What is Avalanche (AVAX)?

Luis Clark

- Home

- /

- Cryptocurrencies

- /

- What is Avalanche (AVAX)?

Luis Clark

What is Avalanche (AVAX)?

Avalanche is an open-source smart contracts platform that enables users to launch decentralized applications and enterprise blockchain deployments in a single interoperable and scalable ecosystem. The platform was one of the first of its kind (smart contracts platform) to process 4,500+ transactions per second and confirm transactions instantly. Avalanche also enables Ethereum developers to build quickly as it features solidity.

The native token of Avalanche is AVAX, which is used to secure the network via staking. It is also used to pay for fees on the network and provide a single unit of account between the several subnetworks built on the Avalanche platform.

Who is the Founder?

Avalanche was founded by Ava Labs, which was created by Emin Gün Sirer. That said, the project is open-source and partners with several contributors to develop the underlying infrastructure of the platform.

How does Avalanche (AVAX) Work?

There are 4 aspects with regards to how the Avalanche network works:

- Architecture

- Subnets

- Snowman Consensus Protocol

- Avalanche Consensus Protocol

Architecture

The Avalanche network utilizes 3 chains to maximize efficiency and divide its processes:

- Contact Chain or C-Chain: The Contract chain enables smart contracts to be developed and run on Avalanche. The contract chain is also where dApps can be found. This utilizes the Snowman Consensus Protocol, which helps the Contract chain to enable high throughput and secure smart contracts.

- Exchange Chain or X-Chain: The Exchange Chain allows for the creation and trade of cryptocurrencies such as AVAX in the ecosystem. The Exchange Chain utilizes the Avalanche network Consensus Protocol.

Platform Chain or P-Chain: The Platform Chain allows the creation of subnets and their governing rules. The Platform Chain uses the Snowman Consensus Protocol, which helps it enable secure smart contracts.

Subnets

Subnets stand for subnetworks. These are special chains that can be either private or public that run alongside Avalanche’s blockchain. They are also secured by groups of specific validators. Once a developer creates a subnet they can set the rules that will oversee it. For example, rules like how many validators are permitted or the type of people who can run a node. Most importantly, every subnet validator must validate Avalanche’s primary chain.

Because some validators are included in the Avalanche network, but not all, the platform can make things simpler. This allows different specialized chains to coexist at once.

Snowman Consensus Protocol

Avalanche has its unique consensus mechanism termed the Snow Consensus Protocol, which is powered by the network’s Consensus Protocol. This protocol, which uses Proof of Stake as its foundation, was developed to balance transaction speed, energy efficiency, speed, network capacity, security, and decentralization.

Avalanche’s protocol is considered leaderless, which means the Snow Consensus Protocol does not require one blockchain node to be the leader that defines the goal for the group. Rather, once a validator receives a user’s transaction it samples or asks random close-by validators if they agree. This process is constant with other validators until the whole network reaches a consensus on the transaction’s validity. The set of steps in the Snow Protocol is termed Slush, Snowflake, and Snowball. Each step builds on the previous one till it becomes an Avalanche that boosts conviction and confidence in the blockchain’s state.

Avalanche Consensus Protocol

Avalanche primarily works with the Avalanche Consensus Protocol, which like the Nakamoto Consensus is a probabilistic protocol. Avalanche embraces probability just like Nakamoto exchanged a small chance in probability for performance. This is to ensure that the probability of error is equally as microscopic and like every aspect of Avalanche, configurable by node validators on unique subnets.

The Avalanche platform can make errors so infinitesimal that it becomes less likely that safety violations occur on an Avalanche node than the probability of discovering an SHA-256 hash collision. To clarify this, it is mathematically impossible for an SHA-256 collision to be detected in a thousand years by a network that computes 1 quintillion hashes per second. This means the Avalanche consensus is safe.

That said, Avalanche also completes every transaction right away without stalling for confirmations. The network can achieve this as it’s a generalization over Classical Consensus, so it gets this particular property. Avalanche, on average, has transactions finalized within a second. This is fast when compared to the current decentralized networks.

Also, as a generalized classical consensus with probabilistic models involved, Avalanche possesses the property of being high-throughput and CPU-bound. And doesn’t need specialized hardware to attain high-performance numbers (4,500 transactions a second). This means a regular PC is strong enough to run Avalanche. These factors make Avalanche nodes economical and eco-friendly.

There’s also no known cap on the number of people that can participate in the network at the deepest levels. This is unlike Classical protocols whose performance drops exponentially with increased participation.

That said, Avalanche does not depend on Proof of Work like the Nakamoto Consensus. With protocols like Bitcoin, Proof of Work is needed for both security and organization against bad actors. On the other hand, Avalanche doesn’t use Proof of Work but Proof of Stake. This compels users to hold AVAX before being permitted to vote on transactions.

