Luis Clark

- Home

- /

- South Africa & Crypto

- /

- Crypto Exchanges in South...

- /

- VALR vs AltCoinTrader 2023:...

VALR vs AltCoinTrader 2023: Fees, Features and Benefits

Luis Clark

- Headquarter: Johannesburg, SA

- Year Founded: 2018

- No. of Cryptos: 60+

- Fiats Available: 2 (ZAR and ZMW)

- 0.01% maker fee and 0.1% taker fee | Free deposit via EFT | 3.9% for card deposits | Free crypto deposits | $10 for USDC wire transfers 8.5 ZAR for fiat withdrawals | $25 for USDC wire transfer | 0.75% for Auto-Buy | 0.1% for crypto-to-crypto pairs | 0.75% for fiat-to-crypto pairs | 0.85% for Simple Swaps

- NFTs Available: No

- Native Coin: No

- Beginner Friendly: Yes

- Platform App: Desktop, Android and iOS apps

- Security Features: 2FA, cold storage, multi-signatory internal systems

- Headquarter: Johannesburg, SA

- Year Founded: 2012

- No. of Cryptos: 33+

- Fiats Available: 1 (ZAR)

- 0.1% trading fee | 0.75% for Easy Buy/Sell | 0.5% for ZAR deposits or a maximum of 95 ZAR | Cash deposits incur a 5% additional fee | Withdrawal fee of 16 ZAR plus 0.5% or a maximum of 95 ZAR | Crypto transfers are network-dependent | Zero fees for Easy Save

- NFTs Available: No

- Native Coin: No

- Beginner Friendly: Yes

- Platform App: Desktop, Android, iOS and Huawei App

- Security Features: Cold storage, SSL certificate encryption

Several crypto surveys indicate that South Africans are significantly interested in cryptocurrency. Many crypto exchanges have launched in the country to meet this rising demand for a modern investment hub. VALR and AltCoinTrader are South African-based crypto exchanges that provide a seamless trading experience for all SA investors.

VAKR vs. AltCoinTrader: Verdict

However, VALR ranks higher due to its larger virtual currency support and more elaborate platform functionality. We considered user-friendliness, payment methods, fees, functionalities and security protocols during our VALR vs AltCoinTrader review to determine which is the better exchange.

For a detailed overview of both crypto exchanges, read our full VALR vs AltCoinTrader review.

In our VALR vs AltCoinTrader review, we discovered that both platforms aim to bring crypto trading to the average SA investor. While AltCoinTrader has been operating since 2012, VALR launched in 2018. Still, VALR has significantly outpaced the older exchange in asset support and platform features. Below, we consider the pros and cons of using VALR or AltCoinTrader.

Pros

- Supports 60+ digital assets

- Offers an industry-leading maker/taker fee of 0.01/0.1%

- Provides an advanced trading platform for sophisticated investors

- Offers recurring crypto purchases through Auto-Buy

- Built-in payment processing system via VALR Pay for fiat and crypto transactions

- Easy to use

- Supports multiple payment methods

Cons

- Card deposit fees are quite high

- Complicated fee structure for different services

- Unregulated

Pros

- Offers 33+ assets, including top coins like Bitcoin

- Offers Easy Buy for rapid asset purchase

- Zero fees for its Easy Save service

- Beginner-friendly

- Offers a mobile app for three operating systems

Cons

- High platform fees

- Limited functionality

VALR vs. AltCoinTrader: Unique Features

Crypto exchanges provide users with a pathway to trade and manage their digital assets. However, several exchanges offer unique add-on services. Our VALR vs AltCoinTrader review discovered several unique features between the two exchanges.

VALR Features

VALR offers more assets than its Jo’Burg competitor. The exchange supports 60+ virtual assets with hundreds of trading pairs allowing users to buy and sell Bitcoin, Ethereum, and Bitcoin Cash, amongst others.

VALR also offers a payment system through its VALR Pay service. This payment system allows users to send and receive crypto or cash via their VALR Pay ID or VALR account. The service is free, and clients receive their funds almost instantaneously.

