Luis Clark

- Home

- /

- Australia & Crypto

- /

- Crypto Exchanges in Australia

- /

- CoinSpot vs. KuCoin 2023:...

CoinSpot vs. KuCoin 2023: Fees, Deposit and Security

Luis Clark

- Headquarter: Victoria, Australia

- Year Founded: 2013

- No. of Cryptos: 370+

- Fiats Available: AUD

- Fees: Up to 1%

- NFTs Available: Yes

- Native Coin: No

- Beginner Friendly: Yes

- Platform App: Mobile and Web

- Security Features: Cold storage, 2FA, ISO 27001, custom withdrawal restrictions and session timeout limit, certification, AUSTRAC regulation

- Headquarter: Seychelles

- Year Founded: 2017

- No. of Cryptos: 700+

- Fiats Available: USD, EUR, GBP, AUD, ARS, QAR, PHP, JPY, RUB, TRY, VND, CNY, IDR, CAD, and much more

- Fees: Up to 0.10%

- NFTs Available: No

- Native Coin: KCS

- Beginner Friendly: No

- Platform App: Desktop, Mobile

- Security Features: 2FA, anti-phishing safety phrase, login safety phrase, trading password, restrict login IP

CoinSpot vs. KuCoin: Verdict

Our pick is CoinSpot. The exchange offers a beginner and intermediate-friendly interface and has never been hacked.

Pros

- Supports over 370 cryptocurrencies

- Good customer service

- It offers crypto bundles

- Audited Australian crypto exchange

- Supports Australian bank accounts

- Offers Mastercard that is compatible with Google Pay and Apple Pay

- Good security

Cons

- High trading fees

- Does not support credit and debit cards

- No support for margin trading

Pros

- Supports margin trading

- Supports futures trading

- Low trading fees

- Free trading bots

- Users can lend their crypto and earn interest

- Supports a wide selection of cryptocurrencies

Cons

- Not suitable for beginners

- Limited deposit methods

CoinSpot vs. KuCoin: Unique Features

Unique Features of CoinSpot

CoinSpot Market

The CoinSpot market allows users to buy and sell cryptocurrencies with other CoinSpot traders at the best available market price. Once you sign up to CoinSpot and verify your account, you will be able to use this feature.

CoinSpot users can set specific price targets for the buying or selling of their cryptocurrency-related. Once the market reaches the set rate, the system will execute the trade on behalf of the customer.

Asides from access to good rates, the CoinSpot market also gives users access to low trading fees (0.1%).

CoinSpot Mastercard

CoinSpot Mastercard is a prepaid cryptocurrency debit card that allows users to pay for goods and services in-store and online using cryptocurrencies just like fiat currency. The card is preloaded with any of the over 370 cryptocurrencies supported by CoinSpot and can be used anywhere Mastercard is accepted worldwide.

The CoinSpot Mastercard can be used with both Google Pay and Apple Pay. There are no annual fees for the card.

