Luis Clark

- Home

- /

- Canada & Crypto

- /

- Crypto Guides Canada

- /

- Which Canadian Banks allow...

Which Canadian Banks allow cryptocurrency in 2023?

Luis Clark

Crypto-friendly banks are forward-thinking financial institutions accepting cryptocurrencies as a form of payment. Customers can use these institutions to access lower transaction fees when switching between crypto and traditional currencies. This type of crypto-friendly bank combines cryptocurrency and conventional banking activities.

Some banks are limiting access to discourage and prevent Canadians from buying digital currencies, for example on crypto exchanges, despite the fact that crypto transactions are becoming more popular, and purchasing crypto is now easier than ever. One reason for this can be to safeguard their customers from fraud and scams, as well as to prevent them from losing money because of price fluctuations.

Which Canadian Banks Allow Cryptocurrency: Our Opinion

National Bank of Canada is the best option if you’re looking for a Canadian bank that accepts cryptocurrency purchases.

With the exception of one, all of Canada’s major banks have lately imposed limitations on cryptocurrency purchases. Most Canadian banks accept cryptocurrency in some form, however not all payment methods are accepted. Some banks have prohibited the purchase of cryptocurrencies via Interac Online, bank transfer, debit or credit cards. Others just prohibit credit card purchases while allowing debit cards and Interac Online transactions. Several smaller Canadian banks and credit unions have also imposed bitcoin limitations.

Many Canadian banks prohibit users from purchasing cryptocurrency with credit cards, although debit card transactions are permitted (or buy via Interac e-transfers). When you use a credit card, you are borrowing money, however, when you use a debit card, you are spending your own money. It’s logical that banks would seek to safeguard themselves and their customers in the event that borrowed funds were not repaid.

Many crypto aficionados, on the other hand, believe that banks are merely trying to protect themselves because bitcoin may threaten their very existence in the future. Many people dislike the financial system as a whole and believe they must be allowed to buy whatever they want. Many people consider bank intervention to be censorship.

If you are wanting to purchase cryptocurrency in Canada, you will want to know which Canadian bank is the most crypto-friendly. Hence, we researched Canada’s biggest banks to find out whether they accept cryptocurrency transactions. In this post, we discuss which Canadian banks allow and accept cryptocurrencies so that you can make an informed decision about which bank is best for you.

Canadian Banks Allowing Crypto Transactions

Following is a handpicked list of the Top Most Crypto-Friendly banks in Canada.