Lastly, unlike Bitcoin and other protocols based on the Nakamoto Consensus that require perpetual action, Avalanche nodes act only when work needs to be done. There’s no polling or mining to find new blocks. Rather, transactions are broadcast to the network, which hears them and begins voting. If no transaction is available for voting, the network nodes remain idle. They only listen to hear new transactions. So the Avalanche Consensus works a lot smarter than the Nakamoto or Classical Consensus.

Key Features of Avalanche (AVAX)

Avalanche Rush Program

Avalanche Rush Program is an incentive program created by the Avalanche Foundation to fuel liquidity in the AVAX ecosystem of DeFi apps.

Avalanche Rush has $180 million worth of the fund. The program offers rewards to liquidity providers with AVAX coin incentives. It is also aimed at introducing more applications and assets to Avalanche’s growing DeFi ecosystem and onboarding DeFi protocols Curve and Aave to the Avalanche public blockchain.

The Rush program was launched to incentivize the usage of Avalanche’s layer 1 blockchain. It also rewards users for borrowing or lending with DeFi. The reward for these users is in the form of interest on deposited tokens and Wrapped AVAX tokens (WAVAX). Wrapped AVAX tokens can be converted back to AVAX at a 1:1 ratio.

At the launch of the Avalanche Rush program, the Avalanche Foundation allocated $7M AVAX to Curve and $20M AVAX to Aave users.

Avalanche Bridge

Avalanche Bridge was launched in 2021 and it was designed to enhance cross-chain interoperability in the AVAX blockchain. The Avalanche Bridge facilitates ERC-20 token swaps and makes transactions in the Avalanche ecosystem 5 times cheaper.

The Avalanche Bridge lets people use their ERC-20 tokens on the AVAX blockchain. This makes it possible for the blockchain to have a lot of tokens available, which are worth billions of dollars.

The Bridge speeds up transactions and also increases transparency. Users have access to all the information they need about every step of their transaction. It also makes crypto assets intuitive, which makes it easy for users to understand how to use the bridge.

The Avalanche Bridge is compatible with wallets like Metamask. This enables users to efficiently use ERC-20 tokens on the AVAX blockchain.

Core

Core is a non-custodial browser extension hot wallet. Asides from being a wallet, Core is also an all-in-one operating system that brings together Avalanche apps, bridges, subnets, and NFTs in one easy-to-use browser experience.

Core was created to eliminate the stress associated with the fragmentation of vital aspects of the network across different applications. This challenge is one of the reasons for the poor reception of Web3. By eliminating this problem and giving users easy access to Avalanche dApps and tools, Core grants Web3 users a better experience than what was previously obtainable.

Core revolutionizes the way users manage their portfolios by automating complex tasks like adding new tokens. This provides a hassle-free, user-friendly, and secure solution. Moreover, Core offers an intuitive interface that caters to both novice and experienced crypto enthusiasts.

Below are the 9 primary features of Core that were revealed when it was launched.

- Swap: Users can directly swap hundreds of Avalanche tokens from Core. This feature is powered by ParaSwap.

- Buy: Powered by MoonPay, this feature enables Core users to easily fund their Core Wallet with cash.

- Bridge: Users can bridge their native Bitcoin with the same technology that powers the Avalanche Bridge.

- Subnets: Core offers native support for subnets such as Swimmer and DFK.

- Portfolio: Core users do not need to add token addresses manually or switch networks. They can easily view all their assets in a unified display.

- Account Switcher: With Core, users can create and manage multiple addresses with the same recovery phrase.

- Ledger-enabled: Core Wallet is compatible with the Ledger hardware wallet.

- Address Book: Users can use the address book to save trusted and frequently used addresses.

Collectibles Gallery: This feature enables users to display and manage their favorite NFTs in one consolidated portal.

Weaknesses of Avalanche (AVAX)

A major weakness of Avalanche is that price of becoming a validator on the network is expensive. To become an Avalanche network validator, a user must have a minimum of 2,000 AVAX, that’s about $34,000 today (the price of AVAX at the time of this writing is $17.05).

Prospective validators are also required to stake their AVAX Avalanche token for a maximum of 1 year and a minimum of 2 weeks. They must also be online and correct for a minimum of 60% of the time.

These requirements are too strict and not attainable by many users on the Avalanche network.

Another problem with Avalanche is that careless or malicious validators are not penalized. Most crypto networks penalize validators for mistakes or taking fraudulent actions. This misbehavior is often punished by “Slashing”. This means that the offending validator loses some or all of their crypto stake.

Unlike these other networks, Avalanche clearly states that staked tokens are not at risk of slashing. While this is good news for validators, it isn’t for other users because it creates an enabling environment for validators to do as they please without any consequences.