Unique Features of KuCoin

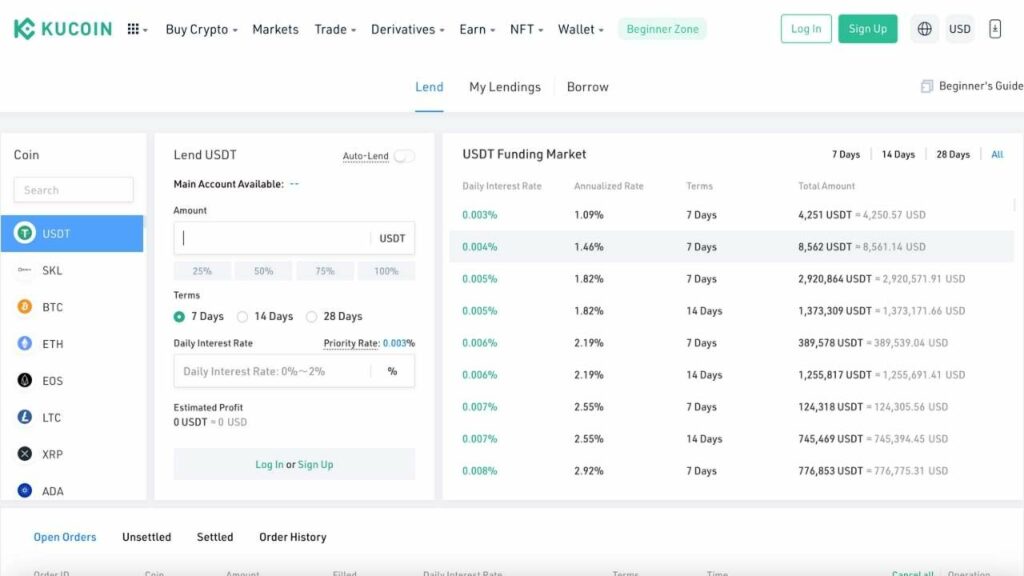

KuCoin Crypto Lending

This is a peer-to-peer platform that allows KuCoin users to lend cryptocurrencies to other users and earn interest. Users can lend over 50 cryptocurrencies including Bitcoin, Tether, etc.

Lenders on the platform can set an expected APY and open lending orders. The lending orders will be displayed in the market for other users to see. Borrowers can go through the various orders in the market and choose those that meet their requirements.

Funds lent on the lending platform are used for trades in the KuCoin margin trading market. The minimum amount lent, varies depending on the coin. The lender cannot request that the borrower repays the loan before the deadline. The borrower can, however, decide to repay the loan early. KuCoin ensures that all borrowed funds are repaid in full with the appropriate interest.

KuCoin lending has 2 different methods: Normal Lend and Auto Lend. With Normal Lend, the user can configure their desired daily lending rate. If the rate set is higher than the priority rate, it may be difficult to lend out the funds.

With Auto Lend, on the other hand, funds are only lent out at a rate equal to or higher than the minimum daily rate. Funds returned by other borrowers are lent out again.

In some cases, a user’s funds may not be lent out for a long period especially if they have set a very high daily interest rate or minimum daily rate. Also, if the user is using Auto Lend, and wishes to lend out all the funds in their account, the reserved amount should be set at zero.

To lend crypto on KuCoin, do the following:

- Open the KuCoin homepage and go to “Earn-Crypto Lending”

- On the lending page, select the coin you wish to lend

- Select the amount and interest rate

- Choose either Auto Lend or Normal Lend

- To use Normal lend, full in the amount, daily interest, choose the term and click “Lend USDT”

- To use Auto Lend enable auto lend and fill in the minimum daily rate and the reserve amount and click “Enable Auto Lend”

Below is the meaning of some of the terms you may see when using KuCoin crypto lending:

- Amount: This is the number of funds you intend to lend out for margin trading.

- Term: This is the duration of the loan. Users can choose from 7 days, 14 days, and 28 days.

- Daily Interest Rate: This is the daily interest you expect to receive on the loan.

- Priority Rate: This is the current best available rate in the KuCoin lending market.

- Reserved Amount: The number of funds you wish to reserve in your account. These funds will not be lent out.

- Minimum Daily Rate: This is the minimum rate you can accept from borrowers.

- Order History: This page shows you the history of all orders both settled unsettled and canceled orders.

- Open Orders: These are orders in the lending market that are yet to be filled.

- Settled: Loans that have been repaid

Unsettled: These are orders that have been lent out but not repaid.

Free Trading Bots

Winner in Unique Features

KuCoin is the winner here. It provides more features than CoinSpot.