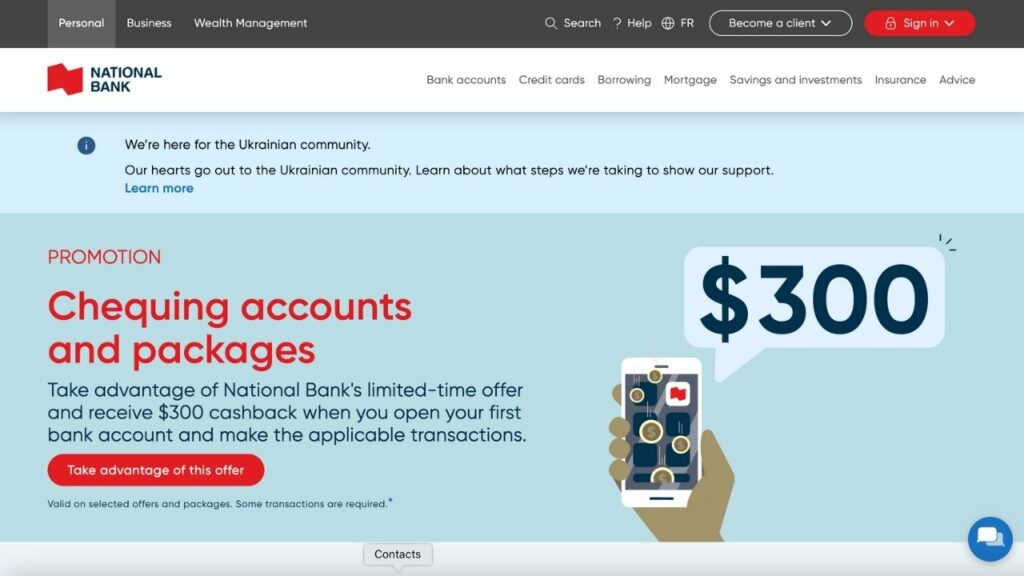

National Bank of Canada

The National Bank of Canada is Canada’s 6 sixth-largest bank. It has branches in almost all Canadian provinces and has 2.4 million personal customers. It is headquartered in Montreal. Branch offices, international centres in Canada and overseas, foreign-exchange counters, commercial banking centres, and other service units make up National Bank’s large network.

They have locations in Florida and right here in town. The National Bank of Canada, the largest bank in Quebec and one of Canada’s largest financial institutions, maintains several hundred correspondent accounts, manages over 2,000 SWIFT and telegraphic keys, and provides a comprehensive range of services to meet the requirements of international financial institutions in Canada.

It is one of the most digital currency–friendly banks. Customers can go for crypto purchases from the National Bank of Canada using Interac e-Transfers, debit and credit cards, and wire transfers.

Payment Methods

- Interac e-Transfer: Yes

- Credit card: Yes

- Debit card: Yes

- Wire transfer: Yes

Royal Bank of Canada

The Royal Bank of Canada (RBC) is a worldwide financial services firm headquartered in Halifax, Nova Scotia, established in 1864. The headquarter of the company is in Toronto, Ontario, with additional offices in Montreal, Quebec.

The Royal Bank of Canada is a financial services conglomerate. The bank offers personal and commercial banking, insurance, wealth management services, corporate and investment banking, and transaction processing services. RBC serves business, personal, institutional clients, and the public sector in Canada, and the United States.

RBC, the largest bank in the country by market value, proudly serves over 16 million customers and employs over 86,000 individuals worldwide. Recognized for its significance in the global financial landscape, RBC was listed among the global systemically important institutions by the Financial Stability Board in November 2017.

Royal Bank of Canada allows crypto purchases using debit cards and Interac e-Transfers. However, the bank no longer permits its customers to buy cryptocurrencies with their credit cards. for customers looking at buying cryptocurrencies from a bank with a proven track record, in that case, Royal Bank of Canada can be considered.

Payment Methods

- Interac e-Transfer: Yes

- Debit card: Yes

- Credit card: No

- Wire transfer: No

Fees

- Interac e-Transfer fee: CAD 1.00

- Debit card fee: Free

Toronto Dominion

The Toronto-Dominion Bank (TD) is a Canadian multinational banking and financial services firm that was founded on February 1, 1955, when the Bank of Toronto and The Dominion Bank, both founded in 1855 and 1869, merged to become the Toronto-Dominion Bank.

The bank is known as TD and operates as the TD Bank Group. Its headquarters are located in Toronto, Ontario.

According to S&P’s ratings, TD Bank Group was the biggest bank in Canada by total assets and market capitalization in 2021, a top-10 bank in North America, and the world’s 23rd largest bank. In the year 2019, the Financial Stability Board identified it as a worldwide systemically important bank.

The bank and its subsidiaries employ approximately 89,000 people worldwide and serve over 26 million customers. In Canada, the bank is known as TD Canada Trust, and it has over 1,091 locations that service over 11 million customers. The bank is known in the United States as TD Bank, which was formed through the amalgamation of TD Bank North and Commerce Bank.

Customers can go for crypto purchases from Toronto Dominion using Interac e-Transfers, debit and credit cards, and wire transfers. Those looking for a crypto-friendly Canadian bank can opt for Toronto Dominion bank.

