Luis Clark

- Home

- /

- UK & Crypto

- /

- Crypto Cards in the...

- /

- Wirex Card UK Review...

Wirex Card UK Review 2023: Benefits, Pros & Cons

Luis Clark

- URL: https://wirexapp.com/en-gb/card

- Physical Card Cost: Free

- Cash back: Up to 8%

- Annual Fee: None

- Platform App: Desktop/Mobile

- Staking Rewards: 6%

- No. of Cryptocurrencies Supported: 8

- Type of Card: Debit Mastercard

Wirex Card UK: Our Opinion

The Wirex debit card enables UK residents to spend their cryptocurrency funds conveniently. This card ha a lot of advantages to offer. It comes with no issuing fees, provides regular cashback rewards (cryptobacks), and charges zero fees for foreign ATM withdrawals.

The Wirex Card UK is suitable for online and in-store purchases. It is also a good travel companion for work and leisure trips because of its unmatched utility and adaptability.

However, the debit card only supports eight cryptocurrencies for UK residents, and there’s an ATM withdrawal limit of £400 per month.

An Overview of Wirex Card UK

Wirex is a digital payment network that was established in 2014 by CEOs and co-founders Pavel Matveev and Dmitry Lazarichev. Its goal is to make cryptocurrencies and conventional currencies equally and widely available.

The company is based in London, with offices in Singapore, Kyiv, Toronto, Dallas, and Atlanta. Wirex has roughly 4.5 million clients spread across 250 countries.

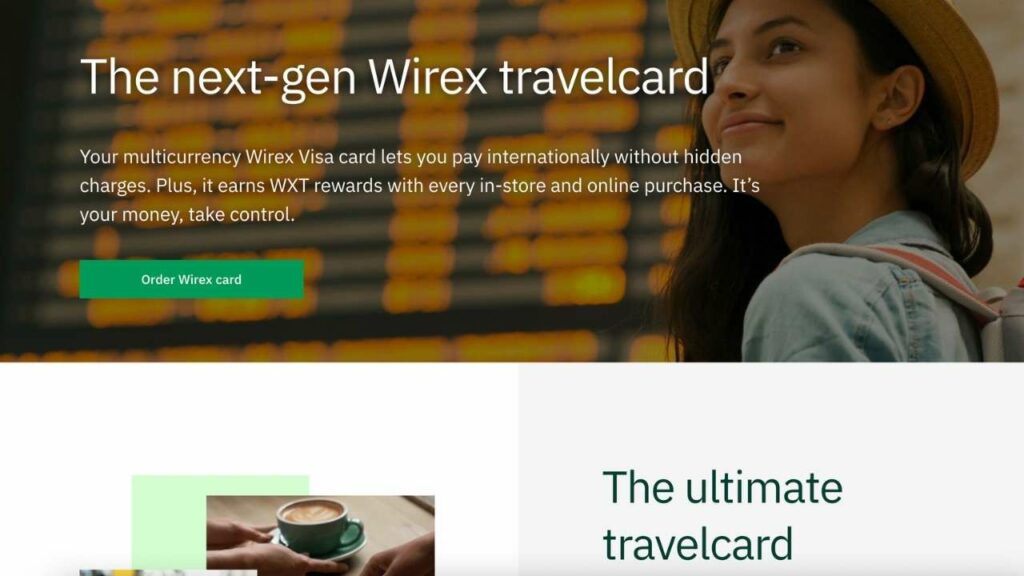

The crypto firm’s goal is to simplify fintech. Investors can buy, save, exchange, and spend a wide range of traditional and digital currencies instantly, securely, and without hassle, thanks to its free account, cutting-edge mobile app and next-generation visa card.

Wirex is the only global crypto firm granted principal membership status with VISA and Mastercard. This enables Wirex to close the gap between Web 3.0 and the mainstream market because of its direct connections to the two biggest payment processors worldwide.

Wirex offers MasterCard to investors in the UK. In this section, we’ll discuss the advantages the Wirex Card UK offers, along with its downsides.

Pros

- The Wirex card is free.

- The multicurrency Wirex card saves users up to 3% on international purchases, with real-time point-of-sale (POS) conversion.

- Compatible with over 150 currencies globally

- Offers up to 8% cryptoback rewards

- No monthly maintenance fee

- Zero exchange fees for international exchange

Cons

- ATM withdrawal limit (£400 per month)

- Limited support for fiat currencies and cryptocurrencies

Wirex Mastercard: What Is It?

Wirex offers a Mastercard debit card in the UK and the European Economic Area, as well as a Visa debit card in Asia Pacific and the United States. Users get instant access to over 150 currencies globally with the multicurrency Wirex card, thanks to real-time conversion at the point of sale and zero FX exchange costs. The card also offers several perks and benefits, like earning cryptoback rewards of up to 8% on all purchases.

Cardholders can use a single card to spend both fiat and digital currency anywhere Mastercard is accepted worldwide. The Wirex card provides numerous spending and travel advantages, including over-the-counter (OTC) exchange rates.