CoinSpot vs. Kucoin: Cryptocurrencies Available

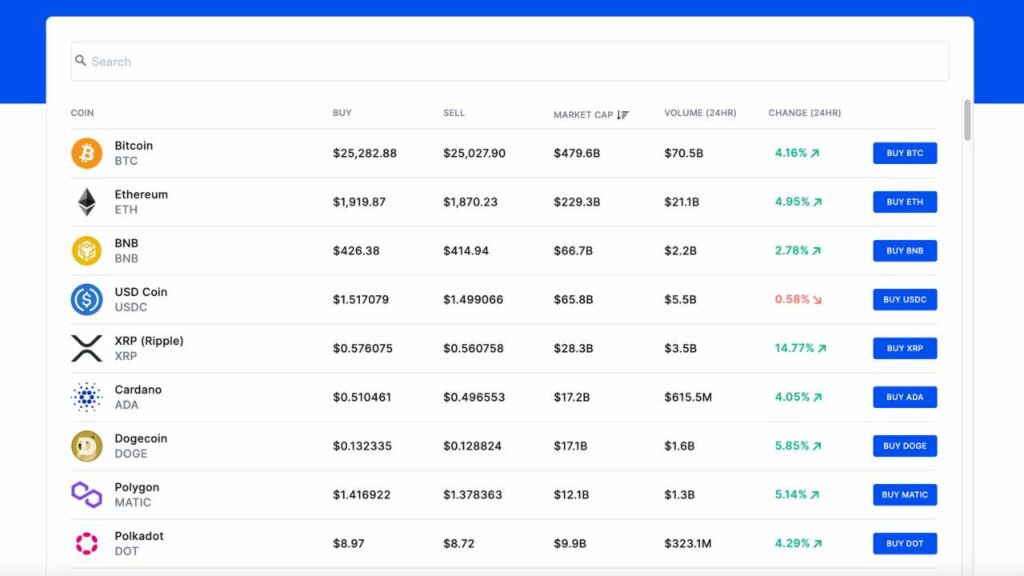

Cryptocurrencies Available on CoinSpot

CoinSpot supports the trading of over 370 cryptocurrencies including Bitcoin, Litecoin, Ethereum, USD Coin, Polygon, Solana, Shiba Inu, Dogecoin, Bitcoin Cash, Binance Coin, etc.

Cryptocurrencies Available on KuCoin

KuCoin supports the trading of over 700 cryptocurrencies. This includes Bitcoin, Ethereum, Binance Coin, Binance USD, Dogecoin, Polkadot, Polygon, Solana, Cardano, Litecoin, Shiba Inu, Avalanche, Chainlink, Cosmos, Ethereum Classic, Bitcoin Cash, Stellar Lumens, Monero, etc.

Winner in Crypto Availability

In this Coinspot vs Kucoin battle, Kucoin wins in crypto availability, it supports almost twice the number of cryptocurrencies available on CoinSpot.

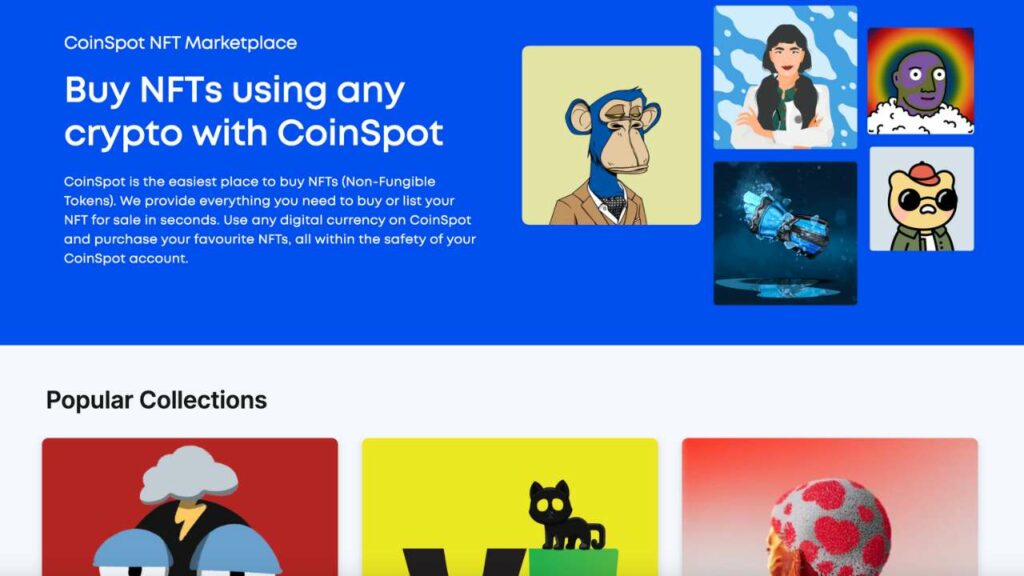

CoinSpot vs. KuCoin: Can You Buy and Sell NFTs?

Can You Buy and Sell NFTs on CoinSpot?

Yes, CoinSpot allows you to buy and sell NFTs via its CoinSpot NFT marketplace. NFT traders can choose from over 400,000 NFTs and 300 collections in various popular categories. For sellers, CoinSpot NFT does not support minting. So sellers have to mint their NFTs elsewhere and then move them to CoinSpot to sell. The platform charges a flat fee of 0.10% on all NFT transactions. It is supported by the Ethereum and Binance Smart Chain.

Winner in NFTs Availability

CoinSpot is the clear winner in NFT availability. Kucoin does not support NFTs so there's no battle here.

