Swen Keller

- Home

- /

- Singapore & Crypto

- /

- Crypto Guides Singapore

- /

- Crypto Tax Singapore: The...

Crypto Tax Singapore: The Complete Guide 2023

Swen Keller

In this crypto tax Singapore guide, we will discuss all you need to know about the taxation of your digital assets in the country.

Our guide is built on an in-depth study of the current cryptocurrency and NFT tax laws in Singapore. We also interacted with experts on taxation laws in the nation to ensure we provide an exhaustive guide.

The Inland Revenue Authority of Singapore (IRAS) released 2 electronic tax guides concerning the taxation of digital tokens. One for the goods and services tax (GST) implications and the other dealing with income taxation. However, for most individuals, the crypto tax laws and regulations are still shrouded in ambiguity.

For this reason, we’ve come up with this guide to help you understand all there is to know about cryptocurrency tax treatment in Singapore. This article will help you see if you need to pay tax in Singapore, how to calculate crypto taxes, the tax treatment of payment tokens, services tax, capital gains taxes, and much more.

Do I Need to Pay Crypto Taxes in Singapore?

The Monetary Authority of Singapore divides cryptocurrency tax treatment into 3:

- Income Tax

- Capital Gains

- Goods and Service

Capital Gains

All derived capital gains are not taxable in Singapore for individuals and the nation does not have a capital gain tax regime. A great example of a capital gain is profit generated due to a one-off long-term hold of cryptocurrency. However, if the action is consistent and for profits then the resulting gains will be taxable.

Income Tax Treatment

Income tax treatment in Singapore is yet again divided into 3 segments:

Taxes on Purchased Crypto

Buying cryptocurrencies in Singapore will not trigger a taxable event. But your intention during purchase would determine the tax treatment of gains and losses from subsequent cryptocurrency disposals.

Taxes on Cryptocurrency Disposal

Any resulting gains or losses from the disposal of cryptocurrencies will be taxable if you engage in the selling or buying of digital assets as a business. This means that resulting losses or gains from cryptocurrency disposals aren’t generally taxable if you do not hold your crypto assets for trading purposes.

Taxable gains are dependent on the circumstances and facts of each scenario. For instance, factors such as holding period, frequency of transactions, and purpose of transactions are considered.

Receiving Digital Assets

You can receive cryptocurrencies from services offered such as employment services or the sale of products. The digital tokens you receive will be taxable depending on the value of the services you perform or the value of the products sold.

Also, if you decide to conduct mining activities and receive cryptocurrencies as a result, the law states that mining activities are considered a hobby. So gains acquired from the sale of mined crypto assets are not taxable and are treated as capital gains. But if you display a systematic and habitual effort to generate gains from mining activities, the IRAS may place you under individuals with the vocation of a crypto miner. This means that your profits generated from the sale of mined digital tokens will be subject to income tax treatment.

Goods and Services Taxes (GST)

The goods and services tax in Singapore does not apply to sales made by you in a personal capacity. But if you supply digital tokens by selling them in an exchange or pay for goods and services using virtual currency in the bid to further your business or in the course of a business transaction you may be required to register and pay GST on your activity.

Irrespective of the GST law, virtual currencies that are under the Digital Payment Tokens class are not subject to the GST law if they are exchanged for other digital payment tokens or fiat currency. For a virtual currency to be described as a Digital Payment Token it must exhibit particular characteristics stated by the Inland Revenue Authority of Singapore. Some of the virtual currencies identified by IRAS as Digital Payment Tokens include Monero, Litecoin, Bitcoin, Zcash, and XRP. Also, using Digital Payment Tokens to pay for anything other than other Digital Payment Tokens or fiat currency does not apply as a GST event.

