizes a delegated Proof of Stake consensus mechanism. This means you just need to store CRO tokens and stake them to get the equivalent of mining rewards. Investors get rewards for delegating their CRO assets to validators that run nodes to validate transactions on its native platform Crypto.org chain.

Which Blockchain does Cronos (CRO) Use?

Cronos is the utility token of the Cronos.org chain and the crypto.org chain.

How to Use Cronos (CRO)?

CRO is the native token of the Cronos blockchain. It can be used to pay for transactions on Cronos and Crypto.com blockchains. It is used for payment on different Crypto.com products like the Crypto pay app and Visa Cards. The token is also used to pay gas fees on Cronos.

CRO token holders can also participate in Cronos governance. The token gives the holder the ability to make proposals, fund proposals, and vote for proposals. Staking of CRO on the Cronos platform allows the Cronos holder to be a delegator or node operator on the network.

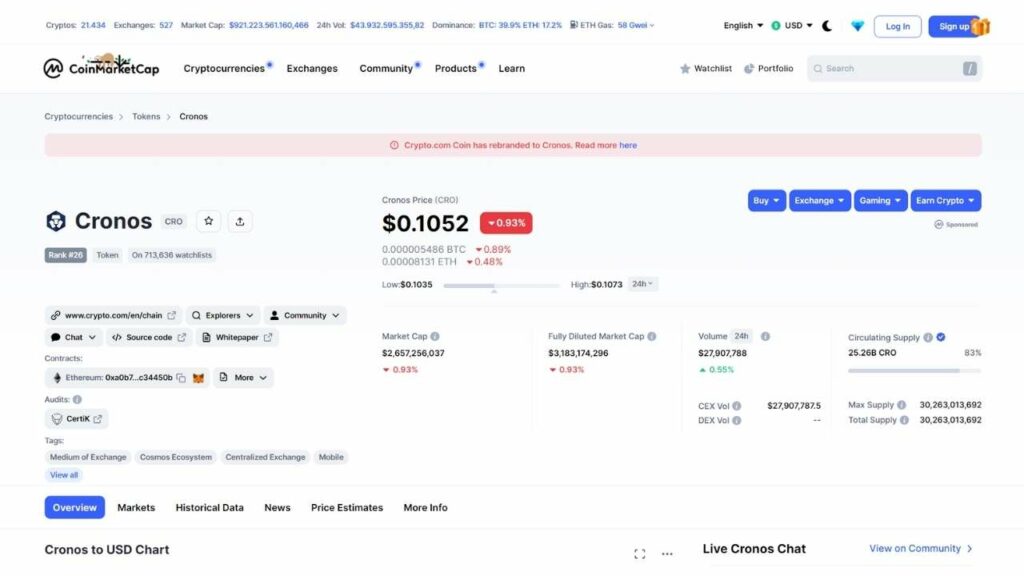

How To Buy Cronos (CRO)?

CRO can be purchased on crypto exchanges like Bittrex, Huobi Global, Crypto.com, Gate.io, Uniswap, etc. CoinMarketCap has a detailed list of all the exchanges that support the trading of CRO.

You will need to pick an exchange that best suits your need. It is important to choose an exchange that has good security. This will protect your crypto assets from malicious attacks.

After successfully setting up and confirming your account on the exchange, you’ll be able to add money to your wallet using regular currency. Then, you can easily purchase CRO coins from the exchange.

How to Store Cronos (CRO)?

You can store your CRO assets in a wallet on the exchange where you purchased them or you can move them to an external wallet. That said, exchange wallets are not secure, so you may want to move your tokens to a more secure wallet.

CRO assets can also be stored in software wallets like Metamask wallet, Gnosis wallet, Freewallet, Exodus Wallet, and Atomic Wallet. Just like exchange wallets, software wallets are not safe. While some software wallets have good security, they are still very susceptible to hacking attacks. Storing a large amount of CRO in software wallets is not advised. If however, you intend to trade often, you can find a secure software wallet to store your tokens in.

Hardware wallets like Ledger Nano X and Trezor Model T also support the storage of CRO assets. Hardware wallets are the best for storing any type of crypto assets. Since they are not connected to the internet, hardware wallets are not susceptible to malicious attacks. This type of wallet is best for storing a large amount of CRO tokens.

Best Place to Stake Cronos (CRO)?

There are several options available where you can stake your Cronos tokens, but the best options include:

- Crypto.org DeFi wallet

- Crypto.com app

- Crypto.com Exchange

Crypto.org DeFi Wallet

There are 2 types of CRO tokens. There’s the CRO token that’s native to Crypto.org, this token has addresses that start with “CRO”. Then there’s the ERC-20 CRO token built on Ethereum with addresses that start with 0x. If you intend to stake on Crypto.org then you need to hold the CRO native token and this shouldn’t be mistaken for the ERC-20 CRO token.

To begin staking your tokens, launch the DeFi Wallet application and press “start earning” Next, choose CRO, and include the number of tokens you intend to stake. Hit on “To Validators” to pick a validator.