Payment Methods

- Interac e-Transfer: Yes

- Debit card: Yes

- Credit card: No

- Wire transfer: Yes

Fees

- Monthly fee: CAD 10.95

- Transactions included per month: 25

- Interac e-Transfer fee: Free

- Additional transaction fee: CAD 1.25/transaction

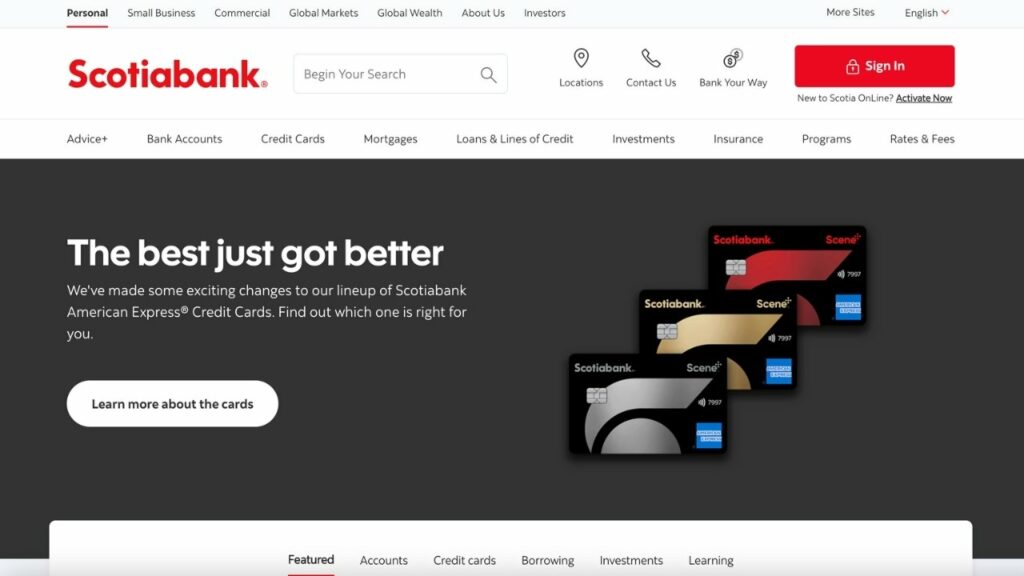

Bank of Nova Scotia

Scotiabank is a worldwide banking and financial services corporation based in Toronto, Ontario, Canada. It is the third-largest bank in Canada in terms of deposits and market capitalisation. It is one of Canada’s “Big Five” banks.

It provides commercial and personal banking, corporate and investment banking, and wealth management, to more than 25 million customers worldwide. Scotiabank trades on the New York as well as Toronto stock exchanges. It has over 92,001 employees and over CA$1,136 billion in assets.

Due to its acquisitions largely throughout Latin America and the Caribbean, as well as Europe and portions of Asia, Scotiabank bills itself as “Canada’s most international bank”. Scotiabank is a London Bullion Market Association member and one of 15 accredited banks that engage in the London gold fixing. This was done through ScotiaMocatta, the company’s precious metals branch, from 1997 until 2019.

Customers can buy crypto with debit cards, wire transfers, and Interac e-Transfers at Scotiabank. Scotiabank is unlikely to support crypto purchases using a credit card. Since regulatory and risk considerations relating to cryptocurrencies are constantly changing, Scotiabank always examining its policies regarding cryptocurrency transactions.

Payment Methods

- Interac e-Transfer: Yes

- Debit card: Yes

- Credit card: No

- Wire transfer: Yes – if it is a Canadian crypto exchange

Fees

- Interac e-Transfer fee: CAD 2.00

- Debit card fee: Free

- Wire transfer fee: CAD 15.00

Canadian Imperial Bank of Commerce

The Canadian Imperial Bank of Commerce (CIBC) is a Canadian multinational banking and financial services company based in Toronto, Ontario. The bank is one of the two original Big Five banks in Toronto, and it is located on Commerce Court in the city’s Financial District.

On June 1, 1961, the CIBC (established in 1867) and the Imperial Bank of Canada (established in 1873) merged to form the Canadian Imperial Bank of Commerce.

Canadian Commercial Banking & Wealth Management, Canadian Personal & Business Banking, U.S. Commercial Banking & Wealth Management, and Capital Markets are the bank’s four strategic business areas. It operates in the United States, Asia, the United Kingdom, and the Caribbean on a global scale. Globally. CIBC employs over 40,000 people and services over eleven million customers. The bank is placed at number 172 on the Forbes Global 2000 listing.