It’s important to state that digital tokens like USDT pegged to a fiat currency do not meet the requirements of the IRAS to qualify as Digital Payment Tokens. This is because one of the demands to classify a virtual currency as a digital payment token is that it isn’t denominated by any fiat currency and isn’t pegged to any currency by the issuer of the coin. That said, stablecoins can also qualify for GST exemption if it is established that the individual in possession of the coins isn’t deliberately seeking to avoid taxes by holding the stablecoin.

Can the MAS track Crypto?

The Monetary Authority of Singapore is delegated under the Payment Services Act to be responsible for allegations of money laundering within the nation’s financial institutions. For this reason, licensed cryptocurrency exchanges that are compliant with the anti-money laundering (AML) regulation can have crypto transactions within the exchange and to other compliant exchanges monitored. The Huobi Singapore exchange, for example, only permits deposits and transfers to other AML compliant addresses and this is so that they can track all transactions. This is all under the MAS AML regulation, which implies that the institution can track crypto transactions.

How Do You Calculate Crypto Taxes in Singapore?

The easiest way to calculate your crypto taxes is by using a cryptocurrency tax calculator. The crypto tax calculator will calculate your taxes taking into account the nation’s income tax treatment, services tax act, virtual currencies in question, etc. We’ll dive into more detail in the crypto calculator section below.

Crypto Capital Gains Singapore

As already stated above, crypto gains in Singapore are being recognised for taxes depending on the reason the underlying virtual currencies were acquired. For tax treatment, considerations such as frequency of trades and length of holding are applied in examining whether the holder bought the digital tokens for personal use or profit. If purchased for profit, then the crypto gains would be taxable as investment income.

Also, capital gain taxes are applicable on arbitrage trades. Arbitrage trading is when a trader buys virtual currencies on one exchange and then sells them at a higher price on another exchange. If you were to generate profit from such activity you’ll be liable to pay taxes on your digital token capital gain. However, if you used a digital token as a mode of payment or a long-term investment, the tax treatment of profits generated will be recorded as capital gains.

This is also true for utility tokens. You can for instance purchase MANA tokens to facilitate transactions on the metaverse project Decentraland. With time, the MANA token can rise in value however, you won’t need to pay taxes on the profit. But if you buy utility tokens as part of speculative trade and dispose of them the next day, the profits gained would not be classed as a capital gain. So utility tokens are just like any other digital token when it comes to their tax treatment. The purpose determines whether it triggers a taxable event.

That said, in general, there aren’t any one-size-fits-all standards that differentiate capital gains from investment income. Rather, various considerations are applied on a case-by-case basis to know which category your crypto gains fall under.

Crypto Capital Gains Tax Rate

Singapore does not have a capital gains tax for individual investors that do not demonstrate or display business activities. However, businesses that utilize digital tokens on a day-to-day basis for profit must pay an income tax for crypto capital gains. The income tax rate for businesses in Singapore is 17%. This applies to both foreign and local companies.

Singapore Crypto Taxes Threshold

Crypto taxes in Singapore are primarily applicable to businesses. However, businesses with a net profit below a particular threshold are exempt from paying tax. Start-ups in Singapore can be eligible for a tax exemption of up to $125,000 on the first $200,000 of earnings for their first 3 years of business. To be eligible for this exemption, your company must be incorporated in Singapore and have less than 20 shareholders.

Business Income Tax

The average business income tax in Singapore is 17%. This is the tax that applies to businesses making a profit in the nation. However, high-income businesses can get taxed up to 22%. This means Singapore has one of the lowest tax rates in Asia. The Philippines and Indonesia, for example, have tax rates of 35% and 45% respectively.

Crypto Income Tax

The income tax in Singapore is taxed just like every other income tax – 17% in net profit. There is no difference in the tax rate from the regular business income tax.

Crypto Capital Loss

Crypto capital losses are not tax deductible in Singapore. In addition, taxes in Singapore are income based and if you do not have a profit there is no crypto capital tax.

Tax on Lost or Stolen Crypto

Tax on lost or stolen crypto is deductible on a case-by-case basis if it is established that the loss was not due to negligence on the part of the business such as loss of private keys.