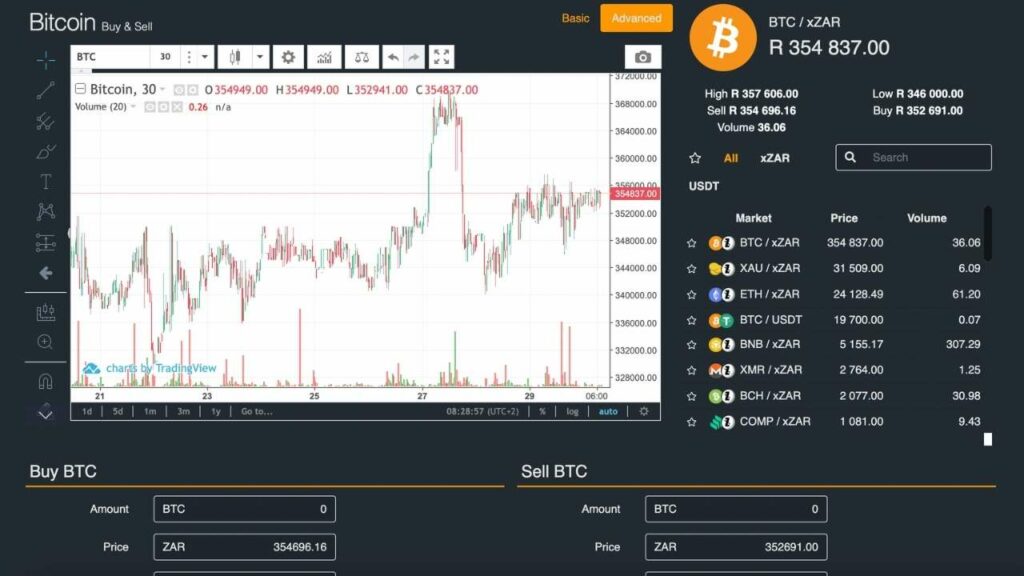

Another useful VALR feature is the advanced exchange service. VALR’s advanced exchange system features multiple indicators, a graphic and detailed live chart, and various timeframes for trades. Also, users can set limit and market order types and view the order books for a real-time rundown of transactions.

For novices who want to buy or sell digital assets easily, VALR offers a Simple Buy/Sell feature. This allows users to directly trade their assets without bothering about the technical jargon. In addition, a Simple Swap service allows users to exchange one asset for another at low trading fees.

VALR also has an Auto-Buy feature, enabling users to make recurring purchases. Investors can set an automatic buy order for crypto assets, and the sum will be deducted from their bank accounts.

Finally, the VALR app allows users to trade on the go. And VALR mobile trading is available for Android and iOS devices.

AltCoinTrader Features

AltCoinTrader offers numerous platform features, although it does not possess an elaborate offering like its competitor. The exchange’s most prominent feature is the Easy Save service, which allows users to earn interest on their idle crypto assets when they store them on the platform. The service supports nine cryptocurrencies, including Bitcoin, Ethereum and Matic, with interest rates as high as 4.96%. And investors who use AltCoinTrader’s Easy Save can earn a tokenised version of the Rand called South African Rand Tether (xZAR). In addition, AltCoinTrader’s Easy Buy has zero fees and no lockup period, allowing clients to access their funds anytime.

Like VALR, AltCoinTrader has an Easy Buy system. This provides a simple and quick way to buy Bitcoin, Bitcoin Cash, and other virtual currencies —instead of using the main exchange.

The AltCoinTrader exchange is split into Basic and Advanced. The Basic option displays the underlying asset’s current price with their timeframes and zero indicators. In contrast, the Advanced option provides all the technical and fundamental details about the asset and the limit and market order types. During this VALR vs AltCoinTrader review, we discovered that clients can easily switch between both options by tapping the one they prefer in the trading dashboard.