You can use your debit card to buy cryptocurrency at the bank. The bank, on the other hand, does not allow clients to purchase cryptocurrencies using their credit cards.

Payment Methods

- Interac e-Transfer: Unknown

- Debit card: Yes

- Credit card: No

- Wire transfer: No

Fees

- Debit card fee: Free (2.5% administration fee for foreign transactions)

Tangerine

Tangerine is a well-known Canadian online bank founded by Scotiabank in 2014. Because of its ties to Scotiabank, it’s one of the few online banks which hasn’t drifted too far from the brick-and-mortar bank norm.

Tangerine, despite this, is among the few Canadian banks that have embraced cryptocurrency. It presently supports crypto purchases via Interac e-Transfers and includes features like real-time spending notifications and goal-based sub-savings accounts that make saving for a certain purpose easier.

Payment Methods

- Interac e-Transfer: Yes

- Credit card: No

- Debit card: No

- Wire transfer: No

Fees

- Interac e-Transfer fee: Free

Bank of Montreal

The Bank of Montreal is a multinational investment bank and financial services firm based in Montreal, Canada. It was formed in 1817. It is the fourth-biggest bank in Canada by market capitalisation and assets, and one of the 10 biggest banks in North America. It is one of Canada’s Big Five banks.

Bank of Montreal (BMO Financial Group, BMO) is a financial services company that offers a wide range of services. Personal and Commercial Banking, BMO Wealth Management, and BMO Capital Markets are the three operational groups. Corporates, individuals, institutions, and government clients can access a wide range of personal and commercial banking, wealth management, investment banking products and services, and global markets. In FY 2021, the Bank of Montreal employed 43863 people across 47 locations and generated C$32.76 billion in revenue.

You can purchase crypto from the Bank of Montreal through Interac e-transfer or wire transfer. However, customers can no longer use their credit cards to purchase cryptocurrencies such as bitcoi4n. Retail customers can no longer buy cryptocurrency with Mastercard-branded credit or debit cards, according to the bank.

Payment Methods

- Interac e-Transfer: Yes

- Credit card: No

- Debit card: No

- Wire transfer: Yes

Fees

- Interac e-Transfer fee: Free

- Wire transfer: CAD 125

Best Crypto Exchanges To Pair Canadian Banks With

You will need to use a reputable cryptocurrency exchange to purchase cryptocurrencies. Here are some of the best cryptocurrency exchanges and crypto companies in Canada:

CoinSmart

Without a doubt, CoinSmart is the best crypto platform in Canada. CoinSmart’s trading fee is only 0.2%. They provide exceptional customer service via phone, live chat, and email 24 hours a day, seven days a week, and user accounts are quickly validated.

The Ontario Securities Commission (OSC) has classified CoinSmart as a Registered Marketplace, and as a publicly-traded company, their financial statements are audited by a third-party firm every year. They also have a 95% cold storage policy, ensuring that the crypto is kept safe and secure in any situation.

You’ll get a $30 bonus when you fund your CoinSmart account, which you may use to buy Bitcoin, Ethereum, or any of the 16 assets CoinSmart offers. CoinSmart is an excellent choice if you’re looking for a highly secure and reputable crypto platform. It is best for investors because of its lowest trading fees and has the best overall trading experience.

Coinsmart Fees

- Account Opening: Free

- Trading Fees: 0.2%

- INTERAC Deposit: 0%

- Bank Wire Deposit: 0%

- Bank Wire Withdrawal: 1%

- EFT Withdrawal: 1%

Bitbuy

The Bitbuy online platform is a good choice for Canadians looking for a safe and secure cryptocurrency exchange.

Bitbuy’s trading fee, like CoinSmart’s, starts at 0.2% and is as low as 0.1% for transactions conducted through their advanced trading platform. It supports 15 cryptocurrencies, immediately verifies accounts, has competent customer service representatives, and has an attractive, well-rated interface.

Bitbuy’s 350,000+ Canadian users have handled over $4 billion in trades. It’s an Ontario Securities Commission (OSC)-registered marketplace and investment dealer, which implies it’s a very safe and secure exchange with deep liquidity for all order sizes.