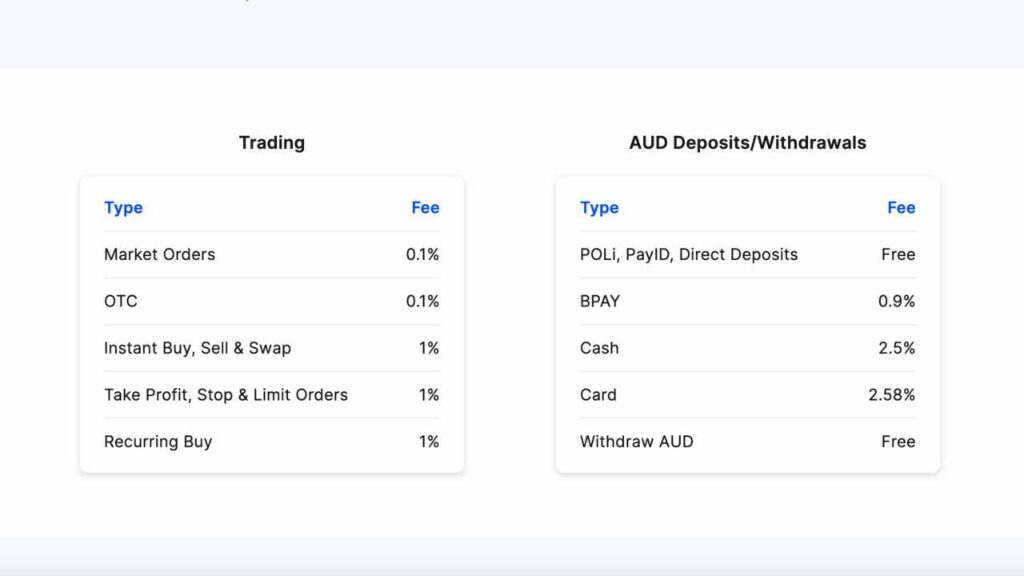

CoinSpot vs. KuCoin: Fees

CoinSpot Fees

The CoinSpot cryptocurrency exchange does not charge crypto traders withdrawal fees as long as the transaction is in the Australian Dollar (AUD). That said, here are the trading fees the exchange does charge:

- Market Order: 0.10%

- OTC: 0.10%

- Instant Buy, Sell, and Swap: 1%

- Recurring Buy: 1%

- CoinSpot NFT: 0.90%

- Take Profit, Limit Orders, and Stop Loss: 1%

To deposit fiat currency deposits CoinSpot charges the following:

- PayID: Free

- POLi: Free

- Direct Deposits: Free

- BPAY: 0.9% Fee

- Cash Deposit: 2.5% Fee

CoinSpot Card Deposit: 2.58% Fee

KuCoin Fees

Kucoin offers a complex fee structure using a maker-and-taker model that’s based on the user’s spot and futures trading volume in the last 30 days, the amount of KCS the trader has held in the last 30 days, and if the investor uses KCS to pay for fees.

If you use KCS to pay for fees Kucoin offers a 20% discount on the higher trading fees you’re meant to pay for the current tier you’re on. Your current level or tier is determined by the amount of KCS you hold and your trade volume in the last 30 days.

That said, trading fees on the Kucoin crypto exchange range from -0.005%/0.0025% to 0.10%/0.10% in maker/taker fees.

It is free to deposit fiat currency, while withdrawals depend on the coin you intend to withdraw.

Winner in Fees

Kucoin wins this CoinSpot vs Kucoin round. The exchange charges lower fees and even offers the opportunity of decreasing fees by holding and paying with its native currency, KCS.

CoinSpot vs. KuCoin: Payment Methods

CoinSpot Payment Methods

CoinSpot supports the following payment methods for its Australian users: Cash Deposit, CoinSpot debit card, PayID, POLi, BPAY, and Direct deposit. PayID, POLi, and Direct deposit offer instant payments.

CoinSpot does not support credit/debit cards for cash deposits except its own issued card.

KuCoin Payment Methods

Kucoin does not support the deposit of fiat currency into your account. If you want to use a cash deposit to purchase assets on the platform, you’ll have to pay for it directly at the point of sale.

For this, Kucoin supports Apple Pay, Visa/Mastercard credit/debit cards, and PayID. The exchange does have a “fiat deposit” option but this simply binds your credit/debit card to the account and when you want to make a purchase, the platform will charge your card directly. AUD payments usually incur a 3% to 5% fee.

Winner in Payment Methods

CoinSpot wins in deposit methods. It offers more deposit methods and provides a less complex payment process than Kucoin.