Avalanche is also faced with stiff competition from other blockchains like Ethereum, Polkadot, Solana, Terra, and Cardano. For instance, Ethereum 2.0 intends to upgrade to 100,000 TPS, this is a challenge to Avalanche as there has not been any talk of increasing the network’s transaction speed.

How is Avalanche (AVAX) Created?

AVAX minting (token creation) is accomplished via validators putting up a stake and being a part of its consensus protocols. That said, AVAX’s total supply has a cap of 720 million tokens.

At its launch, 360 million tokens were available which were subject to variable vesting schedules of up to 10 years. Of the 360 million tokens, 10% was kept for the members of Ava Labs, 9.26% was allocated to the Avalanche Foundation for incentive and marketing programs, 10% was sold in public sales, 6% was used in seed/private sales, 7% was allocated to organizations and individuals, 3% was part of the TestNet and airdrop incentive program, and 5% was allocated to strategic partners.

The remaining 360 million is to be minted over time at a pace that can be changed through platform governance. Also, AVAX used as transaction fees are burned. This process is used to offset the inflation of the token creation process.

Mining Avalanche (AVAX)?

The AVAX crypto uses Proof of Stake instead of Proof of Work (which is mined) so you cannot mine it. Simply put, you don’t need to mine AVAX, spending value in electricity but rather you lock value (stake AVAX) to secure the network and earn rewards.

Which Blockchain does Avalanche (AVAX) Use?

AVAX uses the Avalanche blockchain. Avalanche (AVAX) is a rival cryptocurrency and blockchain to Ethereum. And AVAX is the native token of the Avalanche blockchain. The Avalanche blockchain uses smart contracts to support various blockchain projects.

How to Use Avalanche (AVAX)?

AVAX is the native token of Avalanche. It is the utility token used as the common medium of exchange in the Avalanche ecosystem. The token is used to pay gas fees and interact with smart contracts.

Staking AVAX on Avalanche secures the Avalanche platform. Also, AVAX’s deflationary token mechanism is dependent on compounding the value gotten from staking the token on the platform. The AVAX token used to pay transaction fees on the network is taken out of supply. This permanently reduces the circulating supply of the AVAX token.

AVAX also provides a basic unit of account between the different Subnets created on the Avalanche Blockchain.

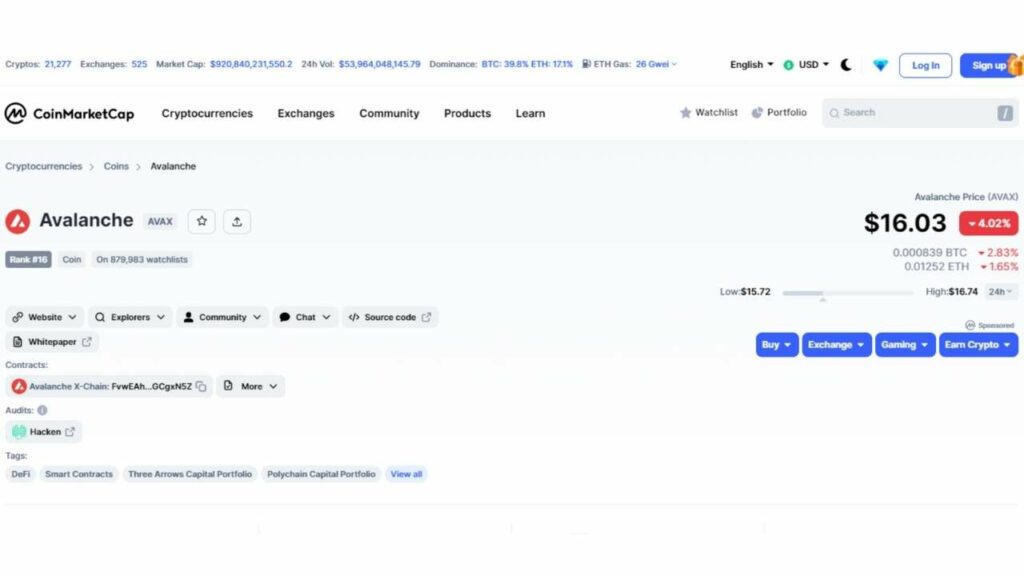

How to Buy Avalanche (AVAX)?

AVAX is available for purchase on top exchanges like Binance, Coinbase, Kucoin, Gate.io, Kraken, and Bitfinex. You can check CoinMarketCap for a list of all the exchanges that support the trading of AVAX.

To buy AVAX from an exchange, you will need to create an account with the exchange and fund your wallet.

You can also buy AVAX via decentralized peer-to-peer trading using the Avalanche Bridge to trade ETH or other Ethereum-based tokens for AVAX. To use this option, you will need to have a decentralized application browser and a non-custodial wallet.