BitBuy Fees

- Trading Fees: 0.1% to 0.2%

- Account Opening: Free

- INTERAC Deposits/Withdrawals: 1.5%

- Bank Wire Deposit: 0.5%

- Bank Wire Withdrawal: 1%

Crypto.com

Crypto.com is a prominent global player that offers Canadian crypto investors a mature, well-established exchange. It supports over 100 cryptocurrencies, making it excellent for anyone wishing to invest in new altcoins before they become popular.

Crypto.com has key features that no other cryptocurrency exchange in Canada can match. Users can trade options and futures contracts, earn interest by staking their currencies, and conduct trades with up to 10x leverage if they are confident in a certain coin.

Crypto.com has also put a significant amount of money into the security of its site, making trading with them incredibly safe. Day traders have an advantage over the rest of the market because the exchange is lightning fast (prices update thousands of times per second). Overall, Crypto.com is a reliable cryptocurrency exchange for anyone hoping to profit from fresh new altcoins.

Crypto.com Fees

- Account Opening: Free

- Trading Fees: 0.4%

Final Thoughts

Some Canadian banks are more crypto-friendly than others, according to customer service responses. Tangerine appears to be the least crypto-friendly, permitting only purchases of cryptocurrency via Interac e-Transfer. Bank of Montreal is similar in that it exclusively accepts Interac e-Transfer and wire transfers for purchases.

On a case-by-case basis, Toronto Dominion (TD) accepts crypto purchases using credit and debit cards, Interac e-Transfers, and wire transfers. They may or may not allow you to finalise your transaction. National Bank of Canada is the best option if you’re looking for a Canadian bank that accepts cryptocurrency purchases.

Fortunately, purchasing cryptocurrencies is a seamless process regardless of the options we have previously explored. Irrespective of your chosen bank, it is essential to connect your bank account to a trustworthy and efficient cryptocurrency exchange. This connection enables you to easily buy, sell, or trade various crypto tokens with confidence.

Our extensive analysis of the Canadian Crypto Space doesn’t stop here. You can also check out our full list of Crypto Guides for Canadians.

FAQ

Most frequent questions and answers

Some of the banks that allow crypto transactions are

- Toronto Dominion (TD).

- Royal Bank of Canada (RBC).

- Bank of Montreal (2008)

- National Bank of Canada

- Bank of Nova Scotia (Scotiabank).

- Canadian Imperial Bank of Commerce (CIBC)

TD Bank has virtually halted the use of credit cards to purchase cryptocurrencies, a stance that has been typical among banks. TD Bank, which previously allowed purchases even after the first wave of bank moves, has now joined the expanding policy shift.

Members of all of Canada’s main banking institutions will be able to purchase crypto. The method of buying differs from one branch network to the next. However Canadian crypto exchanges such as Bitbuy and Coinberry, make it simple for investors to buy cryptocurrencies in Canada.

The Toronto-Dominion Bank (TD Bank) does not yet give its Canadian clients the option to purchase and sell digital assets through their banking apps. You’ll need to sign up with a regulated digital asset platform if you want to buy crypto with Canadian Dollars from a TD Bank account.

There are three main reasons why banks refuse to let customers use their debit or credit cards to buy crypto assets. The first reason is that purchasing cryptocurrency is still illegal in several countries.

The second reason is that some banks are concerned about bad actors, which includes both individuals who engage in illegal crypto operations and customers who may file chargebacks or default on a bitcoin purchase made using a credit card.

The final reason banks prevent you from purchasing cryptocurrencies is because they do not want to put in mechanisms to protect against bad actors, deal with potential scams, or incur needless risks since they do not perceive it as a financially viable option.

If you’re wondering if you can buy Bitcoin or other cryptocurrencies using a credit card, the answer is yes — but not easily. Using a credit card to purchase Ethereum, Bitcoin, coins, or other cryptocurrencies is possible, but your credit card provider or the exchange selling the cryptocurrency may prevent you from doing so.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual’s needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.