What is Algorand (ALGO)?

Luis Clark

- Home

- /

- Cryptocurrencies

- /

- What is Algorand (ALGO)?

Luis Clark

What is Algorand (ALGO)?

Algorand is a new open-source blockchain project built to broaden the possible use cases for digital assets by increasing transaction speed and decreasing the time needed for transaction finality in its network. Plus, the Algorand protocol is capable of hosting other blockchain projects and cryptocurrencies on its blockchain network.

ALGO is Algorand’s native cryptocurrency and it is used to pay for processing fees on all Algorand-based transactions and to secure its native blockchain.

The Algorand protocol is Pure Proof of Stake Consensus. This is a consensus mechanism that recruits validators from a pool of users for the purpose of validating transactions. This new blockchain network further allows users to develop smart contracts and tokens which can represent current and new assets.

Who is the Founder?

Silvio Micali founded Algorand in 2017 as a decentralized, scalable, and secure blockchain network that offers a universal platform for creating products and services for a geographically limitless economy.

Since 1983, Silvio Micali has been on the MIT faculty in the Electrical Engineering and Computer Science Department. Micali’s research interests include zero knowledge, mechanical designs, cryptography, blockchain, secure protocols, and pseudorandom generation.

Specifically, Silvio Micali is the co-creator of probabilistic encryption, verifiable random functions, zero-knowledge proofs, and most of the protocols that form the foundation of current cryptography.

Silvio Micali has received numerous rewards such as the RSA Prize in cryptography, the Turing Award in computer science, and the Gödel Prize in theoretical computer science. Silvio Micali got his Ph.D. in computer science at the University of Berkeley in California, the United States, and his Laurea in mathematics from the University of Rome. He is currently a member of the American Academy of Arts and Sciences and Accademia Dei Lincei, the National Academy of Engineering, and the National Academy of Sciences.

How does Algorand (ALGO) Work?

To understand how the Algorand platform works we’ll look at various key aspects of a blockchain.

The Consensus Protocol

Most blockchains are challenged with the blockchain trilemma, which means they are forced to sacrifice one of the vital aspects of security, scalability, and decentralization to achieve their goal. The Algorand platform has sought to solve this by a new consensus, which it calls the Pure Proof of Stake (PPoS) consensus protocol. This is the protocol the Algorand blockchain is based on.

Here’s how the Pure Proof of Stake protocol works. It selects a block proposer and a group of voting committees at every block round. These selections aim to purpose a block and validate the proposal. This selection of a proposer and committee is randomly done from a pool of all ALGO token holders. And the possibility of being picked is directly proportional to the users’ stake in the Algorand network (the number of ALGO tokens the account holds relative to the whole).

There are also a couple of cryptographic algorithms like cryptographic sortition and verifiable random functions that ensure voting is fair, the overall system is secure, and no one can conclude.

Also, unlike the Proof-of-Work consensus that projects like Bitcoin use, which requires the solving of complex cryptographic puzzles before anyone else ultimately resulting in computing power playing a significant role in who wins. Proof of Stake protocols, including Algorand’s Pure Proof of Stake, do not need large amounts of energy to create a block. This reduces the energy consumption problem faced by Proof of Work chains.

Governance

Algorand is governed by the Algorand Foundation. The Algorand Foundation is a nonprofit organization that developed the Algorand mainnet. The goal of the Algorand Foundation is to contribute to the decentralization of the chain and commit more of the decision-making process to the care of the Algorand community.

Throughput

On the Algorand platform, blocks are created every 4.5 seconds and can support up to 5000 transactions. This results in average throughput of 1000 transactions per second (1000 TPS).

Fees

Fees on Algorand are dependent on the size of the transaction and users can opt to augment fees to help prioritize block acceptance when blocks are full and network traffic is high. Algorand does not use the concept of gas fees. The minimum Algorand fee is 0.001 ALGOs.

Open Blockchain

If a blockchain is operated and managed by a couple of entities this would mean that the centralized nodes can manipulate the blockchain’s state. Algorand seeks to avoid this by ensuring that the blockchain is fully open and permissionless. So anyone willing to stake Algorand tokens can participate in the consensus.

No Forking

Forking happens when a blockchain separates into 2 differing paths. This happens intentionally sometimes when a part of the community intends to transform the foundations of the protocol. On other occasions, forking is accidental and happens when 2 miners locate a block simultaneously. The outcome would be that one of the paths is ignored, this means that every transaction that occurred since the fork on the ignored path of the orphaned chain is invalid. The implication here is detrimental to transaction finality.