CoinSpot vs. KuCoin: Security

CoinSpot Security

CoinSpot is one of the most secure crypto exchanges in Australia. It is the only Australian-based exchange that holds both an ISO27001 Certification for Information Security Management and a Blockchain Australia Certification.

CoinSpot stores the majority of its assets in offline cold storage. Users’ accounts are also protected with customizable security features like two-factor authentication and custom withdrawal restrictions.

Kucoin Security

KuCoin conducts 24/7 monitoring on all accounts to ensure that users’ assets are secure. It also conducts regular security code audits, security penetration Testing, and security architecture review.

KuCoin is not regulated in Australia.

Winner in Security

CoinSpot wins in security. It has more security measures than KuCoin and it is regulated in Australia.

CoinSpot vs. KuCoin: Earn/Staking Rewards

CoinSpot Earn/Staking Rewards

Users can stake 20+ cryptocurrency assets on the CoinSpot Earn platform. The service rewards stakers up to 70% APY and offers an option to increase staking rewards by increasing the staked amount.

Kucoin Earn/Staking Rewards

Crypto investors can earn passive income on supported cryptocurrency assets by staking them on the Kucoin Earn platform. The staking service supports over 45 cryptocurrencies including stablecoins and offers up to 263% in APR.

Winner in Earn/Staking Rewards

Kucoin wins in staking rewards as it offers higher APRs than CoinSpot and has more stakable assets to choose from.

CoinSpot vs. KuCoin: Usability

CoinSpot Usability

CoinSpot offers Australian crypto investors an easy-to-use and friendly interface via its mobile app for Android and iOS. The interface comes with 24/7 live chat support that can help complete newbies find their way around the platform. It is best for beginners and intermediate crypto traders. Advanced traders may find the exchange a bit elementary.

Kucoin Usability

Kucoin is built for professional and advanced traders who want to engage in numerous trades and expert orders like futures trading. That said, its deposit methods complexities with fiat currencies as mentioned above make this platform hard to navigate for beginners. So it’s best for users who already own cryptocurrency. The exchange offers a mobile and desktop app.

Winner in Usability

CoinSpot wins in usability as the exchange is easy to use for beginners and most Australian users would find the platform more suited to them than Kucoin.

CoinSpot vs. KuCoin: Customer Service

CoinSpot Customer Service

CoinSpot offers customer service via live chat support every day of the week. The support team is responsive and offers prompt service to customers. It also has a well-equipped help center.

KuCoin Customer Service

KuCoin provides customer service via online live chat support or by submitting a ticket. It also has a help center with helpful information about the platform

Winner in Customer Service

CoinSpot wins as it offers a quicker response in customer service via live chat support than KuCoin.

Conclusion: Final Verdict

CoinSpot is one of the leading cryptocurrency exchanges in Australia and Kucoin is a top one globally. However, CoinSpot is more suited to Australian users in terms of payment methods and usability. It also features excellent customer service and has never been hacked. Kucoin, on the other hand, has been hacked and is quite complex for most beginners. That said, while it charges 0.10% in trading fees, deposit fees via credit/debit card can get high (up to 5%).

Overall Winner

CoinSpot wins with 3.6/5 rating.FAQ

Most frequent questions and answers

Kucoin is a legitimate crypto trading platform but you cannot withdraw or directly deposit AUD on Kucoin.

Yes, you can trade on Kucoin but you cannot deposit or withdraw AUD directly.

In general, Kucoin is better than Coinbase and offers a larger selection.

No, you cannot withdraw AUD from KuCoin.

Kucoin is headquartered in the Seychelles.

Kucoin isn’t an AUSTRAC-regulated exchange so it most likely isn’t tracked by the ATO.

No, Kucoin is not licensed by AUSTRAC.

CoinSpot Australia is owned by Casey Block Services Pty Ltd.

No, CoinSpot does not offer trading bots.

We always try to provide the most accurate information available, and make sure our team follow through.

If you want to know more about our Crypto Exchanges Review Methodology follow the link below

Skrumble.com provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade, or sell any investment instruments or products, including but not limited to cryptocurrencies, or use any specific exchange. Please do not use this website as investment advice, financial advice, or legal advice, and each individual’s needs may vary from that of the author. Investing in financial instruments, including cryptocurrencies, carries a high risk and is not suitable for all investors. It is possible to lose the entire initial investment, so do not invest what you cannot afford to lose. We strongly advise conducting your own research before making any investment decisions. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read here.