Taxes on NFT Trading

In March 2022 the Finance Minister of Singapore announced the introduction of taxes in NFT trading in Singapore. NFT trading in Singapore will be taxed under existing income tax standards.

NFT taxes in Singapore only apply to people who generate income from NFT trading. Individuals who earn capital gains from NFTs are excluded from the taxes. This is because Singapore does not have a framework for capital gains tax. For this reason, Singapore is considered a tax haven for people who generate capital gains from digital payment tokens and stocks.

The tax department in Singapore, called the Inland Revenue Authority, looks at different things to decide if someone is making money from NFT trades. They think about how many trades a person does, how long they keep the digital tokens, why they bought them, and why they sell them.

Tax on Crypto Gifts and Donations

Receiving digital payment tokens as gifts or donations is tax-free. However, the disposal of digital payment tokens for income by swapping, selling, etc is not eligible for a tax break.

Is any Crypto Tax-free in Singapore?

Digital payment tokens taxes in Singapore are dependent on the activity behind the possession of the digital asset, not the type of crypto.

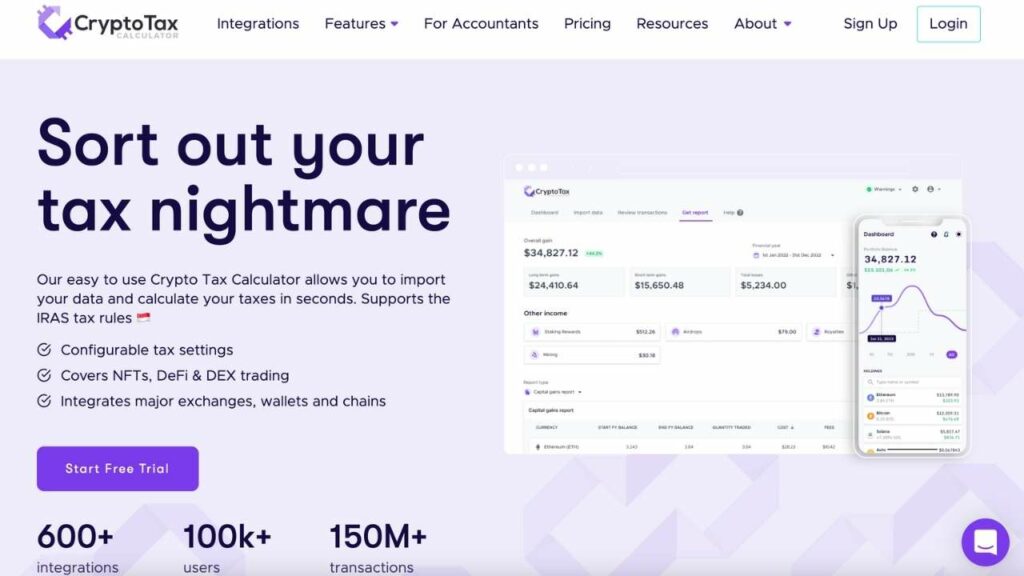

What is a Cryptocurrency Tax Calculator?

A cryptocurrency tax calculator is a tool that enables crypto taxpayers to calculate the estimate of the tax payable amount that the individual is expected to pay on the gains from crypto transactions. The calculation is done by applying the relevant income tax rule. This tool is very important to cryptocurrency investors in countries where digital payment tokens are taxed.

With this tool, investors can easily calculate how much they need to pay in crypto tax. The tool applies all the necessary tax provisions and provides an accurate estimate of the tax payable.

How to Use a Cryptocurrency Calculator

As already stated, the cryptocurrency tax calculator is easy to use. To calculate the tax on your crypto transactions using the calculator, do the following:

- Choose the tax year, you wish to do the calculation for

- Select the tax filing status

- Input the purchase and sales price got the cryptocurrency

- Calculate the crypto tax.