If you are using a decentralized application browser like Coinbase, you can easily exchange your Ethereum assets from the Avalanche Bridge in the wallet.

How to Store Avalanche (AVAX)?

AVAX can be stored in Avalanche Wallet. This is the official wallet for storing AVAX. It is a web wallet, which means that you do not need to install it on your device. Avalanche wallet is a non-custodial wallet. It also has a simple user interface that allows you to easily store and access your AVAX token.

AVAX can also be stored on Ledger Nano S and X hardware wallet, as well as, other software wallets like Metamask wallet, MathWallet, Coinomi wallet, and Core Wallet.

Ensure you carry out proper research on the different wallet options and only store your crypto assets in a secure wallet, preferably one that doesn’t have any history of malicious attacks.

If you intend to store a large amount of AVAX or you intend to hold your crypto assets for a long time, it is best you use the hardware wallet as they are not susceptible to malicious attacks.

Best Place to Stake Avalanche (AVAX)?

There are numerous great options to stake AVAX, however, the recommended option is to stake the token on-chain (on the Avalanche platform). The Avalanche platform’s official wallet offers up to 11% APY on staked AVAX for validators with the option of setting your fee for accepting delegations to your node.

For delegators, you can stake your tokens in the official Avalanche wallet as well. To do so, you just need to create a wallet account and click ‘Earn’ then choose if you want to stake as a delegator, which requires that you hold at least 25 AVAX tokens, or run a validator node, which requires that you hold 2,000 AVAX tokens.

That said, there are certain rules concerning staking on Avalanche. First, if the validator you’ve delegated your tokens to is both responsive and correct based on Avalanche’s standard then you’ll get a reward after delegation. Delegators will get rewards in accordance with the same function as validators. But the validator you delegate keeps a part of your reward, which is specified by the validator’s fee rate.

When delegators issue transactions to delegate tokens, the transaction fee and staked tokens are deducted from the delegators’ wallet address. After staking, the staked tokens are refunded to the relevant addresses. If the delegators earned rewards it is sent to the address specified when staking the tokens.

What You Need to Know About the Future of Avalanche (AVAX)

Avalanche’s rapid growth has moved the blockchain platform to look for several ways to manage its rising users while maintaining its affordability and speed. The leading method is subnetting, which enables sovereign projects developed on Avalanche to stay connected to the mainnet through individual chains without consuming space on the Avalanche mainnet.

Dividing traffic this way may enable the blockchain platform to escape gas fees and transaction speed issues as it scales in size. These are problems that have negatively impacted other blockchain networks like Ethereum.

Also, early in 2022, Avalanche announced a $290 million initiative that would assist developers to incorporate subnets into projects they build on the blockchain platform. This initiative was called the Avalanche multiverse and will incentivize developers to build customizable application-specific networks on the Avalanche network. This will theoretically allow crypto networks like Ethereum and Bitcoin to live on Avalanche while maintaining and using their native cryptocurrencies.

Subnets can even be customized to add “Know Your Client” features which can permit conventional financial institutions to develop on Avalanche.

Also, subnets have been adopted by large-scale projects like the play-to-earn game the DeFi Kingdom, which was developed on Harmony, an Ethereum sidechain.

Conclusion: Should You Put Your Money in Avalanche (AVAX)?

If the Avalanche project is adopted by more platforms and individuals in the future this will boost the price of its native token, which will make for a great investment. Also, AVAX has a strong burning mechanism that will help drive the price value of the token upwards. These and other factors make Avalanche a great investment opportunity. However, if the burning mechanism isn’t maintained and it loses users and partnerships then its price value will drop which would make for a bad investment.

Risk in Investing in Avalanche (AVAX)

The Avalanche token (AVAX) is extremely volatile and can potentially cost you your entire investment. So only invest money, spare money, or cash you’re willing to lose.

FAQ

Most frequent questions and answers

In terms of their performance, Solana is more performant than Avalanche with a throughput of more than 50,000 TPS and over 200 nodes. Solana is also quicker than Avalanche with fewer nodes than the latter. However, Solana had already its fair share of issues, for example, network downtimes and hacks.

No, AVAX runs on its custom blockchain called Avalanche. But it is compatible with the Ethereum virtual machine.

Yes, it is compatible with the Ethereum Virtual Machine.

The maximum supply of AVAX is 720 million tokens.

Cardano and Avalanche are both quality blockchains, however, Avalanche has a larger ecosystem.

AVAX is the native token of the Avalanche blockchain.

Yes, it is public Proof of Work blockchain.

Validators secure the blockchain network, process transactions, and create new blocks.

The Avalanche blockchain was launched in 2020.

Avalanche solves the transaction finality and scaling problems challenging the decentralized finance and crypto markets.

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.