AltCoinTrader also offers mobile trading services via its mobile app. The app offers the same functionality as the web platform, allowing clients to buy Bitcoin and sell assets while on the move. AltCoinTrader’s mobile trading is available on Android, iOS, and Huawei devices.

Winner in Unique Features

Even though AltCoinTrader is a much older crypto exchange, it offers fewer platform features than VALR—this is why VALR is the winner in this section.

VALR vs. AltCoinTrader: Cryptocurrencies Available

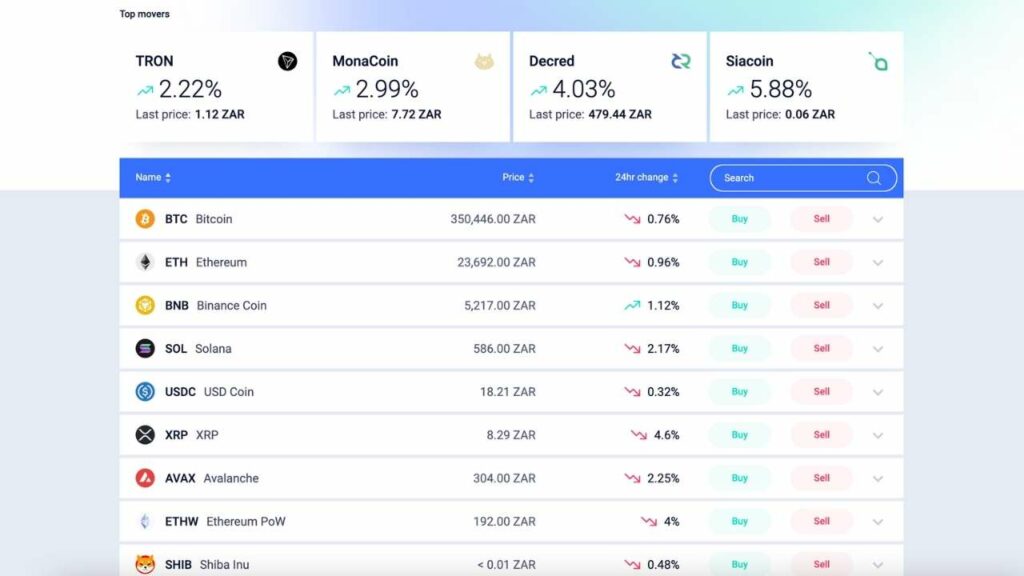

Both platforms offer popular digital assets in their lineup. However, their asset libraries vastly differ.

VALR supports 60+ asset types. While its offering is little compared to global exchanges like Binance and Coinbase, it is still a sizable offering for most SA investors.

On the other hand, AltCoinTrader offers just 33 digital assets with limited fiat support. This may be suitable for beginner investors but not for more sophisticated traders.

Winner in Crypto Availability

In crypto support, VALR also takes the number one spot.

VALR vs. AltCoinTrader: Fees

Trading fees are a major issue when selecting an exchange. Most trading platforms offer lower fees to stay competitive and attract investors. For our VALR vs AltCoinTrader review, we closely scrutinised both platforms’ fee structures to select the best for the average South African investor.