Now, because Algorand is Pure Proof of Stake and utilizes a voting mechanism to validate blocks, forking is an impossibility. The worst that could happen is the blockchain temporarily stalling or slowing down when the committee takes extra long to reach an agreement.

Finality

Key Features of Algorand (ALGO)

AlgoFund

AlgoFund is a fundraising and accelerator program designed to empower innovative and disruptive projects on the Algorand blockchain. This launchpad was created to leverage the network’s potential to provide fully decentralized transparent and efficient services. It is the first decentralized IDO platform dedicated to the launching of new projects on the Algorand network.

AlgoFund was designed to fund startups and create a safe environment for investors who wish to do so. This program makes it easier for projects that need funding to access IDOs.

The program caters to high-quality projects in different sectors such as NFTs, infrastructure, DEXes, and DeFi.

AlgoFund provides a fair presale offering to investors on behalf of the startups. Users who wish to participate in new project sales must stake the $ALGF token before each sale begins.

The participants can choose to be part of one of these pools below:

- Guaranteed Pool: The participant in this pool receives an allocation that is proportional to the number of tickets the participant submits and the total number of tickets submitted to the pool.

- Lottery Pool: All the participants in this pool are included in a whitelist for allocation. Every ticket gives the participants a chance to win one allocation.

Algorand Virtual Machine (AVM)

AVM was created to offer developers a collection of tools for building dApps on the Algorand network. It presents dependable and practical resources that simplify the process of constructing on the Algorand infrastructure.

The Algorand Virtual Machine is a virtual machine that contains a stack of engines that evaluates smart signatures and smart contracts against the transactions they are called with. AVM runs on every node in the Algorand blockchain and they can either succeed and apply changes according to the contents and logic of the transaction or they can fail and reject the transaction.

Every smart contract contains a logic that is deployed and can be called remotely from any node on the Algorand blockchain by issuing an Application Call transaction. If the call to a smart contract is not successful, the changes produced by the call will fail to be committed to the blockchain. If however, the call is successful, the changes will be recorded to the blockchain.

Smart signatures also contain logic. Logic is commonly used for signature deleting. The logic in the smart signature is stored in the chain and is not remotely callable. When the logic is submitted to a node, the Algorand Virtual Machine evaluates the logic and decides if it failed or is successful. If it failed when executed by the AVM, the transaction it was associated with will not be applied.

Weaknesses of Algorand (ALGO)

Algorand is not the first protocol to introduce smart contracts and DeFi. Protocols like Ethereum have been at it long before Algorand appeared on the scene. This has made developers naturally lean towards the Ethereum blockchain for the development of dApps. For Algorand to surpass its competitors like Ethereum, it needs to introduce something unique to the DeFi space.

Also just like other cryptocurrencies, the ALGO cryptocurrency is very volatile meaning that market movements can easily affect ALGO cryptocurrency prices.

How is Algorand Created (ALGO)?

ALGO holders are selected at random to validate and approve subsequent blocks in the chain to issue Algorand’s native cryptocurrency. The pool of users is randomly selected whenever there’s a new block. Through this process, the Algorand blockchain remains decentralized and secure.

Mining Algorand (ALGO)

It is impossible to mine Algorand as it is based on a unique consensus called Pure Proof of Stake. To earn rewards as you would in mining, you just need to stake your held Algorand in crypto or Algorand wallet.

Which Blockchain does Algorand (ALGO) Use?

The ALGO token uses the Algorand blockchain, a Pure Proof of Stake consensus chain built to facilitate decentralization and solve the blockchain trilemma.

How to Use Algorand (ALGO)?

ALGO is the native token of the Algorand blockchain. It can be used to pay for transactions on the Algorand ecosystem and purchase goods and services, as well as, on-chain items like NFTs in the crypto space.

People who own ALGO can join the world of DeFi as investors and have a say in how the Algorand network is managed.

ALGO is also used to secure consensus among participation nodes on the Algorand blockchain.

How to Buy Algorand (ALGO)?