Because users receive cryptoback points for their card usage, the Wirex card is an important part of the Wirex rewards programme—X-Tras. The level of X-Tras advantages the user decides to sign up for determines the proportion of cryptoback rewards earned each time a purchase is made.

In collaboration with Snowdrops, the card is endorsed by the merchant reconciliation service (MRS) and Google Maps as an alternative way to offer familiar mainstream features to users.

Wirex Debit Card: How Does It Work?

Investors can instantly spend several cryptocurrencies and fiat currencies with the Wirex debit card. Users can start making purchases at locations worldwide that accept Mastercard by adding their preferred cryptocurrency to their Wirex wallet.

The Wirex card simplifies crypto and fiat spending and is the ideal travel companion. At the point of sale, it immediately converts to local currency using the best live and over-the-counter (OTC) rates available. As a result, users may easily spend more than 150 different currencies in real-world situations, such as when picking up a check or using a mobile device to board a bus.

The card has no monthly maintenance charge, and cardholders are offered free ATM withdrawals of up to £400 per month.

Benefits & Perks

The Wirex card offers several perks and benefits to its users. Here are some of the perks cardholders enjoy:

- Access to over 150 currencies at live rates in over 80 million locations globally

- When customers travel and pay with the multicurrency Wirex card, the exchange rate is instantly converted to the local currency, saving users up to 3% on international purchases. It chooses the best live exchange rates available at all times and does so with zero FX conversion fees.

- New Wirex cards offer free international ATM transactions up to £400 and a 2% fee for withdrawals above that amount.

- Customers can earn up to 8% in cryptoback rewards every time they use their Wirex card in-store or online.

- Customers can also use their multicurrency Wirex Mastercard to enjoy great offers. All they have to do is visit the specific websites provided by Wirex to access amazing offers and discounts. Users can save up to 15% on expenses from shopping or travelling.

Cryptocurrencies Supported

The Wirex Mastercard allows UK residents to spend different crypto and fiat currencies and earn interest. However, they have access to just eight cryptocurrencies and nine fiat currencies. These are the cryptocurrencies supported:

- BTC

- LTC

- XRP

- ETH

- WAVES

- DAI

- NANO

- XLM

Fees Explained

UK residents can acquire the Wirex Mastercard for free. However, there are other transaction fees involved. We have highlighted these fees in the table below.

Different Card Holder Tiers

The Wirex multicurrency MasterCard comes in three tiers: standard, premium, and elite. We have highlighted an overview of the different card tiers below:

Opening an Account

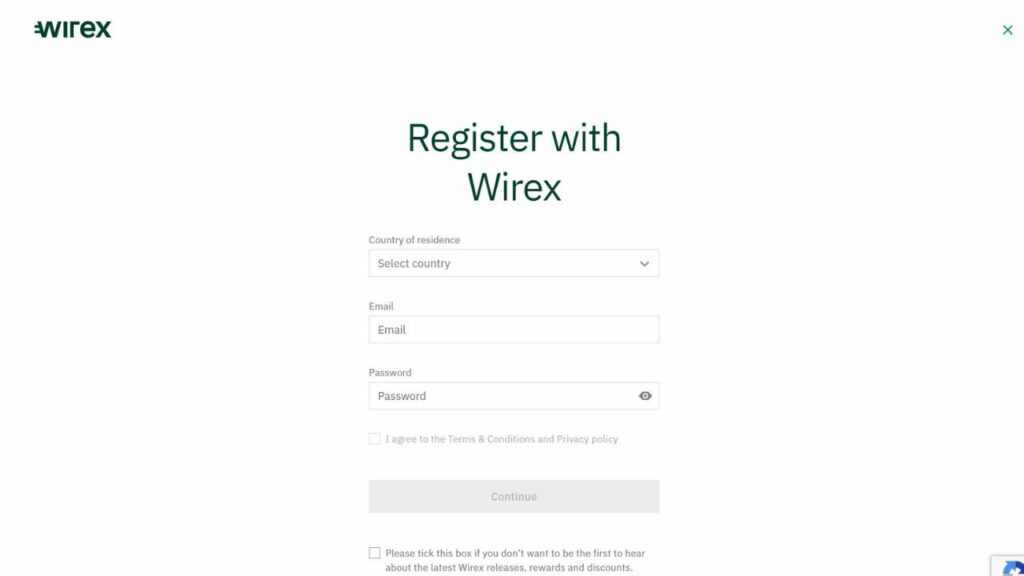

UK residents must register a Wirex account to apply for the Wirex Mastercard. Below are the necessary steps to follow:

Sign Up

Customers should visit the official Wirex website or download the Wirex mobile app and select “Register”. Then, enter an email address and country of residence, create a password, and click “Continue”. A confirmation email will be sent from Wirex to the user’s email address. Click the link attached to the email and follow the onscreen prompts to confirm their address, personal information, and phone number.

Verify Account

After registering, users must submit legitimate government-issued identification, such as a passport or driver’s licence, to authenticate their account.