Finally, go over all the entered details and conclude the transaction by tapping on “Confirm Stake”. After you’re done staking, your staked CRO will show up on the DeFi Earn page.

You’re also free to claim your CRO tokens whenever you want to use them by tapping “Earn” on the app’s navigation menu at the bottom of the DeFi Wallet screen.

To view your staking details, tap on the CRO token and then “Claim Rewards” beneath the “corresponding validator”. Your earned tokens will show on the CRO wallet’s available balance.

Staking your CRO assets on the crypto.com app has a couple of benefits:

- Get crypto wallet rewards like extra cash back and purchase rebates

- Receive a higher APR on the Crypto Earn and Crypto Credit programs

- Reserve premium metal crypto.com Visa cards.

Crypto.com App

It’s quite seamless to stake CRO on the Crypto.com app. To do so, just head over to the Card option located at the bottom right side of the app, choose your preferred card, and then click “Stake CRO” and adhere to the instructions that follow.

Crypto.com Exchange

If you want to stake native CRO on the Crypto.com exchange then you need to either have already purchased the token from the exchange or sent it in from another wallet.

Once that’s done, go to the “Stake and Earn” page and choose “Stake CRO“. Next, enter the number of tokens you intend to stake, hit “Review Staking” and click confirm.

On the next page, you should see the amount of CRO you have staked and the days left till you’ll be allowed to withdraw it.

What You Need to Know About the Future of Cronos (CRO)

The Cronos Team recently revealed their future goals, which include the following:

- Introducing the Cronos roadmap which will further embrace multichain interoperability and continue to broaden the IBC bridge to additional IBC-enabled chains, as well as, increased support for more Cosmos-based assets.

- Creating new strategies to attract new users to the Cronos chain including those who aren’t familiar with Web3, EVM chains, DeFi, etc.

- Hastening the widespread adoption of cryptocurrency and onboarding new gaming, Metaverse, and DeFi projects.

These plans all focus on broadening the Cronos chain in terms of user acceptability and product offered, which is great for the value of the CRO token as it is associated with Cronos.

Conclusion: Should You Put Your Money in Cronos (CRO)?

The decision to purchase Cronos (CRO) or any cryptocurrency is largely dependent on your financial risk capacity and your long-term belief in the Cronos and Crypto.com project.

If you believe in the Cronos token standard and that the objective of the Cronos network to gain greater widespread acceptance will succeed in the coming years. And that the Crypto.com platform will carve a greater name for itself in the crypto space after personal research then you can decide to put your money in CRO.

Risk in Investing in Cronos (CRO)?

Cronos is a volatile asset. This means that its price value can drop drastically in a matter of hours causing you to lose your entire investment. So before investing ensure you have a high-risk tolerance and only invest money you can afford to lose.

FAQ

Most frequent questions and answers

No, Crypto.com and Cronos are separate entities even though they are both owned by Crypto.com. That said, Crypto.com offers resources and support to the Cronos ecosystem. For example, Crypto.com’s suite of products like the exchange, app, and DeFi Wallet currently support the Cronos chain.

No, Cronos is an Ethereum-compatible blockchain developed on the Cosmos SDK. It is supported by the cryptocurrency exchange brand, Crypto.com.

The CRO token used to be called the Crypto.com coin but it rebranded to Cronos. According to a statement by the brand, the new name was given to reflect the growth of the ecosystem into decentralization.

There is a maximum supply of 30 billion Cronos Coins.

Cronos Coin was created on June 2016.

CRO uses the delegated Proof of Stake (DPoS) consensus mechanism. This means that investors/delegators/ earn rewards for delegating their CRO tokens to preferred validators that’ll run nodes to validate transactions on the Crypto.org Chain. So block rewards are gotten in CRO, which is then distributed to delegators after removing commissions.

The rewards gotten for staking are dependent on the platform and the staking method picked. The CRO token also has no minimum stake requirements and delegators can unstake and stake anytime. That said, when unstaking your CRO you’ll be bonded to a 28-day lock-in period, which is required by the blockchain. In this period, the unbounding balance will not receive rewards.

As with any type of investment, there are certain risks associated with CRO staking. For one, validators must be chosen carefully. The rule of thumb is that your preferred validator should have more than 8% voting power and 99% uptime. If a validator has too much downtime, the network can penalize them and this will result in 5% of your staked crypto being lost.

Also, by unstaking your CRO you will have to pass through the 28-day period where you can’t withdraw the asset. In addition, if you use the DeFi Wallet you are completely responsible for remembering your seed phrase. If you lose it, you’ll lose all the cryptocurrency stored in the wallet.

Staking on Crypto.com also has its risks as unlike decentralized finance wallets, centralized services are responsible for holding the cryptocurrency’s private keys, not you. So this means that if the Crypto.com exchange is hacked, you can lose your assets.

Yes, Cronos is built on the Cosmos SDK. The Cosmos SDK is an open-source blockchain framework.

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.