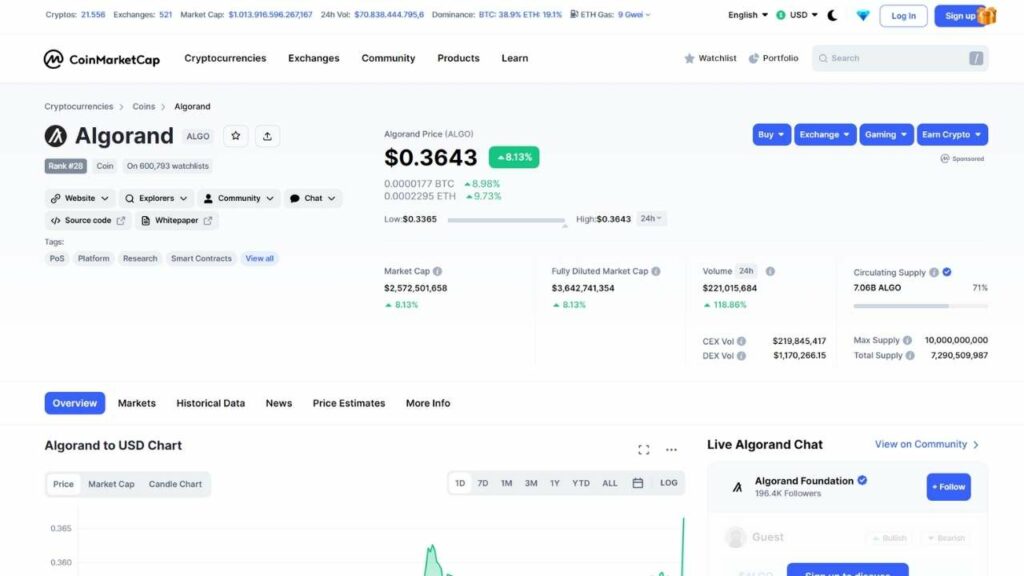

ALGO can be bought on popular exchanges like Coinbase, Kraken, Coinmama, Binance, and Bybit. You can check CoinMarketCap for a list of all the exchanges that support ALGO trading.

To buy ALGO, all you need to do is to create and verify an account with your preferred exchange and fund your wallet. After funding your wallet, you will be able to buy ALGO from the exchange.

How to Store Algorand (ALGO)?

ALGO can be stored on web-based dedicated ALGO wallets like MyALGO Wallet, Algorand CORE Wallet, and MyALGO Wallet UI.

You can keep your ALGO tokens in different software wallets such as Pera Wallet, Trust Wallet, and Atomic Wallet. Additionally, ALGO tokens can be stored in hardware wallets like the Ledger Nano X.

Best Place to Stake Algorand (ALGO)?

The best place to stake your held ALGO is on the official ALGO wallet and the Algorand Foundation Governance Program (Pera Algo Wallet). Other options include Binance and Coinbase. However, staking ALGO now does not offer staking rewards but governance rewards.

What You Need to Know About the Future of Algorand (ALGO)?

Algorand seeks to solve the blockchain trilemma, how and when it achieves this goal will determine the future of the project. Also, its transition from offering staking rewards to staking governance rewards has negatively impacted the incentivization of the community. This may affect its user base in years to come.

Conclusion: Should You Put Your Money in Algorand (ALGO)?

Algorand’s objective to solve the blockchain’s trilemma makes the project a possibly great investment opportunity but whether they achieve this goal or not would determine if ALGO is a worthwhile investment.

Risk in Investing in Algorand (ALGO)

ALGO is a volatile asset and can lose its entire price value in a day. The project can also stop existing if the main actors give up on it. This means you can lose your entire investment should any of the above occur.

FAQ

Most frequent questions and answers

Every blockchain possesses a native token that plays a crucial role in incentivizing acceptable network behavior. ALGO, Algorand’s native token enables holders to register and participate in consensus (the process of proposing and voting on new blocks).

ALGO also acts as the network’s utility token. This means when you use Algorand to build an application, you’ll need to use ALGO tokens to pay transaction fees, as well as, serve as minimum balance deposits if you intend to store data on Algorand. In most cases, the cost of transaction fees and minimum balances are on average the fractions of a penny.

Algorand provides solutions to excess energy consumption and slow transaction speeds in Proof of Work blockchains like Bitcoin.

Algorand is more energy efficient, less expensive, and faster than Ethereum.

The maximum supply cap for Algorand is 10 billion ALGO minted at Genesis.

If you want to take part in the governance of the Algorand network, staking Algorand is worth it.

Algorand is faster and a lot more energy-consumption-friendly than Ethereum.

The Algorand Blockchain in total uses the energy equivalent of what is required to power 7 homes in a year. This carbon usage is part by purchasing carbon credits via smart contract and it’s guaranteed to stay carbon negative on a net basis.

The main projects on the Algorand Ecosystem are decentralized applications and services.

No, you cannot move ALGO because it uses the Pure Proof of Stake Consensus mechanism.

The Algorand Foundation exists to fulfill the global objective of blockchain technology via the Algorand protocol and open-source software. With its belief in the establishment of a permissionless and open blockchain, the Algorand Foundation pursues the vision of an inclusive ecosystem.

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.