The genuine, government-issued document serving as proof of identity must match the personal data users entered when setting up their Wirex account. Customers should upload the required paperwork, take a selfie to finish the verification process, and press “Next”.

Fund Account

Users can fund their accounts with fiat money or cryptocurrency using local cards or bank transfers. Find the “Account” tab on the left side and click on it to deposit funds. Then, click the “Add Funds” button after choosing the account to add funds. Next, decide which linked card or external account will be used to make the deposit.

The Wirex app enables users who have selected a linked card to complete their transactions immediately. However, the relevant information on how to transfer funds to a Wirex account from an external platform will be provided to those who choose an external crypto or currency account.

Order Card

Customers can order a Wirex card only after their Wirex account has been successfully verified. Before ordering their card, they might be asked to top up their account if there aren’t enough funds. The exact amount required in an account to order a card will be shown in the app.

Customers can order from desktop websites and mobile apps. Follow these steps to order the card:

- Scroll down to “Order Cards” on the Dashboard.

- Click “Get the Card” in the “Order New Card” window.

- Review the billing address and personal information. If something needs to be changed, click “Contact Support”.

- Select a delivery option.

- Then click “Place Order”. The success message will be displayed. To get back to using the application, click “Back to Dashboard”.

Customers can opt for standard delivery, which is free and takes about 4–7 working days to get delivered. Alternatively, they can select DHL Express delivery, which costs 7.99 EUR but delivers in 1–3 days.

Once the card arrives, users can activate it by following these steps:

- Go to the dashboard, pick the right card from the list found on the left, and click “Activate Card”.

- Insert the card’s last four digits and expiration date.

- Click “Activate”. If a customer is using a mobile app, they can simply scan the card details.

Wirex Card App

Wirex provides users with a mobile app: Android and iOS users can download the app from the Wirex website, Google Play, and Apple store.

Wirex customers can use this app to perform full functionality tasks on the go, just like on the website. They can order Wirex cards, monitor their accounts and portfolios, and block their cards if they are lost or stolen.

Security measures, like a password and facial or fingerprint identification, are also employed to secure the Wirex mobile app. However, customers have occasionally reported experiencing verification problems and bugs.

Customer Satisfaction

Wirex claims to have provided several methods of contact through which customers can obtain satisfaction from their services. The exchange has a customer service directory and a “Contact Us” option for their UK customers.

Users can help themselves via the FAQ and Wirex help centre or submit a request. They can also use the community forum or “Contact Us” page, where various email addresses are available.

Notwithstanding these options, Wirex only scored an above-average rating of 3.2 stars on the third-party Trustpilot app. While the ease of use received praise, some users had negative reviews about slow Wirex support and the inability to withdraw funds on time.

Is Wirex Card Right for You?

The Wirex Mastercard is suitable for crypto enthusiasts. This payment card allows seamless point-of-sale exchange with zero exchange fees for cryptocurrency spending. Customers also receive free ATM withdrawals and can earn various cryptoback benefits online and when they spend their Wirex card in-store.

The Wirex card is a great travel card, and people who are constantly on the move will find it beneficial. This card automatically converts to the local currency when customers pay, saving them up to 3% on international transactions with no exchange fees, using the best live and over-the-counter (OTC) rates. This is a game-changer for any investor who actively trades or purchases Bitcoin anywhere.

Final Thoughts

Crypto enthusiasts in the UK will appreciate the perks the Wirex card UK offers. It enables investors to get value for their crypto assets, letting them use digital currency anywhere that accepts card payments.

According to our review, the Wirex Mastercard supports over 150 currency options globally, allowing customers to make payments automatically in their preferred currency with no exchange fees.

However, the card may only partially convince those who prefer more crypto options. This is because the Wirex card only provides investors with a small selection of crypto assets.

If you want to know more about on Wirex Competitors and other Crypto Cards, you can check out our list of the Crypto Cards UK Reviews. You can also read about our Uphold Card UK Review as an alternative to Wirex.

FAQ

Most frequent questions and answers

UK customers can withdraw money from their Wirex account to their bank account. However, the user needs to activate their GBP account details to transfer. To transfer, select “Send” on the Wirex app dashboard. Then, select “Pay – Pay with cryptocurrency or bank transfer”. Choose a British pound account, select “Myself”, enter the account number and the bank’s sort code, and click “Pay” after entering the desired amount.

Wirex is available in about 240 countries and serves over 4.5 million customers worldwide. Wirex is available in the United Arab Emirates, United Kingdom, United States of America, Australia, and many other countries.

Cardholders can use the Wirex card to withdraw from ATMs that accept Mastercard worldwide. There is also a free ATM withdrawal limit of up to £400 per month. Anyone who exceeds this will be charged a 2% fee.

Wirex provides a multicurrency Mastercard in the UK and the EEA region and a Visa debit card in the Asia Pacific and the United States. Customers can use both payment cards wherever Visa and Mastercard are accepted, with real-time conversion at the point of sale and instant crypto rewards.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.