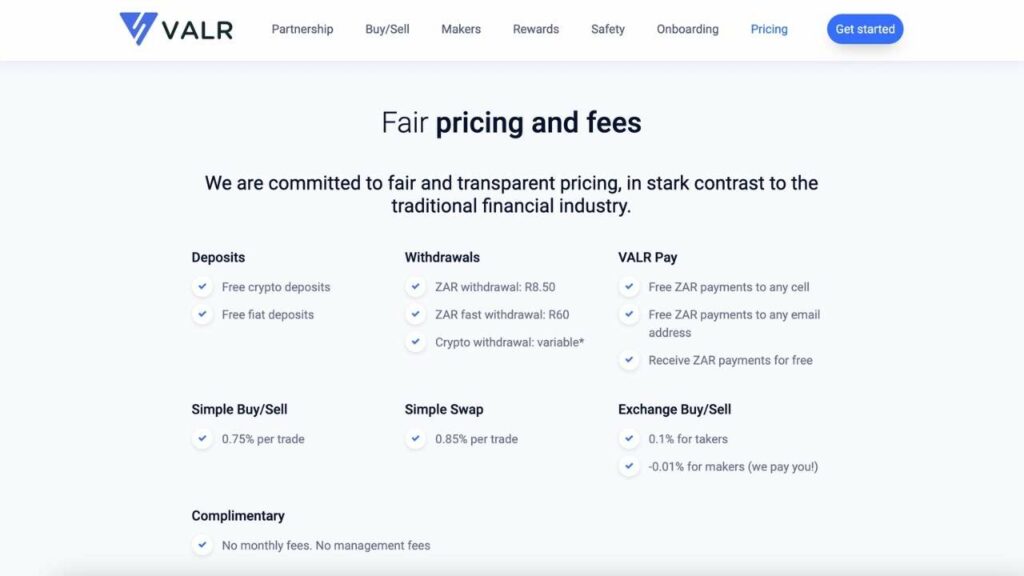

VALR runs a market maker and taker system for its trading fee, which is set at 0.01% and 0.1%, respectively. The platform charges 3.9% for card deposits, $10 for USDC wire transfers, 0.75% for Auto-Buy, 0.1% for crypto-to-crypto pairs, 0.75% for fiat-to-crypto pairs, and 0.85% for Simple Swaps. For withdrawal fees, VALR charges 8.5 ZAR for fiat and $25 for USDC wire transfers, while crypto transfers are free. Crypto-to-crypto trades on VALR cost 0.1%, while fiat-to-crypto trading pairs attract a 0.75% fee.

Meanwhile, AltCoinTrader charges a fixed 0.1% trading fee and 0.75% for Easy Buy/Sell trades. For deposits, the cryptocurrency exchange charges 0.5% or a maximum of 95 ZAR, while cash deposits incur a 5% additional transaction fee. Investors pay 16 ZAR plus 0.5% or a maximum of 95 ZAR for withdrawals on the trading platform. Crypto transfers are blockchain network-dependent. In addition, AltCoinTrader does not charge fees for its Easy Save service, allowing users to maintain 100% of their interests.

Winner in Fees

VALR’s fee structure is complicated — not a great option for fee-conscious investors. AltCoinTrader wins this round and should be a top choice for SA investors looking for a low-fee cryptocurrency exchange.

VALR vs. AltConTrader: Payment Methods

Both platforms offer a simple payment method structure.

AltCoinTrader supports bank deposits, Ozow instant electronic funds transfer (EFT), crypto deposits and credit cards via a Simplex integration. Meanwhile, VALR supports crypto deposits, bank deposits via instant EFT and debit/credit cards.

Winner in Payment Methods

In this section, there is no clear winner.