When you type in the purchase (cost of acquisition) and sale price in the calculator, the calculator will show you the amount you should pay for the crypto transaction.

When using the calculator, it is best you enter the details per transaction instead of aggregating the figures for the whole year. It is also important to note that when inputting the purchase cost, it should not include any other expense that was incurred in the process of the purchase. This is because the income tax rules do not permit any deduction from the sales price except the purchase cost. That said, some crypto tax calculators allow users to import transaction data from supported exchanges. This means that you won’t have to input the details of every transaction manually.

How to Choose the Right Crypto Tax Calculator

Calculating crypto taxes can be complex especially since there are no clear laws guiding them. This difficulty in calculating the taxes is what brought about the use of tax calculators.

Despite crypto tax calculators being created to make tax calculation easy, not all of them are effective. Beginner crypto traders may be comfortable using a crypto tax calculator that has only the basic features needed for the calculation. But investors may need something more.

To get the best crypto tax calculator, you need to know what features to look out for. In this section, we will be taking a look at factors you need to consider when choosing a good crypto tax calculator.

1. Multiple Exchange Support

All crypto investments and trades happen on exchanges, it is therefore important that you choose a tax calculator that supports as many exchanges as possible. Getting a tax calculator that supports different exchanges will make portfolio tracking and tax calculation easy.

2. Unlimited Data Import

When deciding on the best crypto tax calculator, you should find out if the tax calculator has a limit on data import. This is because the process of filing crypto taxes involves the movement of data from wallets and exchanges.

The ideal tax calculator should enable you to easily import your trades from different wallets and exchanges to the tax software. Some tax calculators allow users to download their trade data in CSV or excel file formats. After the download, the user can manually upload the file to the tax software.

3. Compatibility with Country-specific Tax Systems

A good crypto tax calculator should be compatible with the tax systems of different countries. This is because different countries have different tax laws and what is taxable will vary from country to country. So the ideal crypto calculator should put into consideration all the tax policies of different countries.

4. Integration with Traditional Tax Calculators

A good crypto calculator should integrate well with traditional tax calculators. This is because after calculating your crypto tax on the crypto tax calculator, you will still need to move the taxable income from the crypto calculator to a traditional tax calculator. This is very important especially if you have other business and income taxes outside that of the digital tokens that you need to calculate.

Having a tax calculator that integrates properly with a traditional tax calculator will make the tax calculation process easy. It will also enable you to streamline the filing process in a single tax season.

5. Testing Files and Example Files

Calculating crypto tax can be difficult to grasp even for experts. Using a tax calculator doesn’t make it any easier. This is why a good crypto tax calculator should have previous and test filings. This will help you understand how the data works, how to interpret the figures, and the right data to feed the system.

Having test filings will enable you to calculate and file taxes with simulated transactions. This will help you figure out how things work before doing the real tax calculation. Understanding how the software works ahead of time will make the tax calculation process faster and less prone to error which is bound to occur if you are learning on the job.

6. Support for Uncommon Activities

If you’re searching for a great tool to calculate your crypto taxes, it’s important to find one that does more than just handle basic tasks like trading, sending, investing, and receiving crypto. Look for a calculator that also supports less common crypto activities.

The tax calculator should cover uncommon transactions like forks, airdrops, and cloud mining.

7. Pricing

Pricing is an important factor that must be considered when buying any product. In most cases, your budget will determine the type of tax calculator you choose.

Aside from the price matching your budget, you also need to know what you are paying for.

A good tax calculator should clearly show the payment plan and the features available for each plan. This will enable you to make an informed decision when choosing a plan.

Also, ensure that there are no extra or hidden charges. You won’t want a situation where a vital feature of the tax calculator is locked behind some hidden charges that were not disclosed at the point of purchase.

8. Versatility

Any Crypto tax calculator you choose should be versatile. This will make the calculation of tax under different scenarios easy and accurate.