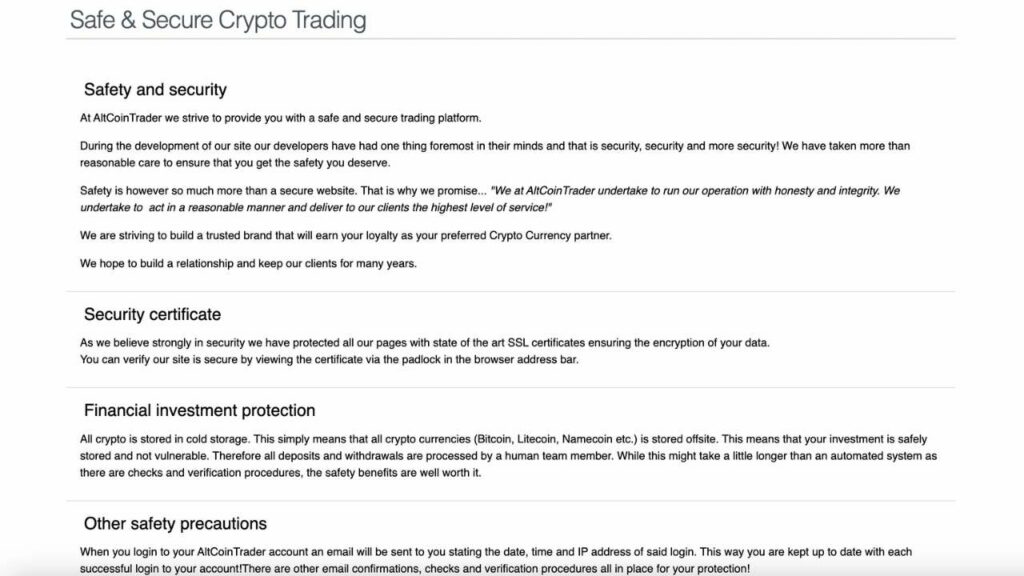

VALR vs. AltCoinTrader: Security

Our VALR vs AltCoinTrader review discovered that both exchanges employ the best security methods to secure users’ funds. VALR offers cold storage, SSL certificate encryption for customers’ data, two-factor authentication (2FA), and multi-signatory internal system controls. Meanwhile, AltCoinTrader offers cold storage and an SSL certificate encryption system.

Winner in Security

AltCoinTrader’s lack of 2FA could be a dealbreaker for investors keen on security. Given this, VALR takes the top spot in terms of security.

Bitbuy vs. Binance: Earn/Staking Rewards

Earn and staking services are features many exchanges offer; investors can earn from storing or staking their assets on these exchanges.

Both exchanges under review lack a staking service. However, AltCoinTrader has an Earn feature called Easy Save, where custoemrs can earn more from their idle crypto assets.

Winner in Earn/Staking Rewards

In this aspect, AltCoinTrader is the clear winner.

VALR vs. AltCoinTrader: Usability

AltCoinTrader and VALR focus on making buying and selling crypto assets as simple as possible.

VALR features a Simple Buy/Sell service, which allows users to buy or sell by tapping a button. The feature offers beginners convenience. Similarly, AltCoinTrader offers an Easy Buy feature.

Winner in Usability

Both platforms provide a streamlined trading experience, with little to no technical competence required. In this section, both exchanges tie.

VALR vs. AltCoinTrader: Customer Service

We examined customer service experience in our VALR vs AltCoinTrader review.

VALR offers a Help Center, which covers key issues like completing KYC, deposits and withdrawals, and setting up an account on the platform. If a user is unsatisfied, the support team can be contacted via a support ticket, which we did. However, the support team informed us that they would reply within a 24-hour window, which is quite long for a crypto trading platform. Nonetheless, clients can contact the exchange via Facebook, Twitter, Instagram, and LinkedIn.

AltCoinTrader also offers a Help Center for detailed walkthroughs on creating an account and depositing, among other issues. The trading platform also has a Contact Us page detailing its customer support line and working hours. However, users can easily connect to the exchange via social media platforms like Twitter, Facebook, Instagram, and Reddit.

Winner in Customer Service

Regarding customer service, both platforms tie as well.

Conclusion: Final Verdict

Cryptocurrencies are considered the future transaction medium. This is why acquiring crypto assets has become a priority for many. We have provided a detailed comparison of two of South Africa’s largest crypto exchanges, covering their features, fees, payment methods, customer support and security protocols.

Overall Winner

In our final summation, VALR ranks higher because of its larger asset support and more robust platform features and offerings.

FAQ

Most frequent questions and answers

Yes, VALR is a top crypto exchange that offers a seamless means of buying and selling crypto assets. It also provides a payment system via VALR Pay and offers users a recurring crypto-purchasing service.

While carrying out our VALR vs AltCoinTrader review, we could not ascertain VALR’s regulatory stance in SA. However, the platform mandates new users to complete its know-your-customer (KYC) process in line with global anti-money laundering (AML) laws.

AltCoinTrader is a long-standing crypto exchange with a solid track record. The platform offers low fees and stores users’ funds in offline cold storage facilities.

Standard Bank is AltCoinTrader’s preferred partner bank. Users can verify if their banks work with the exchange before selecting it.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.