Some of the important indicators of versatility include the following: does the tax calculator have a way of calculating taxes if the exchange bring used is not in the support list? Does the calculator support the upload and download of files in different formats? Is there a provision for manual entry of data if the trader’s mode of trading and investing is uncommon?

You also need a tax calculator that is flexible and can conceptualize and proffer solutions to different problems that traders may run into when calculating their taxes. Getting a tax calculator that checks all the boxes for the above questions will make the tax calculation process a lot simpler.

9. Excellent Customer Support

When you’re picking a crypto tax calculator, one of the key things to think about is how good their customer support is. Even if the software has everything you want, if their support team is unhelpful, it can really spoil your experience.

Getting a crypto tax calculator with excellent customer support is necessary because you can’t predict what difficulties you might run into when using the tool. Difficulty moving crypto data from the tax calculator and difficulty uploading different file formats are some common problems you may run into while using this type of app. Having customer support that you can easily contact will be very helpful when any of these happen.

A major aspect to look out for with the customer support team is how quickly they respond to and resolve complaints. If the support team takes forever to respond to and resolve complaints, it is a red flag. You do not want to wait for hours or days to have a simple issue resolved.

It is also important for the crypto tax calculator to have tax professionals on the team. This is important because you may encounter some complex tax problems when trying to calculate your tax. The regular support team may not be able to resolve these problems, only an expert will.

Final Thoughts

The cryptocurrency tax laws in Singapore can be confusing at first glance but with proper education, it becomes clearer what is eligible for taxes and what isn’t.

Singapore is considered the crypto tax haven by many and that is rightly so. The country does not charge taxes on capital gains and has also eliminated its Goods and Services Tax. Residents just have to pay the income tax on their net profit.

Our extensive analysis of the Singaporean Crypto Space doesn’t stop here. You can also check out our Guide on how to buy NFT in Singapore if you want to know the best way for you to own a NFT.

FAQ

Most frequent questions and answers

Singapore does not charge individuals capital gains tax as long as your activity does not demonstrate a business transaction. So to avoid capital gains tax, do not continuously generate profit on your digital tokens through deliberate actions. Businesses, on the other hand, that actively generate profit on their digital tokens are charged an income tax. In such cases, there’s no way to avoid taxes on digital tokens legally.

In Singapore, you pay taxes on crypto as income or goods and services for businesses. So buying cryptocurrency and holding it won’t trigger a taxable event unless you sell. However, if you hold cryptocurrency to generate profit long-term continuously you’ll be charged an income tax.

If you generate crypto profits as a business then you have to declare the same.

Capital gain income is not taxable in Singapore.

All overseas money transferred to Singapore isn’t taxable. But this exemption isn’t applicable if the overseas income was remitted through a partnership in Singapore.

No, you only have to report taxable events (selling) and Singapore does not tax capital gains.

Cryptocurrencies (payment tokens) are regulated by the Monetary Authority of Singapore.

No legislation particularly relates to mining cryptocurrency in Singapore. That said, mining payment tokens isn’t illegal.

The Monetary Authority of Singapore has not yet authorized or permitted any fund to invest in payment tokens. MAS only authorizes companies that provide cryptocurrency custody services in the country. That said, you can set up a fund to invest in cryptocurrency products in conventional markets.

Just like any other token, the tax treatment of the returns derived from security tokens is dependent on the type of transaction that generated the profit. When the holder disposes of their security tokens the taxation of the disposal gain or loss is dependent on if the security tokens are held as capital or revenue. If the security tokens are held as capital it will not trigger a taxable event.

Utility tokens are assets that facilitate operations on crypto platforms. Axie Infinity and MANA of Dcentraland are great examples. However, utility tokens only trigger a tax event if used to generate income consistently. Holding utility tokens does not trigger a tax event.

Payment tokens are the regular cryptocurrencies used for transactions like Bitcoin, Ethereum, etc. And like any other currency, payment tokens trigger a taxable event when held or transacted to generate income.

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.